bluebird bio

BLUE

entered into a definitive agreement to sell its Rare Pediatric Disease Priority Review Voucher (PRV). Upon completion of the transaction, bluebird will record $102 million from this sale.

The transaction is subjected to customary closing conditions, including anti-trust reviews.

This monetization of the PRV will strengthen bluebird’s financial position since the company has been facing the risk of a cash crunch. Alongside its third-quarter 2022 earnings, management had said its existing cash balance would dry out by second-quarter 2023. The cash inflow from monetization of the PRV will enable bluebird to fund its business plans through non-dilution of capital. The company continues to explore and evaluate additional financial options, including the sale of a second PRV, to further strengthen its financial outlook.

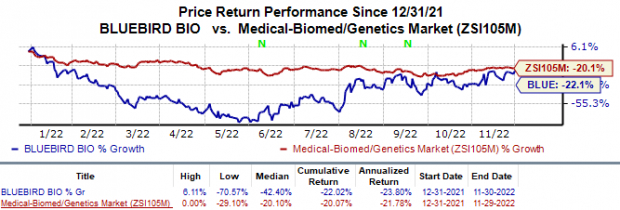

Shares of bluebird bio have plunged 22.0% in the year compared with the

industry

’s 20.1% decline.

Image Source: Zacks Investment Research

In the third quarter of 2022, bluebird gained FDA approvals for two of its gene therapies – Zyntelgo and Skysona. While Zyntelgo has been approved to treat beta-thalassemia in adult and pediatric patients, Skysona received accelerated approval for treating cerebral adrenoleukodystrophy (CALD) in patients under 18 years of age. Upon approval of these two therapies, bluebird was also granted two PRVs by the FDA.

While Zyntelgo has already been launched in the United States, Skysona is expected to be launched in the country by year-end. BLUE will start recognizing revenues from Zyntelgo upon the first commercial infusion in patients, which is expected to start in first-quarter 2023.

Since the onset of this financial year, bluebird bio has been facing the risk of a severe cash crunch. Management had expressed concerns over BLUE’s capacity to continue as a going concern due to the pressure on its existing cash balance, which is expected to dry up soon.

To reduce the risk of running out of cash, bluebird announced in April 2022 that it would implement a comprehensive restructuring plan to save up to $160 million in costs over the next two years. To achieve this target, BLUE intends to reduce its workforce by nearly 30%, which in turn, is expected to result in a 35-40% savings in estimated operating costs. This reduction is anticipated to be reflected in bluebird’s operating budget for 2023.

To focus on its gene therapy business, bluebird bio also completed the divestiture of its oncology business. This oncology business has been set up as an independent entity under the name

2seventy bio, Inc.

TSVT

. Shares of 2seventy bio started trading on the NASDAQ with effect from Nov 5, 2021. As a result of the separation of the oncology business, bluebird’s partnership with

Bristol Myers

BMY

has been transferred to 2seventy bio.

Prior to the divestiture of the oncology business, bluebird collaborated with Bristol Myers to develop Abecma gene therapy, approved by the FDA in March 2021 for treating adult patients with relapsed or refractory multiple myeloma. Per the terms of the agreement, Bristol Myers is responsible for commercializing the therapy, while bluebird would be eligible to receive milestone payments and royalties on net sales of the therapy. Post separation, 2seventybio is now eligible to receive all the milestone payments and royalties under the partnership with Bristol Myers.

Zacks Rank & Stocks to Consider

bluebird bio carries a Zacks Rank #3 (Hold) at present. A better-ranked stock in the overall healthcare sector includes

Repare Therapeutics

RPTX

, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Repare Therapeutics’ stock has declined 24.0% this year so far. While Repare Therapeutics’ loss estimates for 2022 have narrowed from $2.89 to $0.69 per share in the past 30 days, estimates for 2023 have narrowed from $3.22 to $3.21 per share during the same period.

Repare Therapeutics beat earnings estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 240.65%. In the last reported quarter, RPTX reported an earnings surprise of 955.00%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report