After more than 50 years of dominating retail banking, ATMs might finally be on their way out—and a new force of disruption pushing its way in. The global rise in mobile payment platforms such as PayPal Holdings (NASDAQ:PYPL)’s Venmo and Square, Inc. (NYSE:SQ)’s Cash app has led to a steady decline in automated teller machines (ATMs) around the world. This has impacted traditional ATM companies such as NCR (NYSE:NCR) and Fiserv (NASDAQ:FISV). Whereas banks are now trying to keep up by rolling out ATMs with increased capabilities and “eATMs” featuring tablet-like screens and cardless access, a Mark Cuban-invested offering developed by startup Mercuri Systems—Spare CS, Inc.—aims to bypass the banking system altogether through “virtual ATM” services to tap the enormous underbanked population in the United States and the world. With a recent feature on “Shark Tank,” Spare is working on expanding their offering , having inked a deal with Litelink Technologies Inc. (CSE:LLT) (OTC:LLNKF) subsidiary uBUCK Tech to bring their virtual ATM capabilities to the revolutionary uBUCK Pay platform.

ATMs in steady decline

Spare comes at just the right moment in banking history. In our new world of digital money, the decline of ATMs has caused numbers to drop by 1% in 2018 to 3.24m, according to banking consultancy RBR. This downturn is now affecting the world’s largest markets, including China, the United States, Japan and Brazil, while growth in India has slowed significantly. ATM makers such as NCR (NYSE:NCR), a payments company that’s heavily leveraged in cash transactions, is suffering as a result. NCR (NYSE:NCR), which currently controls 27% of the global ATM market, put itself up for sale in May, attracting two bidders who subsequently walked away. There are no new bidders on the horizon. Meanwhile, financial services technology company Fiserv (NASDAQ:FISV), which connects over 412,000 ATMs in 50 US states through Accel, has actively branched out beyond its traditional ATM services business. In one of the largest deals in the history of digital payments, Fiserv (NASDAQ:FISV) recently announced plans to buy payment processor First Data for $22-billion in an all-stock deal.

While the rise of digital payments has impacted the popularity of ATMs, another pain point stems from the expensive convenience fees that out-of-network consumers are charged per withdrawal. Spare’s CEO D’ontra Hughes was himself frustrated at failing to find an ATM affiliated with his bank to avoid these high fees. He subsequently developed the Spare app, which allows users to withdraw cash at one of over 2,500 participating merchants in Los Angeles without needing a debit card, credit card, or a brick and mortar bank.

Spare is remarkably easy to use. First, users link their bank account to the app and enter the amount they wish to withdraw. Spare then populates its in-app map with merchants nearby that are willing to hand users money straight from the cash register, if they’re shown a one-time PIN. Users would pay a convenience fee depending on the merchant—invariably lower than the charges from third-party ATMs, which averages out at a pricey $4.69 in the United States for an out-of-network withdrawal.

Mark Cuban Invests in the Underbanked

The startup is starting to attract some major names. This year, Spare was featured on ABC entrepreneur reality TV series “Shark Tank,” impressing billionaire Mark Cuban to the point in which he invested $500,000 in Hughes’s offering. Specifically, Cuban saw the potential of Spare to access the world’s unbanked and underbanked (yet mobile connected) customers—an enormous untapped market.

According to the Federal Reserve, the underbanked accounts for 22% of US households, as well as roughly one-third of the world population. Cuban understood this demographic all too well, having been too broke to even open up a bank account when he first graduated. “You needed to have 200 bucks,” he recalled. “You needed this, you needed that. They didn’t give me one.” To Cuban, the banking system loaded the dice in favour of the rich, and Spare could turn this around.

