AbbVie, Inc.

ABBV

announced that it has submitted a marketing authorization application (“MAA”) to the European Medicines Agency (EMA), seeking approval for its CGRP receptor antagonist, atogepant, for prophylaxis treatment of migraine.

The MAA seeks approval for atogepant in adult patients who have at least four migraine days per month. The application is supported by data from two pivotal phase III studies, ADVANCE and PROGRESS. While the ADVANCE study evaluated atogepant in patients with episodic migraine, the PROGRESS study evaluated the drug in patients with chronic migraine. In both the studies, participants administered atogepant achieved the primary endpoint of statistically significant reduction in mean monthly migraine days compared to placebo, across the 12-week treatment period.

If the MAA is approved, atogepant will be the first daily CGRP receptor antagonist to be approved in Europe for the prophylaxis treatment of migraine in adults. The grant of approval to atogepant will also make AbbVie the only company to offer two treatments for chronic migraine. The other treatment, which is being marketed by ABBV for chronic migraine is Botox, one of its blockbuster medicines approved for therapeutic as well as cosmetic uses.

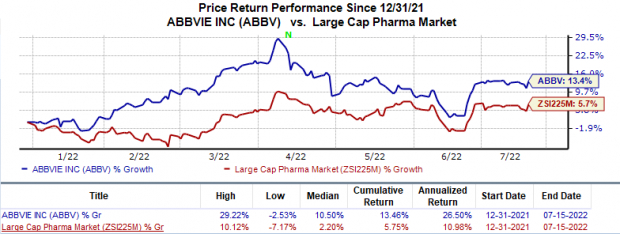

In the year so far, AbbVie’s stock price has increased 13.5% compared with the

industry

’s 5.8% rise.

Image Source: Zacks Investment Research

Atogepant is already

approved

by the FDA for the preventive treatment of episodic migraine since last September. The drug is being marketed under the trade name, Qulipta. Last month, AbbVie filed a supplemental new drug application,

seeking approval

for Qulipta, as a preventive treatment for chronic migraine.

Prior to the MAA approval by the European Commission (EC), the same shall also be reviewed by the Committee for Medicinal Products for Human Use (“CHMP”), which shall also issue a recommendation on the same.

If approved, atogepant will face stiff competition from Vydura, another CGRP receptor antagonist marketed by

Biohaven Pharmaceutical

BHVN

, in partnership with

Pfizer

PFE

, in Europe for the preventive treatment of migraine as well as a treatment of acute migraine. This approval was received earlier this April. Pfizer has exclusive rights to market the drug outside the United States. The drug is also approved for similar indications in the United States and is marketed under the trade name Nurtec ODT.

In the first quarter of 2022, Biohaven Pharmaceuticals generated $123.6 million in sales from Nurtec, up 182% year over year. Biohaven is also evaluating Nurtec in a phase II study in patients with trigeminal neuralgia, a chronic pain condition.

In May, Biohaven also announced that it has entered into a definitive agreement with Pfizer, wherein the latter will acquire the former for an aggregate equity value of $11.6 billion. Pfizer and Biohaven expect to complete this transaction by early 2023.

Zacks Rank & Another Stock to Consider

AbbVie currently carries a Zacks Rank #2 (Buy).

Merck

MRK

, carrying a Zacks Rank #2, at present, is another stock worth considering in the same sector. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Estimates for Merck’s 2022 earnings have increased from $7.28 to $7.31 in the past 60 days. Shares of MRK have risen 23.9% in the year-to-date period.

Earnings of Merck beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 13.4%. In the last reported quarter, MRK delivered an earnings surprise of 18.2%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report