Cadence Design Systems

CDNS

and Tower Semiconductor (“TSEM”) are teaming up to boost automotive and mobile integrated circuit (IC) development.

Previously, both the companies have collaborated on several occasions to deliver solutions for reference flow (RF) and silicon photonics that have helped their mutual customers to develop advanced offerings.

The current collaboration is aimed at developing an automotive reference design flow using Cadence’s Virtuoso Design Platform and Spectre Simulation Platform.

This will enable customers to maintain a comprehensive design verification for advanced automotive IC product development, accelerate the design cycle and achieve a faster path to ISO 26262 certification.

Customers can now leverage the advanced RF to meet the high quality and reliability demands of the automotive market.

The collaboration also promotes automotive SoC design and the broader Cadence Intelligent System Design strategy.

Cadence has placed a dedicated team to tap the automotive market and continues to invest heavily in advanced driver assistance systems related technologies.

Recently, Cadence

rolled

out its custom power integrity solution — Cadence Voltus – XFi, which is integrated with Cadence Spectre, Virtuoso and Quantus platforms. The new solution enables the development of efficient, low-power ICs and improves productivity by three times, per a company report.

Prior to that, Cadence collaborated with Arm and Intel Foundry Services (“IFS”) to tap the growing demand for verification and digital design products.

The collaboration with IFS was aimed at addressing complex design workloads for SoCs and accelerating time-to-market.

The collaboration with Arm was aimed at speeding up the mobile device silicon success by combining Cadence digital and verification tools and the Arm Total Compute Solutions 2022.

Cadence offers products and tools that help customers to design electronic products. The company offers software, hardware, services and reusable IC design blocks to electronic systems and semiconductors to customers.

Cadence posted non-GAAP

earnings

of $1.17 per share in first-quarter 2022, which topped the Zacks Consensus Estimate by 15.8% and increased 41% year over year.

Revenues of $902 million surpassed the Zacks Consensus Estimate by 5% and increased 23% on a year-over-year basis.

For the second quarter, the Zacks Consensus Estimate for revenues stands at $837.05 million, up 14.9% year on year. The consensus mark for earnings is pegged at 97 cents per share, up 12.8% year on year.

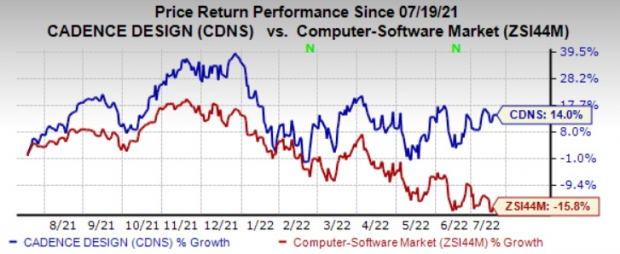

CDNS currently carries a Zacks Rank #3 (Hold).Shares of the company have gained 14% against the

industry’s

fall of 15.8% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Aspen Technology

AZPN

,

Synopsys

SNPS

and

Broadcom

AVGO

. Synopsys and Broadcom sport a Zacks Rank #1 (Strong Buy) whereas Aspen Technology carries a Zacks Rank #2 (Buy).You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Aspen Technology’s 2022 earnings is pegged at $5.49 per share, increasing 0.4% in the past 60 days. The long-term earnings growth rate is anticipated to be 16.3%.

Aspen Technology’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.1%. Shares of AZPN have soared 22.9% in the past year.

The Zacks Consensus Estimate for Synopsys 2022 earnings is pegged at $8.67 per share, rising 9.8% in the past 60 days. The long-term earnings growth rate is anticipated to be 19.6%.

Synopsys earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 2.7%. Shares of SNPS have jumped 14.5% in the past year.

The Zacks Consensus Estimate for Broadcom’s fiscal 2022 earnings is pegged at $37.06 per share, up 3.9% in the past 60 days. AVGO’s expected long-term earnings growth rate is 14.5%.

Broadcom’s earnings beat the Zacks Consensus Estimate in all the preceding four quarters, with the average being 2.2%. Shares of AVGO have gained 6.2% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report