AstraZeneca

AZN

announced an agreement to acquire private biotech, Neogene Therapeutics to build its pipeline of cell-based cancer medicines.

The acquisition of Neogene will provide AstraZeneca access to the latter’s next-generation T-cell receptor therapies (TCR-Ts) that have the potential for targeting solid tumors.

Cell therapies traditionally work by modifying the immune system’s T cells to recognize proteins expressed on the surface of cancer cells. TCR-Ts have a new way of targeting cancer. These can recognize intracellular targets, including cancer-specific mutations, thus having the potential to unlock targets that were previously inaccessible using cell therapies.

AstraZeneca will pay $320 million to acquire all outstanding equity of Neogene, which will include an initial payment of $200 million on deal closing. The remaining $120 million is contingent upon the achievement of certain milestones. The transaction is expected to close in the first quarter of 2023, subject to regulatory clearances. Neogene Therapeutics has operations in Amsterdam, the Netherlands and California.

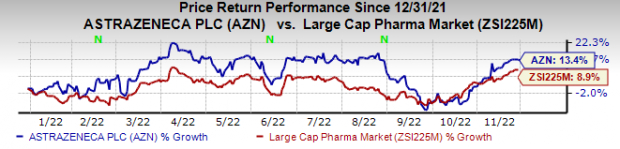

AstraZeneca stock has risen 13.4% this year so far compared with an increase of 8.9% for the

industry

.

Image Source: Zacks Investment Research

AstraZeneca is consistently bolstering its pipeline and through suitable acquisitions and deals.

A key recent acquisition was the July 2021 buyout of Alexion. The Alexion acquisition added its blockbuster rare disease drugs, C5 inhibitors Soliris and Ultomiris, as well as a growing pipeline of candidates in rare diseases to AstraZeneca’s portfolio. The acquisition diversified AstraZeneca’s portfolio, marking its foray into rare diseases, an increasingly attractive field.

In addition to acquisitions, the company is pursuing co-development deals with companies like Innate Pharma, FibroGen, and Daiichi Sankyo to boost its pipeline. AstraZeneca also has a profit-sharing deal with

Merck

MRK

for Lynparza and Koselugo (selumetinib).

AstraZeneca and Merck’s Lynparza, is approved for four cancer types, ovarian, breast, prostate and pancreatic. Lynparza is also being evaluated in an earlier-line setting for the approved cancer indications as well some other cancer types. A regulatory application, seeking approval of Merck partnered Lynparza in combination with Zytiga (abiraterone) as a first-line treatment for patients with metastatic castration-resistant prostate cancer regardless of their genetic mutation status, based on the PROpel study, is under priority review, with an FDA decision expected in the fourth quarter.

Zacks Rank & Stocks to Consider

AstraZeneca has a Zacks Rank #3 (Hold). Some better-ranked large drugmakers are

Vertex Pharmaceuticals

VRTX

and

Gilead Sciences

GILD

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ stock has risen 44% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.52 to $14.61 per share, while that for 2023 have increased from $15.50 to $15.60 per share over the past 30 days.

Vertex has a four-quarter earnings surprise of 3.16%, on average.

Estimates for Gilead’s 2022 earnings per share have increased from $6.91 per share to $7.09 per share, while that for 2023 have increased from $6.70 per share to $6.79 per share in the past 30 days. Gilead’s stock is up 18.1% in the year-to-date period.

Gilead beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 0.36%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report