Pfizer, Inc.

PFE

and partner

BioNTech

BNTX

announced that they have submitted a regulatory filing to the FDA seeking emergency approval for its Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccine. The vaccine will be used as the third dose (3-µg) in its three-dose primary series for children aged six months through four years.

Please note that in children of this age group, Pfizer is not seeking approval of the Omicron BA.4/BA.5 jab as a booster but as a part of the primary series. Currently, the FDA has authorized a three-dose vaccine series of Pfizer/BioNTech’s monovalent COVID-19 vaccine for use in individuals aged six months through four years.

If the FDA grants this EUA, children aged under five years would receive a primary two-dose regimen consisting of two 3-µg doses of the original Pfizer-BioNTech COVID-19 vaccine followed by a third 3-µg dose of the bivalent COVID-19 vaccine.

Pfizer and BioNTech are also undergoing discussions with the health authorities in Europe with regard to a regulatory filing seeking authorization for the use of their bivalent BA.4/5-adapted Omicron vaccine in individuals aged six months through four years. The bivalent vaccine is authorized in Europe as a booster dose for individuals aged five years and older.

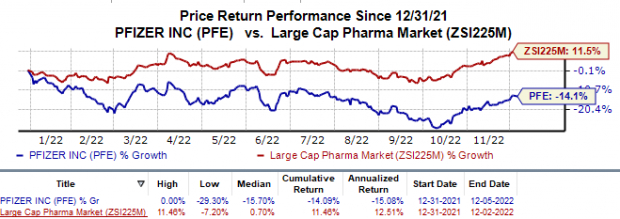

Shares of Pfizer have lost 14.1% in the year so far against the

industry

’s 11.5% rise.

Image Source: Zacks Investment Research

The bivalent vaccine contains an mRNA encoding the spike protein in the original/monovalent Pfizer/BioNTech vaccine and an mRNA encoding the spike protein common in the Omicron BA.4 and BA.5 variants.

This Omicron BA.4/BA.5 bivalent vaccine is already authorized for use in individuals aged five years and older.

In August, the FDA

granted

EUA to Pfizer/BioNTech and

Moderna

’s

MRNA

Omicron BA.4/BA.5-adapted bivalent vaccines for a single booster dose. The Pfizer/BioNTech and Moderna booster vaccines can be given at least two months following primary or booster vaccination.While a 50-µg dose of Moderna’s Omicron booster is authorized for adults aged 18 years and older, a 30-µg dose of Pfizer/BioNTech’s version is authorized for use in adults and adolescents aged 12 and older.

The EUA was

expanded

this October to include children as young as five years. Following the EUA expansion, a 10-µg dose of Pfizer/BioNTech’s bivalent vaccine is authorized for individuals aged between five and 11 years. A 25-µg and 50-µg dose of Moderna’s bivalent vaccine is authorized for children aged six to 11 years and adolescents aged 12 to 17 years, respectively.

The above authorizations granted to Pfizer and Moderna are based on clinical studies on their bivalent Omicron BA.1-adapted vaccines and pre-clinical data from studies on their Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccines.

Last month, Pfizer/BioNTech announced updated data from a phase II/III study on its Omicron BA.4/BA.5-adapted bivalent COVID-19 vaccine. The data showed that BA.4/BA.5 booster elicited substantially higher immune responses against BA.4/BA.5 sub-lineages compared with the companies’ original COVID-19 vaccine. In individuals older than 55 years, the booster produced approximately four-fold higher neutralizing antibody titers against Omicron BA.4/BA.5 sub-lineages compared with the original COVID-19 vaccine. The bivalent vaccine has also

elicited

a greater increase in neutralizing antibody titers against newer Omicron sub-lineages, including BA.4.6, BA.2.75.2, BQ.1.1 and XBB.1, than the original vaccines.

Zacks Rank & Stocks to Consider

Pfizer currently carries a Zacks Rank #3 (Hold).A better-ranked large drug stock is

Merck

MRK

, which carries a Zacks Rank #2 (Buy).You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

In the past 60 days, estimates for Merck’s 2022 earnings per share have risen from $7.37 to $7.68. During the same period, the earnings estimates per share for 2023 have risen from $7.17 to $7.34 Shares of Merck have gained 43.5% in the year-to-date period.

Earnings of Merck beat estimates in each of the last four quarters, witnessing a surprise of 16.07%, on average. In the last reported quarter, Merck’s earnings beat estimates by 10.78%.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report