Quanta Services, Inc.

PWR

received a contract from Xcel Energy

XEL

to serve as the prime constructor for the Colorado Power Pathway high-voltage electric transmission project.

Per the deal, Quanta will manage all construction activities related to the project. The scope of the work includes the construction of approximately 610 miles of 345 kV transmission infrastructure, consisting of up to six segments and spanning more than a dozen counties, primarily in eastern Colorado. Also, it include the installation of four new substations and the expansion of four existing substations.

Post completion, the project will be able to deliver approximately 5,500 megawatts of new wind, solar and other resources through 2030. Of this project, certain segments are likely to be completed by 2025 and the rest in 2026 and 2027. The work is likely to begin in mid-2023.

The terms of the deal were not disclosed, yet Quanta expects to include the estimated revenue in the remaining performance obligations and the Renewable Energy Infrastructure Solutions segment’s backlog during the fourth quarter of 2022.

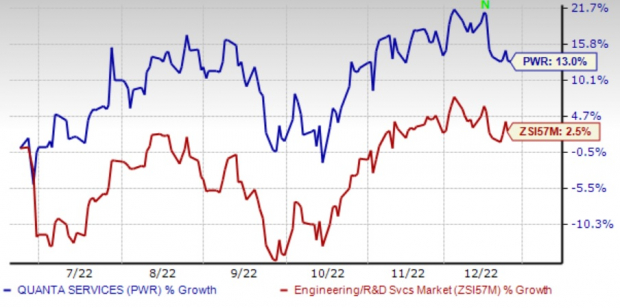

Image Source: Zacks Investment Research

Shares of the company fell 1.47% on Dec 22, but gained 13% in the past six months versus 2.5% growth in the Zacks

Engineering – R and D Services

industry.

Renewable Energy Business, a Boon for Quanta

PWR continues to experience growing demand for renewable generation and infrastructure solutions in 2023 and beyond, giving continued confidence in its multi-year financial targets.

Quanta remains uniquely positioned to capitalize on the megatrends and opportunities to lead the energy transition and enable technological development, with initiatives such as electric vehicle charging infrastructure and the undergrounding of electrical infrastructure gaining momentum.

This Zacks Rank #3 (Hold) company banks on solid project execution strategy and three-pronged growth plan, which emphasizes timely delivery of projects to exceed customer expectation, leveraging the core business to expand in complementary adjacent service lines and consistently explore new service lines. Quanta envisions delivering a 10% organic adjusted EPS compound annual growth rate (CAGR) and more than 15% adjusted EPS CAGR through 2026.

The company ended third-quarter 2022 with a total backlog of $20.87 billion and a 12-month backlog of $12.43 billion. This compares favorably with $17.02 billion of total backlog and $9.76 billion of 12-month backlog a year ago. This demonstrates the strength of its core operations. Quanta’s optimism stems from healthy backlog levels, which are expected to grow further.

About XEL

Xcel Energy with subsidiaries engaged primarily in the utility business. The company has operations in eight states – Colorado, Michigan, Minnesota, New Mexico, North Dakota, South Dakota, Texas and Wisconsin. It currently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Xcel Energy is poised to benefit from long-term investment and renewable power generation. The company’s expanding electric and natural gas customer base along with the enforcement of new rates act as its key tailwinds. It has plans to become carbon neutral by 2050. XEL got the approval for the Colorado resource plan to reduce carbon emissions by at least 85% by 2030.

Better Ranked Stocks

Some better-ranked stocks in the same space are

Altair Engineering Inc.

ALTR

and

ChampionX Corp.

CHX

, both carrying a Zacks Rank #2.

Altair

: This Troy, Michigan-based company provides software and cloud solutions in simulation, high-performance computing, data analytics and artificial intelligence worldwide. Despite significant macroeconomic uncertainty, ALTR has been registering solid growth in billings on a constant-currency basis and witnessing strong demand across all geographies. The company’s focus on delivering services with outstanding technology developments and applications is expected to drive growth.

Altair’s earnings for 2023 are expected to witness 21.5% growth from the year-ago report.

ChampionX

: This engineering services company provides chemistry solutions, engineered equipment and technologies to companies that drill for and produce oil and gas. CHX’s Chemical Technologies offering consists of chemistry solutions for flowing oil and gas wells as well as chemistry solutions used in drilling and completion activities. The company has successfully implemented price increases and surcharges to offset cost inflation. Moreover, CHK remains optimistic about the constructive demand tailwinds in its businesses that support a favorable multi-year outlook for the sector.

ChampionX has an expected earnings growth rate of 46.3% for the next year. The Zacks Consensus Estimate for next-year earnings has improved 4.7% over the last 30 days.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 5 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How To Profit From Trillions On Spending For Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report