Shares of

Workday, Inc.

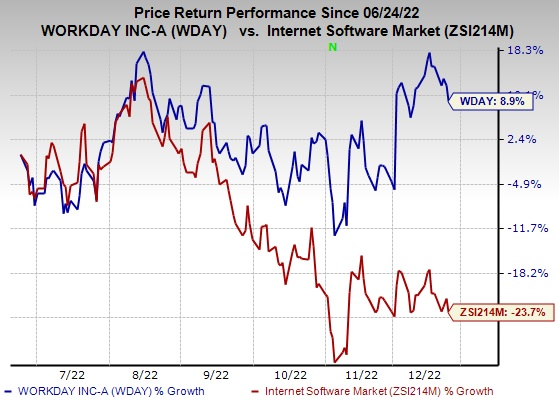

WDAY

have climbed 8.9% over the past six months, driven by improved market demand across its portfolio on the back of a flexible business model and solid cash flow. Earnings estimates for the current fiscal year have increased 3.2% since August 2022 while that for the next fiscal year have risen 4.8% over the past year, implying robust inherent growth potential. With healthy fundamentals, this Zacks Rank #2 (Buy) stock appears to be a solid investment option at the moment. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Image Source: Zacks Investment Research

Growth Drivers

Headquartered in Pleasanton, CA, Workday is a leading provider of enterprise-level software solutions for financial management and human resource domains. The company’s cloud-based platform combines finance and HR in a single system that makes it easier for organizations to provide analytical insights and decision support. Apart from Financial Management and Human Capital Management (HCM) solutions, the company offers applications related to Payroll, Time Tracking, Recruiting, Learning, Planning, Professional Services Automation and Student.

Workday’s revenue growth continues to be driven by high demand for its HCM and financial management solutions. The company’s cloud-based business model and expanding product portfolio have been the primary growth drivers. Moreover, the growing clout of Workday Prism Analytics and Adaptive Insights business planning cloud offerings holds promise. Based on its expanding product portfolio, we believe that Workday is well-positioned to gain from the strong growth prospect going forward.

Workday’s HCM suite of applications demonstrates strong growth momentum, driven by the transition of organizations to the cloud. A steady flow of customers portrays a high customer satisfaction rate, which bodes well for its long-term business model. Workday is also gaining traction in the international market, driven by higher digital transformation initiatives across Finance and HR domains, in tune with the evolving market conditions.

Workday reported strong third-quarter fiscal 2023 results (ended Oct 31, 2022), with the top and the bottom lines beating the consensus estimate. With solid demand trends, the company is confident about its growth opportunities for fiscal 2023. It plans to focus on higher investments in key industries and innovation efforts to expand its footprint within the partner ecosystem.

It has a long-term earnings growth expectation of 22.3% and delivered an earnings surprise of 7.3%, on average, in the trailing four quarters. The stock has a

VGM Score

of B.

Other Key Picks

TESSCO Technologies Incorporated

TESS

, sporting a Zacks Rank #1, delivered an earnings surprise of 126.1%, on average, in the trailing four quarters. Earnings estimates for TESSCO for the current year have moved up 44.3% since December 2021.

TESSCO offers products to the industry’s top manufacturers in mobile communications, Wi-Fi, wireless backhaul and related products. With more than three decades of experience, it delivers complete end-to-end solutions to the wireless industry.

Harmonic Inc.

HLIT

, carrying a Zacks Rank #2, delivered an earnings surprise of 55.5%, on average, in the trailing four quarters. Earnings estimates for Harmonic for the current year have moved up 48.6% since March 2021.

Harmonic provides video delivery software, products, system solutions and services worldwide. With more than three decades of experience, it has revolutionized cable access networking via the industry’s first virtualized cable access solution, enabling cable operators to more flexibly deploy gigabit Internet service to consumers’ homes and mobile devices.

AudioCodes Ltd.

AUDC

, sporting a Zacks Rank #1, is likely to benefit from the secular tailwinds related to IP-based communications. Incorporated in 1992 and headquartered in Lod, Israel, it offers advanced communications software, products and productivity solutions for the digital workplace. It has a long-term earnings growth expectation of 9%.

AudioCodes aims to leverage its long-term partnership with Microsoft to further strengthen its market position. It is also likely to benefit from its continued focus on high-margin businesses.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report