Warren Buffett, also known as the Oracle of Omaha, is undoubtedly a name that comes to the forefront of many minds when thinking of or discussing the financial world. He’s one of the most widely-followed individuals in the realm for a good reason – he’s achieved stellar returns.

Buffett is a philanthropist and businessman. He’s the CEO of Berkshire Hathaway (

BRK.B

), a diversified holding company whose subsidiaries engage in insurance, freight rail transportation, energy generation and distribution, manufacturing, and others.

To put it simply, investors closely monitor each of his moves.

And in 2022, Buffett has gone on the offensive, undoubtedly taking advantage of the massive market recalibration.

Three stocks – Taiwan Semiconductor Manufacturing

TSM

, Occidental Petroleum

OXY

, and Citigroup

C

– have all seen buying activity from the Oracle of Omaha in 2022.

Below is a chart illustrating the year-to-date performance of all three of these buys, with the S&P 500 blended in as a benchmark.

Image Source: Zacks Investment Research

As we can see, OXY has been a big-time winner, whereas Citigroup and Taiwan Semiconductor have lagged behind the general market. Let’s take a deeper dive into each one.

Occidental Petroleum

Undoubtedly Buffett’s most famous buy of 2022, Occidental Petroleum, is an integrated oil and gas company with significant exploration and production exposure.

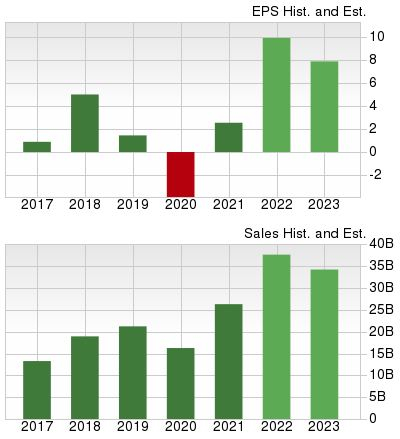

Like many stocks in the Zacks Oils and Energy sector, OXY’s growth trajectory is impressive; the company’s earnings are forecasted to soar more than 280% year-over-year in its current fiscal year (FY22) on top of revenue growth of 42.7%.

Still, the growth is projected to cool off in FY23, with estimates calling for a 23% year-over-year drop in earnings and a 9.6% pullback in revenue. This is shown in the chart below.

Image Source: Zacks Investment Research

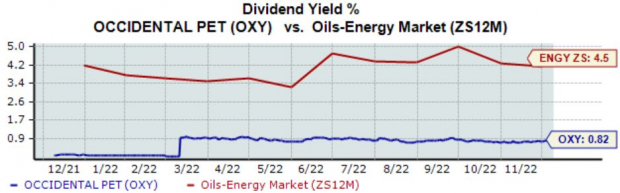

The company does pay a dividend, currently yielding a modest 0.8%, below its Zacks Oils and Energy sector average by a fair margin. OXY pays out just 6% of its earnings.

Image Source: Zacks Investment Research

Taiwan Semiconductor Manufacturing

Excluding OXY, Taiwan Semiconductor Manufacturing has been one of the more exciting names Buffett has dipped into in 2022.

TSM is engaged in the manufacturing and sale of integrated circuits and wafer semiconductor devices.

In addition, the company is responsible for supplying chips to many tech titans, including Apple

AAPL

, Advanced Micro Devices

AMD

, and NVIDIA

NVDA

. Clearly, the company is of mass importance.

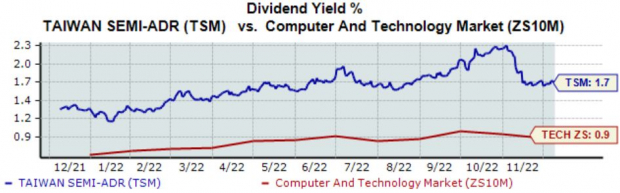

For those with an appetite for income, TSM has that covered; the company’s annual dividend currently yields 1.7%, nicely above its Zacks Computer and Technology sector average.

Image Source: Zacks Investment Research

Similar to OXY, Taiwan Semiconductor has a strong growth profile for its current fiscal year (FY22); earnings estimates suggest an improvement of more than 50% year-over-year, paired with forecasted revenue growth of 27.3%.

The earnings growth slows down in FY23, with estimates indicating a 9% pullback. Still, revenue is forecasted to grow 6.9% Y/Y.

Citigroup

Citigroup, a globally diversified financial services holding company, provides various financial products and services to consumers, corporations, governments, and institutions.

A significant perk of Citigroup shares is the dividend, currently yielding a rock-solid 4.5% paired with a 9% five-year annualized growth rate. As we can see, the current annual yield handily beats the Zacks Finance sector average.

Image Source: Zacks Investment Research

The company has consistently posted better-than-expected quarterly results as of late, exceeding earnings and revenue estimates in three consecutive quarters.

In its latest release, Citigroup registered a 2.7% bottom-line beat paired with a marginal 0.7% sales surprise. Below is a chart illustrating the company’s revenue on a quarterly basis.

Image Source: Zacks Investment Research

Bottom Line

Buffett has gone on the offensive with the market pulling back significantly year-to-date, scooping up shares at a discount.

Taiwan Semiconductor Manufacturing

TSM

, Occidental Petroleum

OXY

, and Citigroup

C

have all seen buying activity from the Oracle of Omaha in 2022.

For those seeking to invest like Buffett, all three precisely fit the criteria.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report