VeriSign Inc

VRSN

has announced that domain name registrations increased 11.5 million or 3.4% year over year.

The company continues to benefit from healthy growth across .com and .net domain name registrations and growing Internet consumption globally. VeriSign provides Internet infrastructure services that include domain name registry services and infrastructure assurance services

However, domain name registrations decreased 1.6 million or 0.4% sequentially to 349.9 million across all top-level domains (TLD) at the end of third-quarter 2022.

In the third quarter, the .com and .net TLDs increased by 2.1 million domain name registrations, or 1.2%, year over year. Also, the .com and .net domain name bases totaled 160.9 and 13.2 million domain name registrations, respectively, for the quarter that ended Sep 30, 2022.

Additionally, the company announced that from Feb 1, 2023, it will increase the annual registry-level wholesale price for new and renewal .com domain name registration by 90 cents to $9.92 from $9.02.

The company processed 9.9 million new domain name registrations for .com and .net compared with 10.7 million in the year-ago quarter. The decrease in new units can be attributed to unfavorable year-over-year comparisons, uncertainty related to global macroeconomic conditions and relative weakness in 2022 registrations from China.

The company has tweaked its full-year guidance due to uncertainty prevailing over global macroeconomic conditions and geopolitical instability. The company expects full-year revenues between $1.418 billion and $1.426 billion compared with the earlier guided range of $1.415-$1.43 billion.

The domain name base’s growth is now expected to be between 0.25% and 1% compared with the earlier expected range of 0.5-1.5%.

The company reported third-quarter 2022 adjusted earnings of $1.58 per share, which beat the Zacks Consensus Estimate by 0.6% and increased 12.9% year over year. Our estimate for third-quarter earnings was pegged at $1.57 per share.

Revenues jumped 6.8% year over year to $356.9 million and came in line with the Zacks Consensus Estimate. We projected revenues to be $357 million for the third quarter.

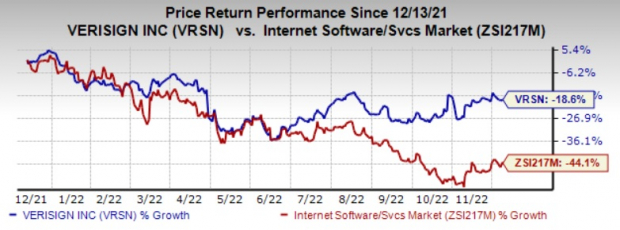

VeriSign currently has a Zacks Rank #2 (Buy). Shares of the company have lost 18.6% in the past year compared with the

sub-industry’s

decline of 44.1%.

Image Source: Zacks Investment Research

Other Stocks to Consider

Some other top-ranked stocks from the broader technology space are

Arista Networks

ANET

,

Plexus

PLXS

and

Super Micro Computer

SMCI

, each presently sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Arista Networks 2022 earnings is pegged at $4.37 per share, up 8.2% in the past 60 days. The long-term earnings growth rate is anticipated to be 17.5%.

Arista Networks’ earnings beat the Zacks Consensus Estimate in the last four quarters, the average being 12.7%. Shares of ANET have jumped 9.2% in the past year.

The Zacks Consensus Estimate for Plexus 2023 earnings is pegged at $5.98 per share, rising 8.9% in the past 60 days.

Plexus’ earnings beat the Zacks Consensus Estimate in three of the last four quarters, the average being 17.5%. Shares of PLXS have gained 16.7% in the past year.

The Zacks Consensus Estimate for Super Micro Computer’s fiscal 2023 earnings is pegged at $9.58 per share, rising 27.7% in the past 60 days.

Super Micro Computer’s earnings beat the Zacks Consensus Estimate in all of the last four quarters, the average being 9.4%. Shares of SMCI have soared 95.1% in the past year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the Zacks Top 10 Stocks portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report