Simulations Plus, Inc.

(

SLP

) is slated to release third-quarter fiscal 2022 results on Jul 6.

The Zacks Consensus Estimate for fiscal third-quarter revenues is pegged at $14.12 million, suggesting growth of 10.5% from the year-ago quarter’s reported figure.

The consensus for fiscal third-quarter earnings has been steady in the past 30 days at 17 cents per share, indicating a deterioration of 5.6% on a year-over-year basis.

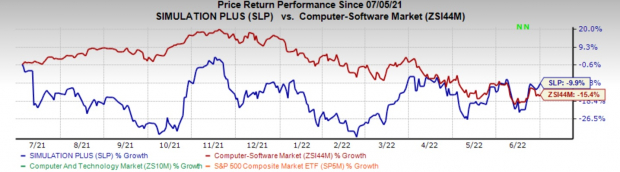

Shares of Simulations Plus have declined 9.9% in the past year compared with the

industry

‘s return of 15.4%.

Factors Likely to Have Influenced Q3 Results

Momentum in Simulations Plus’ software business is likely to have acted as a tailwind. In the software business, the company is witnessing strong demand for GastroPlus and ADMET Predictor solutions. The acquisition of Lixoft is expected to have boosted software business. Also, the strength of Simulations Plus’ diversified product portfolio, including solutions like MembranePlus, DDDPlus and PKPlus, is another driving factor.

In the last reported quarter, the software business grew 25% year over year on an organic basis and contributed 66% to the company’s total revenues. Sales of GastroPlus, MonolixSuite and ADMET Predictor offerings increased 22%, 43% and 13% year over year, respectively.

Steady traction witnessed for DILIsym and other software simulation offerings, including RENAsym, MedChem Designer, NAFLDsym, and IPFsym, combined with advanced analytics functionalities is anticipated to have positively impacted the company’s performance.

Strong adoption of the company’s modeling and simulation workflow platform for drug development across pharma and biotech industries might have aided Simulations Plus’ performance. A favorable mix of higher-margin software business is expected to have driven margin performance.

The impact of instability in Europe, supply chain troubles and rising inflation on the subsequent effects on global macroeconomic recovery are concerns. Increasing operating expenses might have kept margin expansion under check in the to-be-reported quarter.

What the Zacks Model Unveils

According to the Zacks model, the combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. But that’s not the case here.

Simulations Plus has an Earnings ESP of 0.00 % and a Zacks Rank #3 (Hold). You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter.

Stocks to Consider

Here are some companies, which have the right combination of elements to post an earnings beat:

JPMorgan Chase & Co

JPM

has an Earnings ESP of +3.88% and a Zacks Rank of 3 at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

JPMorgan is set to report second-quarter 2022 results on Jul 14. The Zacks Consensus Estimate for earnings is pegged at $2.80 per share, suggesting a decrease of 25.9% from the prior-year quarter’s reported figure.

Shares of JPM have declined 26.9% in the past year compared with the Zacks

industry

’s decline of 20.8%.

Levi Strauss & Co.

LEVI

has an Earnings ESP of +6.67% and a Zacks Rank of 3 at present.

Levi Strauss is scheduled to release second-quarter fiscal 2022 results on Jul 7. The Zacks Consensus Estimate for earnings is pegged at 23 cents per share, unchanged from prior-year quarter’s levels.

Shares of Levi Strauss have lost 41.7% in the past year compared with the Zacks

industry

’s decline of 62.1%.

Delta Air Lines, Inc

DAL

has an Earnings ESP of +4.5% and a Zacks Rank of 3.

Delta Air Lines is scheduled to release second-quarter fiscal 2022 results on Jul 13. The Zacks Consensus Estimate for loss is pegged at $1.70 per share, up 258.9% year over year.

Shares of Delta Air Lines have declined 33.1% in the past year compared with the Zacks

industry

’s decline of 40.6%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report