What do the founders and shareholders of the company that made one of the biggest high-grade gold discoveries of the decade in Quebec know that investors don’t know?

They think they know when and by whom the next big discovery might likely be made.

They think they know because it’s a small-cap explorer who bought territory right next to its own discovery, making that small-cap appear to be one of the best pure play bets in what is one of the hottest gold spots in the world right now.

They also think they know because they’re drilling closer and closer to the small-cap’s property boundary, and with each move closer, the grades are getting higher and the mineralization is open at depth.

The junior explorer is Starr Peak Exploration Ltd. (TSX:STE.V; OTC:STRPF), and some of the founders of AMEX–the company that recently made a huge discovery in the same area–are doubling down that Starr is possibly going to repeat their success.

It is also helpful that Quebec is one of the most coveted gold venues on the planet, and there’s never been a better time to own gold.

AMEX Surged 7,000% in the past year. Anyone that missed that boat will be looking for the next potential one, and exposure is starting to show with Starr Peak–an obvious contender–seeing its shares gain around 800% in 12 months.

That’s because investors are starting to realize what Starr may be sitting on, and they’re watching the junior explorer aggressively move to expand its position with acquisition after acquisition

World-Class Gold Discovery 2.0

Quebec is the world’s queen of gold. Not just because it’s one of the most lucrative venues in the world, but because it’s one of the friendliest. There’s no arbitrary Africa regime to deal with, and there’s tons of infrastructure–the bane of many hotshot miners who get to gold and then can’t do anything with it.

More than 90% of the province’s substratum consists of Precambrian rock, which is famous for rich deposits of gold – as well as iron, copper, and nickel. The province is littered with mines–at least 30 major venues and at least 160 exploration projects.

Still, only around 40% of the province’s mineral potential is known, while the Abitibi Greenstone Belt is the holy grail and home to at least a dozen “world-class” deposits, including the recent giant discovery by Amex Exploration, which hit very high-grade gold here.

That brought fame for AMEX’s Perron Gold Project–along with one of the most exciting stories for investors in ages. Perron is a massive 45 square kilometers boasting two significant faults that cover more than 15 kilometers of strike. With approximately $30 million in cash, AMEX is drilling furiously right now, with 6 rigs working nonstop and announcements coming steadily of more high-grade results.

But here’s where the story gets really compelling for investors looking for the next shiny gold play: Starr Peak quietly swooped in and bought up property from AMEX before the big discovery. They anticipated the find, and they loved the “closeology”.

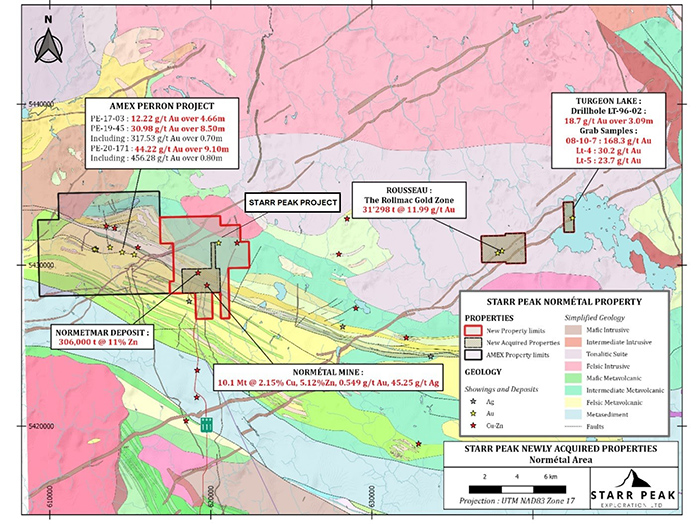

Figure 1: Geological Map of the NewMetal property with the new acquired claims blocs with respect to Amex Exploration’s Perron Project.

No one (except AMEX) was paying attention when Starr Peak made its first big move.

Now, it’s all unfolding to be the junior gold play of the year.

Hot on the Acquisition Trail

Starr Peak (TSX:STE.V; OTC:STRPF) didn’t just stop there…

Starr made a string of strategic well timed acquisitions after its first deal by firstly doubling the size of its property adjoining Amex, taking its mineral claims there from 53 to 64, with over 1,888 hectares thanks to another deal in June.

