Maxar Technologies

MAXR

recently announced that National Oceanic and Atmospheric Administration (NOAA) upgraded its remote sensing license to enable non-Earth imaging (NEI) capability. With this upgrade, Maxar can now collect and distribute images of space objects across the Low Earth Orbit (LEO) to both commercial and government clients.

This capability will now be available for Maxar’s current constellation on orbit and its WorldView Legion satellites. Maxar will start to deploy its NEI capability in 2023 in association with few early adopters who need to map and study space objects extensively.

Maxar’s constellation can now image objects at less than 6-inch resolution at altitude ranging from 200 kilometers up to 1,000 kilometers in LEO. The new capability enables tracking of objects across a much wider area of space.

LEO environment is increasingly getting congested owing to the rapid deployment of space objects. The NEI capability will provide clients with useful information to aid them in their mission operations, protection of assets in space, and tackle important Space Domain Awareness and Space Traffic Management requirements, added Maxar.

Maxar is a space technology firm providing satellite imagery and expert intelligence services, along with spacecraft and robotics for space exploration, research and national security.

The company’s focus on diversifying its products and customer base bodes well. Higher demand for its 3D and other innovative geospatial products is an added advantage. There is huge growth potential among three key parts of its addressable market — the U.S. government, other international governments and commercial customers.

Maxar remains focused on launching WorldView Legion satellites in 2022. Investment in differentiated capabilities and expansion of partnerships with large defense companies is likely to act as tailwinds.

However, the company has lowered its guidance for 2022 revenues due to weakness in the Earth Intelligence segment. Maxar now expects revenues in the range of $1,755-$1,805 million compared with the earlier guided range of $1,805-$1,855 million. Stiff competition, cyclical market, higher costs and lead time associated with macroeconomic weakness are concerns.

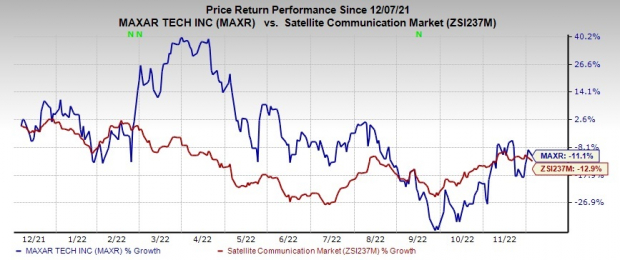

At present, Maxar has a Zacks Rank #3 (Hold). Shares of the company have lost 11.1% compared with the

sub-industry

’s decline of 12.9% in the past year.

Image Source: Zacks Investment Research

Stocks to Consider

Some better-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Blackbaud

BLKB

and

Plexus

PLXS

. Arista Networks and Plexus currently sport a Zacks Rank #1 (Strong Buy), while Blackbaud carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks’ 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated at 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have increased 5.2% in the past year.

The Zacks Consensus Estimate for Blackbaud’s 2022 earnings is pegged at $2.59 per share, up 1.6% in the past 60 days. The long-term earnings growth rate is anticipated at 4%.

Blackbaud’s earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 4.9%. Shares of BLKB have declined 23.9% in the past year.

The Zacks Consensus Estimate for Plexus’ fiscal 2023 earnings is pegged at $5.98 per share, up 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have increased 13.8% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report