Envestnet, Inc.

ENV

currently benefits from recurring revenue-generation capacity and development in technology.

ENV has an impressive

Growth Score

of B. This style score condenses all the essential metrics from Envestnet’s financial statements to get a true sense of the quality and sustainability of its growth. Moreover, revenues are expected to increase 10.7% and 13.4 year over year in 2022 and 2023, respectively.

Factors That Augur Well

Envestnet’s business model ensures solid asset-based and subscription-based recurring revenue generation capacity. ENV provides asset-based and subscription-based services on a business-to-business-to-consumer (B2B2C) basis for financial services clients. These clients offer solutions based on ENV’s platform to their end users. On a business-to-business (B2B) basis, ENV delivers an open platform to customers and third-party developers through an open API framework.

Envestnet’s recurring revenues increased 11% year over year in 2019, 10.2% in 2020 and 20.2% in 2021. In the first quarter of 2022, asset-based recurring revenues rose 27% year over year, while subscription-based recurring revenues gained 4%.

ENV continues focusing on technology development with a view to improve operational efficiency, increase market competitiveness, address regulatory demands and cater to client-driven requests for new capabilities. Per management, ENV’s technology design allows significant scalability.

Envestnet’s current ratio at the end of the March quarter was pegged at 1.83, lower than the current ratio of 1.97 reported at the end of the December quarter and the prior-year quarter’s current ratio of 2.14. Decreasing current ratio is not desirable as it indicates that a company may have problems meeting its short-term debt obligations.

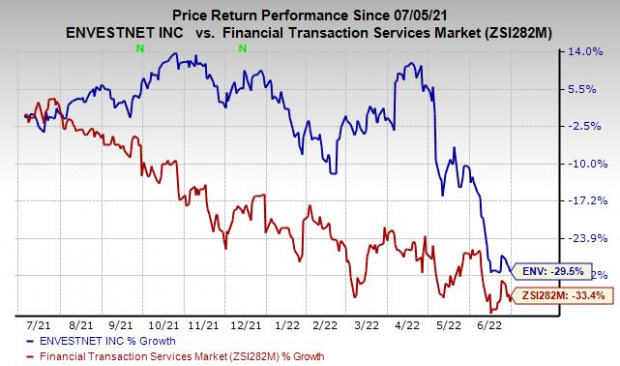

Shares of Envestnet have plunged 29.5% in the past year compared with a 33.4% decrease of the

industry

it belongs to.

Image Source: Zacks Investment Research

Zacks Rank and Stocks to Consider

Envestnet currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Some better-ranked stocks in the broader Zacks

Business Services

sector are

Avis Budget Group, Inc.

CAR

, Cross Country Healthcare

CCRN

and

CRA International, Inc.

CRAI

.

Avis Budget sports a Zacks Rank #1 at present. CAR has a long-term earnings growth expectation of 19.4%.

Avis Budget delivered a trailing four-quarter earnings surprise of 102%, on average.

Cross Country Healthcare flaunts a Zacks Rank of 1 at present. CCRN has a long-term earnings growth expectation of 6.9%.

Cross Country Healthcare delivered a trailing four-quarter earnings surprise of 29.2%, on average.

CRA International carries a Zacks Rank #2 (Buy), currently. CRAI has a long-term earnings growth expectation of 14.3%.

CRAI delivered a trailing four-quarter earnings surprise of 35.8%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report