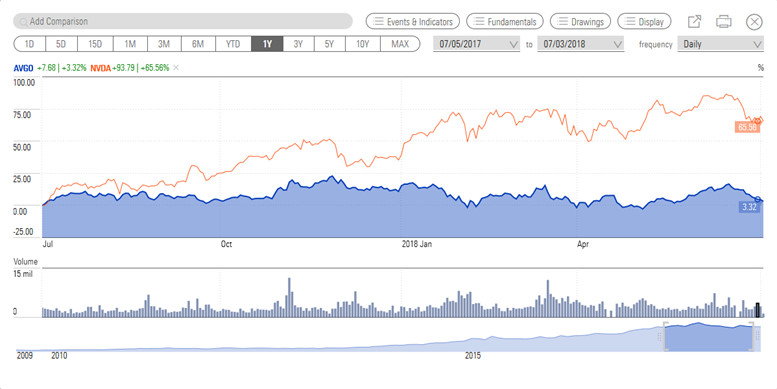

Broadcom Limited (NASDAQ:AVGO): Broadcom shares underperform compared to the substantial gains from the Nasdaq index and its closest counterparts.

AVGO shares plunged 10% since the start of this year; the stock is down 3% in the last twelve months. Meanwhile, the Nasdaq index rose from 6950 points at the beginning of the year to a new record level of 7700 points in June. The index currently stands around 7500 points.

Broadcom’s closest counterparts have also generated significant gains for their investors. NVIDIA Corp. (NASDAQ:NVDA) shares grew 39% year to date, and its shares are up 93% in the last twelve months.

Broadcom Shares Underperform: Low Financial Numbers Impacted Traders’ Sentiments

Although Broadcom has generated a 20% revenue growth in the first quarter, it fell short compared to competitors’ performances. NVIDIA, for instance, generated year-over-year revenue growth of 65% in the first quarter.

Also, Broadcom’s second-quarter earnings declined sharply from the previous quarter. Its net income was standing close to $3.73B, a sharp drop from last quarter’s earnings of $6.57B.

>> Is Buying Walmart Shares a Wise Strategy After Huge Share Price Slump?

On top of that, a lower-than-expected revenue outlook for the third quarter affected traders’ sentiments. The company expects its third-quarter revenue to be in the range of $5.05B, lower than the consensus estimate of $5.06B.

Valuations and Dividends Support Potential Uptrend

The decline in Broadcom’s share price along with the double-digit growth in revenues dropped its valuations to lower than the industry average. Its shares are trading around 9 times to earnings while NVIDIA and NXP Semiconductor (NASDAQ:NXPI) are trading around 39 and 37 times to earnings, respectively. Broadcom has also been offering substantial cash returns to investors in the form of dividends, thanks to its free cash generation potential. It currently provides a quarterly dividend of $1.75 per share, yielding at 2.9%. Broadcom generated a free cash flow of $2.38 billion last year relative to its dividend payments of $1.7 billion.

Featured Image: twitter