Product cost inflation, tight labor market and supply chain issues are some of the headwinds that players in the

Retail–Wholesale

sector have been encountering lately. Soaring prices have squeezed consumer’s disposable income and dampened the demand. To tame inflation, the Federal Reserve is resorting to interest rate hike. But a higher interest rate environment is not conducive for the retail sector.

However, Fed Chairman Jerome Powell’s recent comment about lowering the magnitude of the rate hike from December has come as a breather. Analysts are anticipating a 0.5 percentage point hike. This is down from 0.75 percentage point increases done in the recent past. Evidently, the Fed’s action will determine the course of the stock market in 2023.

Meanwhile, a favorable reading on the Consumer Price Index front has added to the positive sentiment. Although the consumer price index rose 7.1% in November 2022 on a year-over-year basis, it was down from the reading of 7.7% in October. On a month-to-month basis, the consumer price index inched up 0.1% in November, decelerating from 0.4% in October.

Slowing inflation will give some respite to American households and lift consumer confidence. The impact of cooling prices will surely be reflected in increased consumer spending, which accounts for more than two-thirds of U.S. economic activity. Market pundits believe that with the improvement in geopolitical situation inflationary pressure will gradually alleviate next year.

Amid this, it is prudent to scoop up retail stocks that are currently the victims of the wild swings Wall Street has witnessed in 2022. These stocks are fundamentally sound and trading below their potential.

American Eagle Outfitters, Inc.

AEO

,

Arhaus, Inc.

ARHS

,

Expedia Group, Inc.

EXPE

and

Citi Trends, Inc.

CTRN

are among the beaten-down stocks in the retail space that are poised for a turnaround in 2023.

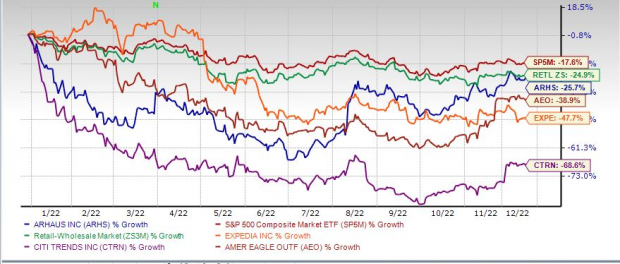

Year to date, the aforementioned stocks have underperformed the S&P 500 index and the overall Retail–Wholesale sector that have declined 17.6% and 24.9%, respectively.

Image Source: Zacks Investment Research

4 Prominent Picks

American Eagle Outfitters

, a leading global specialty retailer offering high-quality, on-trend clothing, accessories and personal care products, is worth betting on. The company’s effort to rationalize inventory and contain costs are paying off. Continued strength in the Aerie brand and a solid online show bodes well. Shares of this Zacks Rank #2 (Buy) have lost 38.9% year to date.

American Eagle Outfitters has a

Value Score

of A. The Zacks Consensus Estimate for fiscal 2023 sales and EPS suggests growth of 3.7% and 30.4%, respectively, from the year-ago period. American Eagle Outfitters has a long-term earnings growth expectation of 11.6%. Decent growth rate is likely to drive the stock in 2023. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Arhaus

is another potential pick. Strong consumer demand, new collections, brand awareness and ramp-up of new showrooms have been driving Arhus’ top-line performance. The company plans to add five to seven new traditional showrooms per year. Shares of this Zacks Rank #2 are down 25.7% year to date.

Arhaus, a lifestyle brand and premium retailer in the home furnishings market, has a Value Score of A. The Zacks Consensus Estimate for fiscal 2023 sales and EPS suggests growth of 13.4% and 2.2%, respectively, from the year-ago period. Arhaus has a long-term earnings growth expectation of 14.3%.

Investors can count on

Expedia Group

, which operates as an online travel company. The company is benefiting from strong travel demand. Its focus on improving products, technology and consumer offerings is helping it to better engage with travelers. Expedia has been making strategic acquisitions to increase its penetration in existing markets, expand in others. Shares of this Zacks Rank #2 are down 47.7% so far this year.

Expedia Group has a Value Score of A. The Zacks Consensus Estimate for fiscal 2023 sales and EPS suggests growth of 9.2% and 18%, respectively, from the year-ago period. Expedia Group has a long-term earnings growth expectation of 14%.

Citi Trends

, a value retailer of fashion apparel, accessories, and home goods, is another potential pick. We believe that management’s focus on curated assortments and incredible values should attract customers. Meanwhile, cost containment efforts and efficient inventory management should help navigate the current environment.

Citi Trends has a Value Score of A. The Zacks Consensus Estimate for fiscal 2023 sales and EPS suggests growth of 6.2% and 97.4%, respectively, from the year-ago period. Shares of this Zacks Rank #2 are down 68.6% so far this year.

Zacks Top 10 Stocks for 2023

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2023? From inception in 2012 through November, the

Zacks Top 10 Stocks

portfolio has tripled the market, gaining an impressive +884.5% versus the S&P 500’s +287.4%.

Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report