For more than a year, the U.S. construction market has been witnessing challenges like inflation, supply chain disruptions, labor and inventory shortages and insufficient inventory. As the Federal Government stepped ahead to curb inflation with frequent interest rate hikes, the picture started to deteriorate.

The residential construction market started experiencing lower demand trends thanks to decades of high inflation, affordability issues due to accelerating mortgage rates, transport bottlenecks and geopolitical uncertainties. Apart from rising borrowing costs, the risk of recession is impacting the single-family homebuilding market. Thus, the residential construction companies are more pessimistic about the housing outlook for 2023.

The non-residential construction market, on the other hand, is poised well for 2023 on the back of increased focus on infrastructural enhancement activities throughout the world. Also, solid renewable energy projects, a shift toward digital transformation and the need for state-of-the-art construction and engineering services will undoubtedly add to the positives.

Thus, 2023 could be a great year for companies indulged in public infrastructure/research and technology services despite significant headwinds. Such companies include

EMCOR Group Inc.

EME

and

Dycom Industries, Inc.

DY

from the Zacks

Building Products – Heavy Construction

industry,

Altair Engineering Inc.

ALTR

and

ChampionX Corp.

CHX

from the Zacks

Engineering – R and D Services

industry and

Cavco Industries, Inc.

CVCO

from the Zacks

Building Products – Mobile Homes and RV Builders

industry are likely to ride high next year.

Expert Opinion

The slowing housing industry due to the prevailing headwinds discussed above and uncertain macroeconomic woes make investment decisions difficult for investors. Thus, it would be a great decision to follow stocks that analysts show interest in because they have deep insight into the companies’ and industries’ fundamentals.

Analysts have a detailed understanding of the overall sector and industry and suggest suitable stocks as investment opportunities.

5 Construction Stocks Worth Considering

We have shortlisted five

construction

stocks with the help of the

Zacks Stock Screener

that currently has a Zacks Rank #1 (Strong Buy) or #2 (Buy). More than 70% of brokers recommend these stocks as a strong buy or moderate buy. Our research shows such stocks offer good investment opportunities. The Zacks Rank is a reliable tool that helps you trade confidently regardless of your trading style and risk tolerance. To learn more about how to use this proven system for market-beating gains, visit

Zacks Rank Education

.

The suggested stocks might have declined due to the ongoing headwinds but have a solid earnings growth rate and are expected to perform well in 2023. This positive trend signifies bullish analyst sentiment, indicating robust fundamentals and the expectation of outperformance in the near term.

You can see

the complete list of today’s Zacks #1 Rank stocks here

.

EMCOR

: Headquartered in Norwalk, CT, this heavy construction company provides electrical and mechanical construction and facilities services in the United States. EMCOR has been benefiting from solid execution in the U.S. Construction segment — comprising the U.S. Mechanical and Electrical Construction units — as well as disciplined cost control. Also, accretive buyouts have been strengthening its overall results by adding new markets, opportunities and capabilities.

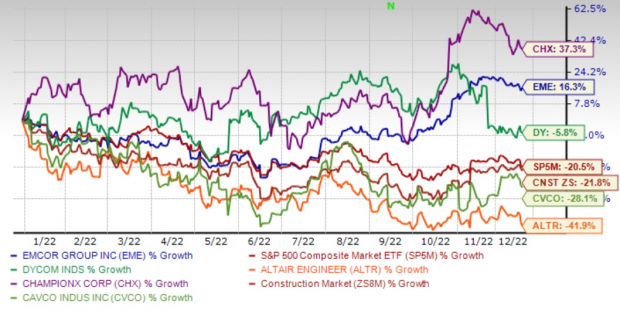

EMCOR, currently carrying a Zacks Rank #2, has gained 16.3% this year. Also, 2023 earnings estimates have increased to $9.10 per share from $8.79 over the past 60 days. Earnings for 2023 are expected to grow nearly 17%.

Dycom

: Based in Palm Beach Gardens, Fl, this specialty contracting service provider in the United States has been benefiting from higher demand for network bandwidth and mobile broadband, extended geographic reach and proficient program management and network planning services. Despite persistent automotive and equipment supply chain challenges, prospects of the Telecommunication business look good given the increased customer need to expand capacity and improve the performance of the existing networks and, in certain instances, deploy new networks. Dycom expects considerable opportunities across a broad array of customers in the future.

Dycom, currently carrying a Zacks Rank #2, dropped 5.8% this year. Earnings per share for fiscal 2024 (ending Jan 2024) are expected to grow 28.1%.

Altair

: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair, with a Zacks Rank #2 at present, has declined 41.9% YTD. That said, its earnings for 2023 are expected to witness 21.5% growth from that reported a year ago.

ChampionX

: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX, currently carrying a Zacks Rank #2, has an expected earnings growth rate of 46.3% for next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days. The stock price of CHX has jumped 37.3% year to date.

Cavco Industries

: This Phoenix, AZ-based company designs, constructs and retails manufactured homes in the United States. The company markets its manufactured homes under the Cavco, Fleetwood, Palm Harbor, Nationwide, Fairmont, Friendship, Chariot Eagle, Destiny, Commodore, Colony, Pennwest, R-Anell, Manorwood and MidCountry brands. Rising mortgage rates have impacted consumers’ ability to buy homes but has not squished consumer interest in manufactured housing product. On a positive note, community demand for new manufactured homes has retained momentum, as demand for rentals remains high, which should help CVCO drive growth.

CVCO shares have lost 28.1% year to date. That said, earnings per share (EPS) for this Zacks Rank #2 company’s fiscal 2023 is expected to witness 27.3% growth from that reported a year ago. The same for fiscal 2024 is likely to fall 8.1% year over year. Nonetheless, earnings estimates for the next fiscal year have increased to $24.95 per share from $24.38 over the past 60 days.

The chart below shows the price performance of our five picks year to date.

Image Source: Zacks Investment Research

Special Report: The Top 5 IPOs for Your Portfolio

Today, you have a chance to get in on the ground floor of one of the best investment opportunities of the year. As the world continues to benefit from an ever-evolving internet, a handful of innovative tech companies are on the brink of reaping immense rewards – and you can put yourself in a position to cash in. One is set to disrupt the online communication industry. Brilliantly designed for creating online communities, this stock is poised to explode when made public. With the strength of our economy and record amounts of cash flooding into IPOs, you don’t want to miss this opportunity.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report