NexImmune, Inc

.

NEXI

recently announced that the FDA has given clearance to its investigational new drug (IND) application for NEXI-003.

Shares of this clinical-stage biotechnology company jumped 23.13% in aftermarket hours trading on Jul 14 after this announcement.

NEXI-003, an autologous antigen-specific T cell product (CD3+/CD4-), is being developed for patients with relapsed or refractory human papillomavirus (HPV)-related cancers.

Following the IND clearance, NexImmune can initiate a study to evaluate NEXI-003 in patients with relapsed or refractory HPV-related cancers.

The phase I study will enroll patients at multiple clinical sites across the United States. The proposed study is a two-part, multicenter, open-label, dose-finding, first-in-human (FIH) study to characterize the safety and clinical activity of NEXI-003 in patients with relapsed or refractory locally advanced or metastatic HPV-related oropharyngeal cancers (with confirmed histopathology detection of HPV-16 and/or HPV-18 expression), who have received at least one prior regimen of standard therapy according to local standard of care guidance(s).

Increasing doses of NEXI-003 will be evaluated in the dose escalation phase, which will consist of multiple safety cohorts. This phase will be followed by an expansion phase that will enroll 24 to 36 patients overall, depending on the number of dose escalations. All patients will be followed for at least one year. NexImmune plans to expand the NEXI-003 development program to include other HPV-related malignancies and evaluate potential SOC combination options across the patient populations following initial data and after the recommended phase II dose has been confirmed.

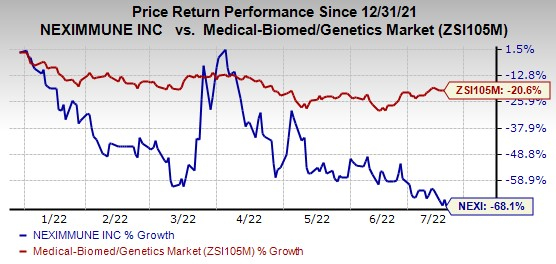

However, shares of NexImmune have plunged 68.1% this year so far compared with the fall of 20.6% for the

industry

.

Image Source: Zacks Investment Research

The two lead programs in the company’s pipeline are NEXI-001 in acute myeloid leukemia, (AML) and NEXI-002 in multiple myeloma (MM). The programs are in phase I/II studies for the treatment of relapsed AML after allogeneic stem cell transplantation and multiple myeloma refractory to at least three prior lines of therapy, respectively. NexImmune is also developing new AIM nanoparticle constructs and modalities for potential clinical evaluation in oncology and disease areas outside of oncology, including autoimmune disorders and infectious diseases.

The company is currently exploring the potential for collaborations or partnerships to further advance the NEXI-002 development program in MM.

Zacks Rank & Stocks to Consider

NexImmune currently carries a Zacks Rank #4 (Sell).

A few better-ranked stocks in the same space are

Alkermes

ALKS

and

Seagen

SGEN

, and

Sarepta Therapeutics

SRPT

. While Alkermes and Seagen sport a Zacks Rank #1 (Strong Buy), Sarepta carries a Zacks Rank#2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Loss estimates for ALKS for 2022 have narrowed to 1 cent from a loss of 13 cents in the past 60 days. Alkermes surpassed estimates in all of the trailing four quarters, the average surprise being 350.48%.

Seagen’s loss per share estimates for 2022 have narrowed from $3.50 to $3.49 in the past 30 days. The same for 2023 has widened from $1.41 to $1.43 in the same time frame.

Earnings of Seagen missed estimates in two of the trailing four quarters and beat the same on the remaining two occasions, the average negative surprise being 40.08%.

Sarepta’s loss per share estimates for 2022 have narrowed by 61 cents in the past 90 days. SRPT’s earnings have surpassed expectations in all of the trailing four quarters, the average surprise being 21.45%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report