Shares of

Arista Networks

(ANET) have gained 3.1% over the past four weeks to close the last trading session at $126.76, but there could still be a solid upside left in the stock if short-term price targets of Wall Street analysts are any indication. Going by the price targets, the mean estimate of $158.88 indicates a potential upside of 25.3%.

The mean estimate comprises 16 short-term price targets with a standard deviation of $21.35. While the lowest estimate of $130 indicates a 2.6% increase from the current price level, the most optimistic analyst expects the stock to surge 60.2% to reach $203. It’s very important to note the standard deviation here, as it helps understand the variability of the estimates. The smaller the standard deviation, the greater the agreement among analysts.

While the consensus price target is highly sought after by investors, the ability and unbiasedness of analysts in setting price targets have long been questionable. And investors making investment decisions solely based on this tool would arguably do themselves a disservice.

But, for ANET, an impressive average price target is not the only indicator of a potential upside. Strong agreement among analysts about the company’s ability to report better earnings than they predicted earlier strengthens this view. While a positive trend in earnings estimate revisions doesn’t gauge how much a stock could gain, it has proven to be powerful in predicting an upside.

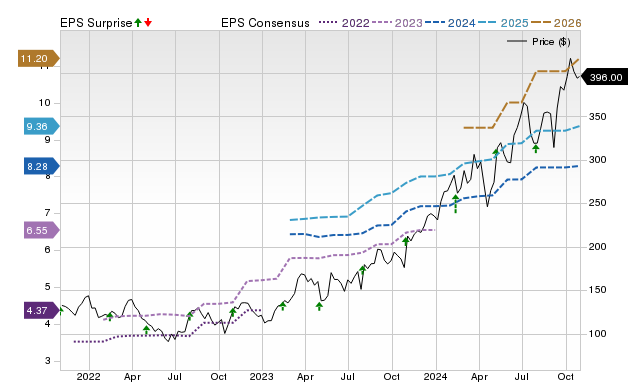

Price, Consensus and EPS Surprise

Here’s What You May Not Know About Analysts’ Price Targets

According to researchers at several universities across the globe, a price target is one of many pieces of information about a stock that misleads investors far more often than it guides. In fact, empirical research shows that price targets set by several analysts, irrespective of the extent of agreement, rarely indicate where the price of a stock could actually be heading.

While Wall Street analysts have deep knowledge of a company’s fundamentals and the sensitivity of its business to economic and industry issues, many of them tend to set overly optimistic price targets. Are you wondering why?

They usually do that to drum up interest in shares of companies that their firms either have existing business relationships with or are looking to be associated with. In other words, business incentives of firms covering a stock often result in inflated price targets set by analysts.

However, a tight clustering of price targets, which is represented by a low standard deviation, indicates that analysts have a high degree of agreement about the direction and magnitude of a stock’s price movement. While that doesn’t necessarily mean the stock will hit the average price target, it could be a good starting point for further research aimed at identifying the potential fundamental driving forces.

That said, while investors should not entirely ignore price targets, making an investment decision solely based on them could lead to disappointing ROI. So, price targets should always be treated with a high degree of skepticism.

Here’s Why There Could be Plenty of Upside Left in ANET

Analysts’ growing optimism over the company’s earnings prospects, as indicated by strong agreement among them in revising EPS estimates higher, could be a legitimate reason to expect an upside in the stock. That’s because empirical research shows a strong correlation between trends in earnings estimate revisions and near-term stock price movements.

Over the last 30 days, the Zacks Consensus Estimate for the current year has increased 0.5%, as one estimate has moved higher compared to no negative revision.

Moreover, ANET currently has a Zacks Rank #1 (Strong Buy), which means it is in the top 5% of more than the 4,000 stocks that we rank based on four factors related to earnings estimates. Given an impressive

externally-audited track record

, this is a more conclusive indication of the stock’s potential upside in the near term. You can see

the complete list of today’s Zacks Rank #1 (Strong Buy) stocks here >>>>

Therefore, while the consensus price target may not be a reliable indicator of how much ANET could gain, the direction of price movement it implies does appear to be a good guide.

Just Released: Zacks Unveils the Top 5 EV Stocks for 2022

For several months now, electric vehicles have been disrupting the $82 billion automotive industry. And that disruption is only getting bigger thanks to sky-high gas prices. Even titans in the financial industry including George Soros, Jeff Bezos, and Ray Dalio have invested in this unstoppable wave. You don’t want to be sitting on your hands while EV stocks break out and climb to new highs. In a new free report, Zacks is revealing the top 5 EV stocks for investors. Next year, don’t look back on today wishing you had taken advantage of this opportunity.

>>Send me my free report revealing the top 5 EV stocks

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report