Roivant Sciences

ROIV

announced the formation of a new Vant company with

Pfizer

PFE

to advance the development of PF-06480605, a TL1A-directed antibody originally developed by Pfizer, for treating inflammatory and fibrotic diseases. TL1A is a cytokine believed to play a key role in inflammation and fibrosis.

PF-06480605, now RVT-3101, is being developed in a phase IIb study for ulcerative colitis (UC), data from which is expected in the first half of 2023. The new Vant or Roivant subsidiary will take care of funding the global development of RVT-3101 in UC and additional inflammatory and fibrotic diseases. The Vant company holds commercial rights to the candidate in the United States and Japan. Pfizer has a 25% equity stake in the Vant company as well as commercial rights outside of the United States and Japan. Roivant Sciences holds the remaining stake in the company.

Roivant Sciences believes RVT-3101 has the potential to transform the inflammatory bowel diseases area as it can be the first approved biomarker-selected precision medicine for these chronic inflammatory diseases, which include UC and Crohn’s disease.

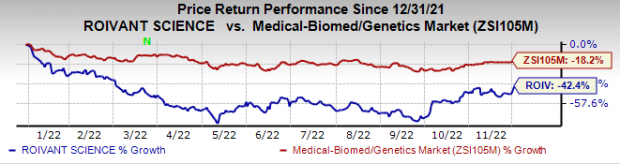

Roivant Sciences’ shares were up 8.2% on Thursday after it announced the deal with the pharma giant. In the year so far, the stock price of Roivant Sciences has plunged 42.4% compared with the

industry

’s decline of 18.2%.

Image Source: Zacks Investment Research

The Vant company also has an exclusive option to collaborate with Pfizer on another next-generation TL1A-directed antibody, which is in early-stage development. Before the candidate enters phase II development, expected in 2025, the Vant can choose to enter into a global development agreement for the drug with 50/50 cost sharing as well as co-commercialization rights.

Zacks Rank

Roivant Sciences currently has a Zacks Rank #3 (Hold).

Some better-ranked large drugmakers are

Vertex Pharmaceuticals

VRTX

and

Gilead Sciences

GILD

, both carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ stock has risen 46.1% this year so far. Estimates for Vertex’s 2022 earnings have gone up from $14.21 to $14.61 per share, while that for 2023 have increased from $15.09 to $15.60 per share over the past 60 days.

Vertex has a four-quarter earnings surprise of 3.16%, on average.

Estimates for Gilead’s 2022 earnings per share have increased from $6.61 per share to $7.09 per share, while that for 2023 have increased from $6.30 per share to $6.79 per share in the past 30 days. Gilead’s stock is up 21.1% in the year-to-date period.

Gilead beat earnings expectations in three of the trailing four quarters. The company delivered a four-quarter earnings surprise of 0.36%, on average.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report