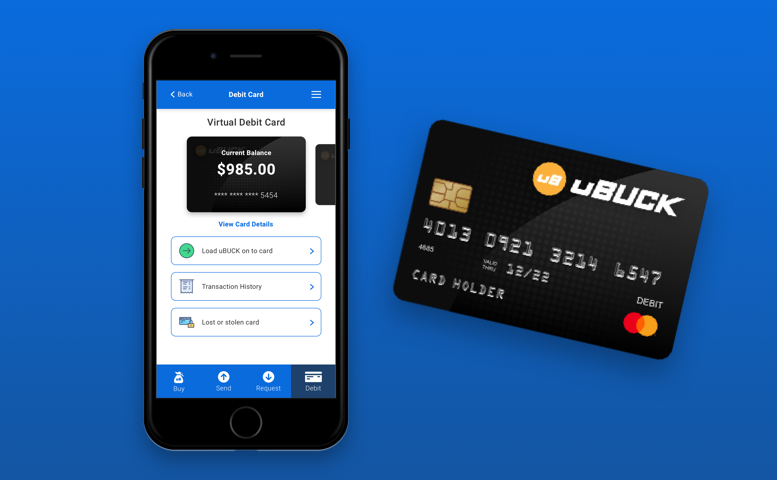

Now, Spare’s latest deal with Litelink Technologies Inc. (CSE:LLT) (OTC:LLNKF) on the uBUCK digital wallet platform puts Mark Cuban’s vision one step closer—effectively levelling the financial playing field for the underbanked. Paired with Litelink Technologies Inc. (CSE:LLT) (OTC:LLNKF)’s uBUCK Pay, Spare’s app solution now offers under-privileged and underbanked consumers more options to deposit and withdraw their cash, transfer money, and make online and offline purchases. Through the platform, users don’t need to maintain a minimum bank account balance, nor do they have to pay the high fees charged by banks, ATMs and even mobile payment services such as PayPal (NASDAQ:PYPL).

That’s because Americans who want to use a service like uBUCK won’t need a bank account at all. Having recently partnered with US prepaid platform PreWay, uBUCK will be able to offer its customers the option of buying uBUCK vouchers at any one of roughly 7,000 convenience stores across the United States using cash. The partnership will allow uBUCK users to purchase vouchers at their convenience store and then withdraw their cash at a registered Spare merchant, all without interacting with a bank.

The World’s Most Accessible Digital Wallet

Litelink Technologies Inc. (CSE:LLT) (OTC:LLNKF)’s subsidiary uBUCK platform is just as potentially world-changing as the Spare app. As a global decentralized online payments platform and pin voucher solution, uBUCK is a viable payment alternative for consumers, businesses and merchants. uBUCK acts as a digital wallet app that manages digital and traditional currency and allows users to transfer uBUCK cash to friends, family, vendors and business associates around the world—all without paying a single penny in transfer fees, commissions or hidden charges.

Free overseas transfers is a ground-breaking concept on its own. For decades, countless individuals and multinational businesses have clamoured for 100% free, instantaneous and secure worldwide money transfers. PayPal (NASDAQ:PYPL)’s fees for international transfers and fees can get quite hefty, while banks and other services charge absurd fees for most wire transfers. Payment platforms such as PayPal (NASDAQ:PYPL) and Square (NYSE:SQ) have also rolled out mobile payment services Venmo and Cash app, but these services can be slow and limited, however, and inhibit international money transfers. Neither Venmo or Square (NYSE:SQ)’s Cash app supports international cash transfers. uBUCK users can make transfers anywhere around the globe and are secure and instantaneous.

By integrating with Spare—which will provide its QR code processing technology—uBUCK could well become the most accessible digital wallet in the world. This latest deal with Spare ensures that American users of uBUCK can also get their cash out in even more places than traditional prepaid cards, through Spare’s “virtual ATM” capabilities.

Meanwhile, the benefits of using uBUCK continue to pile up. Recently, Litelink Technologies Inc. (CSE:LLT) (OTC:LLNKF) subsidiary uBUCK signed a deal with Datable Technology to integrate PLATFORM³, Datable’s loyalty and rewards program into uBUCK’s digital payments platform. This lets uBUCK Pay’s account holders to also earn rewards for purchases and payments made within the uBUCK Pay digital wallet or on their uBUCK Mastercard. Considered the top rewards platform on the market, Datable features over 30 Fortune brands such as Universal, General Mills, Unilever and Toro.

All this means that underbanked consumers now finally have a viable alternative. For decades, banks have underserved a large proportion of the market, while unfairly punishing consumers with hefty fees. New technologies such as Spare and uBUCK promise to change all of this, and signals that the financial industry could finally undergo some serious disruption.

For a free research report on LiteLink Technologies Inc. (CSE:LLT) (OTC:LLNKF), visit microsmallcap.com