Ford Motor Co.

F

recently reported second-quarter 2022 sales figures.

New vehicle sales in the United States saw an uptick of 1.8% year over year in the said period and 31.5% in June. Overall, the company sold 483,688 vehicles in the second quarter.

The results were contrary to the industry’s trend of declining sales in the second quarter, with major automakers reporting a sales fall.

In June, sales increased across Ford’s truck, SUV and EV segments and outperformed the industry. An uptick in shares in the U.S. market was driven by sales of the F-Series truck lineup, the Explorer and Expedition SUVs and the battery-electric vehicles.

For Ford, the ongoing headwinds have not dampened new vehicle demand. Nearly 50% of retail sales came from previously placed orders. F, along with other automakers, has increasingly emphasized its order bank amid a lingering semiconductor shortage and other supply-chain disruptions.

Ford ended the month with 297,000 units of gross stock, which was up from about 236,000 in gross stock inventory at the end of May, although many of the new units are in transit.

In June, sales of F-Series were up 26.3% year over year and comprised 37.9% of the company’s overall sales mix. Nearly 60% of F-Series retail sales came through Ford’s order bank. Overall, its pickup truck sales were up 26.3% from a year ago.

EV sales in June reached 4,353 units, a sharp increase of 76.6% from a year ago. June also saw the sales for the all-electric F-150 Lightning reach 1,837 units. Ford has sold 2,296 units of the battery-electric truck since it was launched.

Ford brand SUV sales of 60,894 were up 35.3%, driven in part by sales of the Bronco lineup, which saw sales grow 82.7% year over year. However, not all of Ford’s SUVs saw an upswing in June. Sales of the EcoSport, Bronco Sport, Mustang Mach-E and Expedition were down. Ford’s year-to-date sales also fell 8.1% year over year.

The automaker’s average transaction price rose to $1,900 per vehicle from May to June, driving the prices for Ford and Lincoln vehicles to $52,200.

Supply-chain disruptions have impacted auto production globally for nearly a year and a half, depleting inventory levels. Consequently, there have been high inflation, rising interest rates and sky-high vehicle prices that are likely to dampen demand, which has so far held up during the pandemic. Amid such tight market conditions, Ford seems to be in a relatively better position than other major auto players.

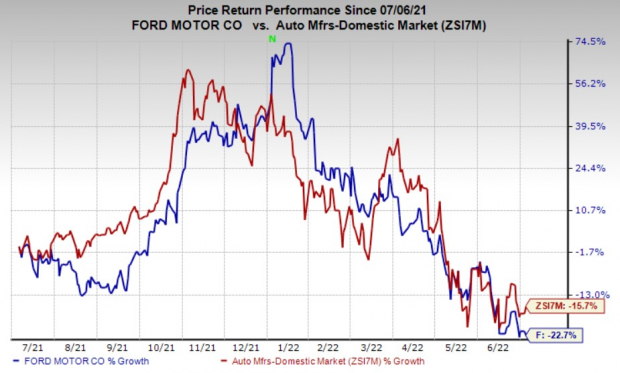

Shares of Ford have lost 22.7% over the past year compared with its

industry

’s 15.7% decline.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

F carries a Zacks Rank #5 (Strong Sell), currently.

Better-ranked players in the auto space include

Allison Transmission Holdings

ALSN

,

LKQ Corporation

LKQ

and

Standard Motor Products

SMP

, each carrying a Zacks Rank #2 (Buy), currently. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Allison Transmission has an expected earnings growth rate of 24.5% for the current year. The Zacks Consensus Estimate for current-year earnings has been constant in the past 30 days.

Allison Transmission’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. ALSN pulled off a trailing four-quarter earnings surprise of 11.71%, on average. The stock has declined 5.1% over the past year.

LKQ has an expected earnings growth rate of 6.3% for 2023. The Zacks Consensus Estimate for current-year earnings has been revised 0.3% upward in the past 30 days.

LKQ’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. LKQ pulled off a trailing four-quarter earnings surprise of 23.55%, on average. The stock has risen 0.1% in the past year.

Standard Motor has an expected earnings growth rate of 5.2% for the current year. The Zacks Consensus Estimate for current-year earnings has remained constant in the past 30 days.

Standard Motor’s earnings beat the Zacks Consensus Estimate in all the trailing four quarters. SMP pulled off a trailing four-quarter earnings surprise of 40.34%, on average. The stock has increased 3.6% over the past year

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report