Santa appears to be late to the party this year. The typically favorable Christmas-themed month has disappointed investors, as just yesterday a sharp year-end slide witnessed the Nasdaq hit a new closing low for the year. Both domestic and international stocks are on pace for their worst annual drop since the 2008 financial crisis. Declining earnings growth, higher interest rates, and recession jitters have invoked investor fears, putting a damper on prospects for a year-end rally that stocks typically enjoy at the end of December.

2022 will undoubtedly go down as one of the more painful years for investors, particularly because the benefits of asset allocation were mainly nonexistent. Along with the negative returns for stocks, bonds suffered their worst year on record as higher rates saw bond prices plummet. And while commodities experienced stellar returns in the first half, many have since come back to down earth. Oil, for example, hit a low for the year earlier this month, briefly falling into negative territory.

Still, certain pockets of the market have recently been showing relative strength. While major tech stocks continue to trade near yearly lows and below key technical levels, other areas have displayed immunity to the year-end volatility. Let’s examine three stocks that look to have more upside as we head into the new year.

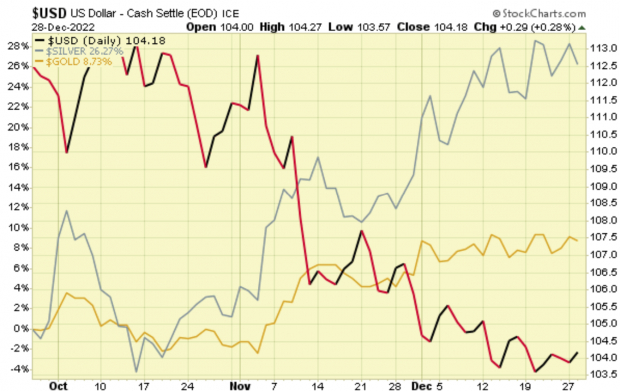

The recent downturn in the U.S. dollar has helped metals rally following a weak start to the year. Over the last three months, silver has rallied more than 26%, while gold has climbed nearly 9% on the heels of the greenback’s weakness.

Image Source: StockCharts

Wheaton Precious Metals

WPM

sells gold, silver, palladium, and cobalt deposits. WPM boasts a portfolio of interests in 23 operating mines and 13 development projects. Wheaton Precious Metals is one of the largest precious metals streaming companies in the world.

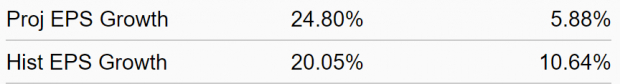

WPM is part of the Zacks Mining – Miscellaneous industry group, which currently ranks in the top 38% out of approximately 250 industries. This group has widely outperformed the major indices this year with a slightly positive return. Also note the favorable characteristics for this industry below:

Image Source: Zacks Investment Research

WPM has staged a new uptrend and is breaking out as we head into the new year. Simply put, not many stocks are experiencing higher highs and sustained buying pressure. WPM currently pays a $0.60 (1.51%) dividend.

Image Source: StockCharts

Another area that is showing relative strength is aerospace and defense. The iShares U.S. Aerospace & Defense ETF

ITA

hit a 52-week high earlier this month, showing immunity to the recent volatility. ITA provides exposure to domestic companies that manufacture commercial and military aircrafts and other defense equipment. The iShares U.S. Aerospace & Defense ETF seeks to track the results of an index composed of equities in the aerospace and defense sector.

As illustrated below, notice how ITA has bucked the market’s downtrend over the past month. The ITA ETF is showing sustained buying pressure on increasing volume – a bullish sign.

Image Source: StockCharts

One of the top holdings in the ITA ETF is Boeing

BA

. The Boeing Company designs, develops, manufactures, and sells commercial jetliners, military aircraft, satellites, missile defense, and human space flight services. BA accounts for more than 7% of the ITA ETF holdings.

Looking ahead, BA is expected to deliver year-over-year earnings growth of 131.72% to $2.78/share in 2023. Revenues are projected to increase 24.34% to $81.66 billion. It appears BA shares are reflecting this bullish outlook, as the stock has advanced more than 40% over the past three months.

Image Source: StockCharts

Not many stocks are rallying into year end. These three bullish setups are a good place to start for investors looking to add some exposure to their portfolios.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report