Legendary Stock-Picker Predicts Best-Performing Stock of 2020

Dr. Steve Sjuggerud loves to make bold and accurate predictions.

He’s been featured on CNBC, Fox News, Market Watch and ever other financial publications you can think of.

And for over 500,000 Americans, his publication True Wealth is still the #1 source for trustworthy financial information.

In January 2000, as most Americans obsessed over dot-com stocks, Dr. Steve Sjuggerud, editor of the True Wealth Newsletter wrote, “We are at the peak of most likely the greatest financial mania that we will ever see in our lifetimes.” The NASDAQ fell 75% shortly after. In May 2003 he wrote, “It doesn’t matter what happens… the price of gold will rise.”

Gold ultimately skyrocketed from $400 to $1,900 an ounce, and the gold stocks Sjuggerud recommended soared as high as 995%. Then, in January 2009, Sjuggerud accurately predicted the bottom of the stock market when he wrote: “We may never see opportunities this good again. Take advantage of it.”

Sjuggerud predicted in 2013 that the market would continue to go higher on national television. The anchors laughed in his face. Ever since his prediction the S&P 500 and the Dow have both nearly doubled. Nasdaq is up 150% since that time and investors have made fortunes.

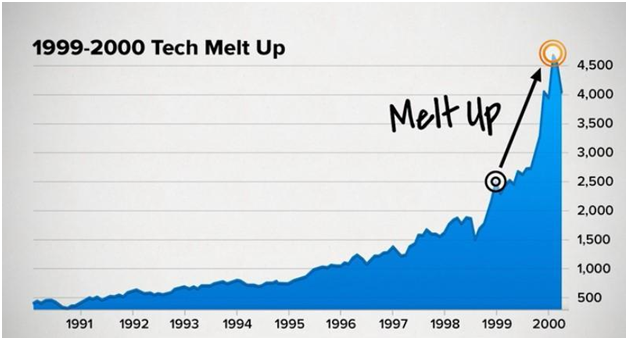

What’s coming next is going to change lives. It’s the biggest investment opportunity in the last 25 years. What’s coming could be more intense than the dot com boom.

The Window of opportunity is closing fast and based on historical data, we won’t see a setup like this for decades. What we saw with crypto and pot stocks over the last two years were mini melt ups compared to what is we will be seeing in the near future.

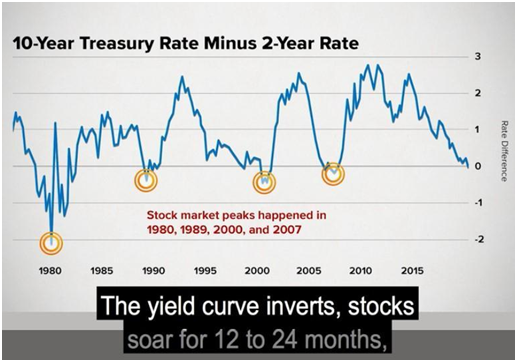

#1 Melt Up Historical Predictor – Inverted Yield Curve

Sjuggerud says one of the most telling moments of a “Melt Up” is an inverted yield curve. It’s happened four times in the past 40 years and every time, the stock market has soared for 12 to 24 months after it occurs.

The last time the yield curve inverted before it happened in March 2019 was in December of 2005, and yet stocks sored for another 2 years before the big crash.

This year, the dow hit a record high of 28000. Sjuggerud is predicting it could hit 40000 or maybe even 50000 when the melt-up hits its peak.

If the market melts up 109% as it did in the roaring 20s, the Dow would top 41000.

If it repeats the pattern that we saw during the Nasdaq melt-up of the late 1990s, it would explode up to 48,000!

Even if the dow jumps half that much, it could still mean the chance for hedging hundreds of thousands of dollars in your retirement fund in less time you’ve ever thought possible.

Sjuggerud just teamed up with one of the biggest and best stock pickers of all time, Matt McCall. McCall’s going to reveal the name and ticker symbol of what he predicts will be the best-performing stock of 2020.

McCall has built one of the greatest track records in the financial world.

He’s pinpointed over 200 stocks that ALL went on to jump 100% or more. Plus 16 more recommendations that skyrocketed over 1,000%.

Today, he’s doing it all over again.

He says,

“I’m confident that this is my next big winner – and I haven’t felt this way since back in 2009. This company is on the cutting-edge of one of the greatest technological advancements of the 21st century. You can’t afford to ignore this.”

See how you could have the chance to become the next melt-up market millionaire today. To see McCall’s prediction for yourself, simply click here. You’ll get this stock’s name and ticker symbol, absolutely free.

About True Wealth

True Wealth is one of the world’s most trusted financial newsletter research advisories. Dr. Steve Sjuggerud’s philosophy in True Wealth is simple but powerful: Buy assets of great value when nobody else wants them, and sell when others will pay any price. Over the past two decades, Dr. Sjuggerud has covered stocks — but also opportunities in timber, gold coins, and government “tax certificates” with outstanding success — all focused on helping readers learn how to potentially generate solid profits.

Risks and Disclosure:

Information provided in this correspondence is intended solely for informational purposes and is obtained from sources believed to be reliable. While all information is believed to be reliable, it is not guaranteed by us to be accurate. Individuals should assume that all information contained on this website is not trustworthy unless verified by their own independent research. Also, because events and circumstances frequently do not occur as expected, there will likely be differences between any predictions made or suggested and the actual results.

Market Jar Media Inc. is not responsible for the validity of all statements. This article does not constitute as investment advice. Each reader is encouraged to consult with his or her individual financial advisor; any and all actions taken by a reader as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and this disclaimer. This article is in no way a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice. Any information on Market Jar Media Inc. should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on Market Jar Media Inc. .

Futures, stocks and options trading involves substantial risk of loss and is not suitable for every investor. The valuation of futures, stocks, and options may fluctuate, and, as a result, clients may lose more than their original investment and possibly their entire investment. Any content on this website should not be relied upon as advice or construed as providing recommendations of any kind. It is your responsibility to confirm and decide which trades to make. Always consult a licensed investment professional before making any investment decision. Be extremely careful, investing in securities carries a high degree of risk; you may likely lose some or all of the investment.