Stock splits have gained a lot of traction in recent years. Fortunately, it is one of the more encouraging announcements for shareholders.

A stock split, of course, does not affect a company’s market capitalization. However, it reduces the value of each individual share, making it easier for the stock price to multiply and provide investors with significant gains.

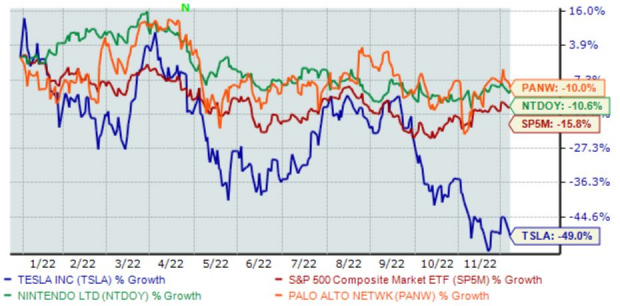

In 2022, we’ve seen several companies split their stock, including Tesla

TSLA

, Palo Alto Networks

PANW

, and Nintendo

NTDOY

. Below is a chart illustrating the year-to-date performance of all three stocks, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

It raises a valid question: which of these stock splits has been the best buy? Let’s take a closer look.

Tesla

We’re all familiar with Tesla, the company that has revolutionized the EV (electric vehicle) industry. It’s been one of the best-performing stocks over the last decade, quickly becoming a favorite among investors.

Earlier in June of 2022, the mega-popular EV manufacturer announced that its board approved a three-for-one stock split; shares began trading on a split-adjusted basis on August 25

th

, 2022.

Since the split, it’s been a challenging road for TSLA shares, down nearly 40% and widely lagging behind the general market.

Image Source: Zacks Investment Research

Nintendo

Nintendo is a worldwide leader in game development and publishing. Some of its beloved game franchises include familiar names such as

Donkey Kong, Pokémon, The Legend of Zelda, and Super Mario Brothers

.

The company executed a 10-for-1 stock split that took place over the weekend of October 1

st

, 2022.

Shares have tacked on 2.3% in value following the split so far, easily crushing Tesla’s performance. Still, the performance has widely lagged behind the S&P 500’s 11% gain during the period.

Image Source: Zacks Investment Research

Palo Alto Networks

Palo Alto Networks offers network security solutions to enterprises, service providers, and government entities worldwide.

PANW’s three-for-one stock split in mid-September seemingly flew under the radar. The company’s shares started trading on a split-adjusted basis on September 14

th

.

Since the split, PANW shares haven’t found many buyers, down roughly 8% and underperforming the general market by a visible margin.

Image Source: Zacks Investment Research

Bottom Line

With splits, liquidity within shares is increased. Additionally, it allows investors to reap considerable gains as the stock climbs back up.

Companies often execute a split when shares become too pricey for individual investors, massively alleviating barriers to entry.

All three stocks above – Tesla

TSLA

, Palo Alto Networks

PANW

, and Nintendo

NTDOY

– have all split their shares in 2022 to boost liquidity.

Of the three, Nintendo has been the best performer post-split, although all have lagged behind the S&P 500 since their split date.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report