U.S. consumer confidence — a key determinant of the economy’s health — stumbled to a 16-month low in June, as soaring inflation and concerns about the economy’s health dampened the Americans’ spirit. Economists cautioned that a back-to-back drop in consumer sentiment spells trouble for the market and overall spending activity. Per the Conference Board, the Consumer Confidence Index fell to 98.7 in June from May’s downwardly revised reading of 103.2.

Lynn Franco, senior director of economic indicators at the Conference Board, said, “Purchasing intentions for cars, homes, and major appliances held relatively steady—but intentions have cooled since the start of the year and this trend is likely to continue as the Fed aggressively raises interest rates to tame inflation. Meanwhile, vacation plans softened further as rising prices took their toll.”

Industry experts see more pain ahead as consumers grapple with soaring commodity and record gasoline prices as well as rising interest rates. We note that the consumer price index rose 1% month on month in May, following an increase of 0.3% in April. On a year-over-year basis, the metric rose 8.6% — the fastest pace since December 1981. This jump was a result of higher gasoline and food grain prices, primarily due to the conflict between Russia and Ukraine.

Addressing shooting commodity prices is a top priority for the Federal Reserve, and it is treading the path of a rate hike to tame the same. In a bold move to counter inflation, the Fed recently announced a 75-basis point hike in the benchmark interest rate that will take the level to a range of 1.5% to 1.75%. This was the biggest rate increase since 1994.

While challenges persist, retailers are still pinning hopes on the

back-to-school season

. Per Mastercard SpendingPulse, U.S. retail sales, excluding automotive, are projected to increase 7.5% year over year during the period that runs from Jul 14 to Sep 5. With e-commerce still one of the preferred modes for shopping, Mastercard SpendingPulse foresees online sales to rise by 4.3%. Notably, in-store shopping is anticipated to increase 8.2%.

Steve Sadove, senior advisor for Mastercard and former CEO and chairman of Saks Incorporated, said, “While Mastercard SpendingPulse anticipates growth across sectors, retailers will need to find innovative ways to entice shoppers as discretionary spending potentially stretches thin as a result of increasing prices.”

Companies have been undertaking a more consumer-centric approach — emphasizing membership programs, upgrading store technology, shopping via mobile apps and last-mile delivery solutions. Expedited delivery services like doorstep delivery, curbside pickup or buy online and pick up at store, as well as contactless payment solutions, will continue to play a crucial role in maximizing the share of customers’ wallet.

That said, here we have highlighted four stocks from the

Retail-Wholesale

sector that have a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

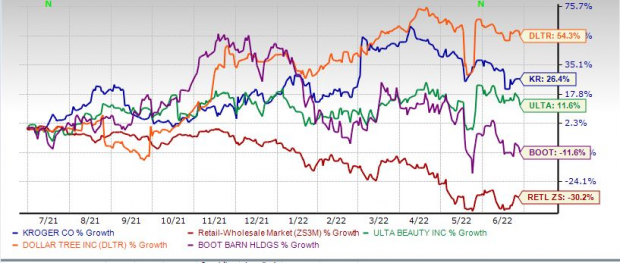

Past Year Price Performance

Image Source: Zacks Investment Research

4 Prominent Picks

You may invest in

Boot Barn Holdings, Inc.

BOOT

. This lifestyle retailer of western and work-related footwear, apparel and accessories has been successfully navigating through the challenging environment, courtesy of merchandising strategies, omni-channel capabilities and better expense management as well as marketing. This, combined with the expansion of the store base, has helped Boot Barn Holdings gain market share and strengthen its position in the industry.

The company has an estimated long-term earnings growth rate of 20%. The Zacks Consensus Estimate for Boot Barn Holdings’ current financial year sales and EPS suggests growth of 17% and 4.4%, respectively, from the year-ago period.

Investors can count on

Ulta Beauty, Inc.

ULTA

. The company has been strengthening its omni-channel business and exploring the potential of both physical and digital facets. It has been implementing various tools to enhance guests’ experience, like offering a virtual try-on tool and in-store education, and reimagining fixtures, among others. Ulta Beauty focuses on offering customers a curated and exclusive range of beauty products through innovation.

Impressively, this beauty retailer and the premier beauty destination for cosmetics, fragrance, skincare products, hair care products and salon services has a trailing four-quarter earnings surprise of 49.8%, on average. We note that the company has an estimated long-term earnings growth rate of 10.7%. The Zacks Consensus Estimate for Ulta Beauty’s current financial year sales suggests growth of 10.3% from the year-ago period.

Another stock worth considering is

Dollar Tree, Inc.

DLTR

. This Chesapeake, VA-based company’s strategic initiatives, including the expansion of $3 and $5 Plus assortment in Dollar Tree stores, as well as Combo Stores and H2 Renovations at Family Dollar, provide tremendous opportunities to drive sales and traffic.

Impressively, Dollar Tree has a trailing four-quarter earnings surprise of 13.1%, on average. This operator of discount variety stores has an estimated long-term earnings growth rate of 15.5%. The Zacks Consensus Estimate for Dollar Tree’s current financial year sales and EPS suggests growth of 6.7% and 40.5%, respectively, from the year-ago period.

The Kroger Co.

KR

, which operates in the thin-margin grocery industry, is another potential pick. The company has been undertaking efforts to strengthen its position not only with respect to products but also in terms of the way consumers shop. It has been making investments to enhance product freshness and quality as well as expand digital capabilities. Kroger has been augmenting Our Brands portfolio by launching new products.

Kroger has a trailing four-quarter earnings surprise of 20.3%, on average. The company has an estimated long-term earnings growth rate of 11.3%. The Zacks Consensus Estimate for Kroger’s current financial year sales and EPS suggests growth of 6.7% and 6.3%, respectively, from the year-ago period.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report