Natural gas futures contracts (NYSEARCA:$GASL) (NYSEARCA:$DGAZ) for the July delivery rose about 4.3%, putting it at around $3.06 per MMBtu (million British thermal units) on June 14th.. This is the highest price the futures has been in since May 31, and was largely due to the unexpected rise in US natural gas inventories.

The $3.06 per MMBtu settlement that occurred happened immediately after natural gas prices started climbing back from its from its three-month low. Oil and gas producers such as Gulfport Energy (NASDAQ:$GPOR), Newfield Exploration Co. (NYSE:$NFX), and Memorial Resource Developmen Corp (NASDAQ:$MRD) have all been influenced by the fluctuating prices of natural gas. If you have investments in any such companies, it is best advised to keep up with the company’s shares and adjust your investment strategies accordingly.

On June 9th, the S&P 500 (INDEXSP:$.INX) hit its highest level of 2,445.7. Despite falling by 0.2% to 2,432.46 on June 15, the bullish momentum that occurred earlier this month for this popular trade index could help the struggling U.S. energy market. The energy sector accounts for about ~5.9% of S&P 500 currently, with crude oil and natural gas accounting for the majority of the energy sector.

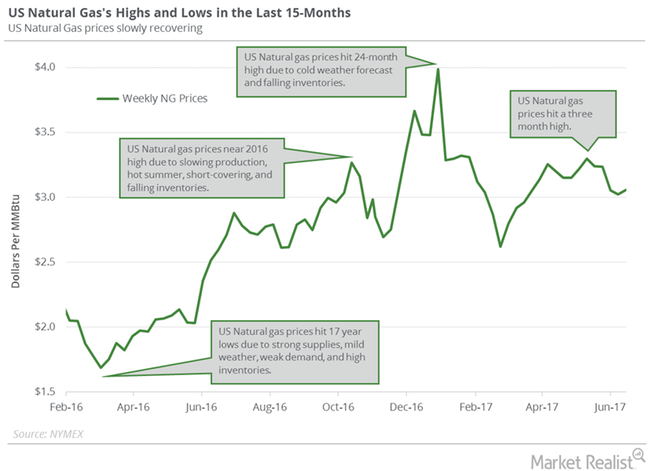

For the past 15 months, natural gas has been fluctuating between highs and lows — making it a highly volatile stock. On December 28, 2016, natural gas futures contracts (NYSEARCA:$UNG) (NYSEARCA:$FCG) hit its all time high in the more than two years at $3.99 per MMBtu. Active US natural gas futures are now only below 23.4% below this high as of June 15 after it settled at $3.06 per MMBtu. However, it is still hard to tell if natural gas prices will be rising or falling from this point, as mild weather and an expectation of production growth has been causing some uncertainties in natural gas prices.

Things are still looking up, however. As of June 15, 2017, prices have risen 81.9% from its 17-year low of $1.68 per MMBtu that occurred on March 4, 2016. Compared to earlier last year, natural gas prices have improved greatly.

Featured Image: twitter