And then it bought the mine on the other side of it, too, on August 10th, when it acquired a 100%-interest in three gold targeted properties, orchestrating what can only be described as a mining coup for a small-cap company like this:

– The Normetal/Normetmar gold, copper, zinc and silver property

– The Rousseau gold property

– The Turgeon Lake gold property

Now, Starr Peak has 74 miner claims on some 2,280 hectares in the world’s best-play gold venue.

Quebec’s Normétal Mine is a past-producing mine from which millions of tons of high-grade gold, copper and zinc have come. The adjacent mine, Normetmar, shows a historic resource of 306,000 t grading 11% zinc, of which only ~48,000 t has been mined since 1990. It also shows several gold intersections.

Two new additions include Rousseau, which is a bloc of 12 claims covering over 470 hectares in the Rollmac gold zone of 31,298 tonnes grading 11.99 g/t Au (historical) …

and Turgeon Lake, an additional 2 claims covering almost 113 hectares with samples at the water line assaying up to 168.3 g/t Au, 30.2 g/t Au and 23.7 g/t Au (GM 52490) and a drill hole assaying 18.7 g/t Au over 3.09 m, including 68.9 g/t Au and 10.48 g/t Ag over 0.4 m.(historical).

It’s that acquisition hunger that’s been shooting the stock upwards over the past months.

But now, there’s something else to look forward to …

In its drilling progress, Amex is moving Eastward, closer and closer to Starr Peak’s property. And the closer they get, the better the numbers become. At last count, AMEX was only a kilometer away from Starr Peak.

With every high-grade result AMEX announces, Starr Peak is the indirect beneficiary.

Now it’s time for Starr Peak to drill, too.

And it’s fully funded to do so.

In fact, Starr Peak just secured the top geological consulting firm in Quebec, Laurentia Exploration to move things forward. The best news: this is the same geology firm behind the AMEX discovery.

Starr Peak is identifying drill targets as we speak, and the drill campaign will launch before the end of this year, making the chances of this going mainstream–soon–extremely high.

Everyone knows the AMEX story. The company is sitting on what some already predict 5 million ounces of gold and keeps proving up more and more. Its stock has gained 7,000% in a year, and it has a market cap of around $264 million.

The biggest rewards for AMEX shareholders have already been handed out for those early-in investors before the discovery.

Now, it might be Starr Peak’s turn–even AMEX founders think so. If Starr Peak is sitting on a similar discovery with a market cap of only ~$40 million, the upside rewards could be phenomenal.

Other companies looking to take advantage of this year’s gold rush:

Barrick Gold (NYSE:GOLD; TSX:ABX)

Barrick is the world’s second largest gold mine pulling down 140.8 tons of gold in 2018. And tho it’s been overtaken by Newmont, the Toronto-based gold giant operates in 13 countries, including Argentina, Canada, Chile, Côte d’Ivoire, Democratic Republic of the Congo, Dominican Republic, Mali, Papua New Guinea, Saudi Arabia, Tanzania, the United States and Zambia.

Backed by its massive market cap of $54 billion, Barrick Gold is on track to produce to produce between 4.6 to 5 million ounces of gold and between 440 to 500 million pounds of copper in 2020. At current prices, that could equate to as much as $1.5 billion in revenue from just its gold and copper assets.

Though Barrick dipped in March as the COVID-19 pandemic took global markets by surprise, year-to-date, Barrick has earned investors a handsome 56% return – in addition to its healthy dividends. With even more market makers turning bullish on gold, Barrick’s investors could see even higher returns by the end of the year.

Yamana Gold (NYSE:AUY, TSX:YRI)

Yamana is one of the most promising miners on the market. Since March alone, it’s seen its stock climb by 145%, and it’s showing no signs of slowing. And that’s great for investors looking for some gold exposure. Compared to the giants of the industry, it’s modest $6 billion market cap and accessible $6.30 share price make it the perfect company for just about any time of investor. Additionally, the company has a healthy record of increasing its dividends, which means that even if investors don’t see oversized gains like they would from junior miners or explorers, there’s still plenty of reason to hang onto the stock is gold prices continue to climb.

Recently, Yamana released a promising set of exploration results for its Minera Florida, El Peñón, and Jacobina mines, noting that “Exploration results continue to support year-over-year growth, with promising new discoveries in the first half of 2020, indicating excellent potential for new mineral reserves and mineral resources at year end.“

Kinross Gold Corp. (NYSE:KGC; TSX:K)

Though Kinross has only been around since 1993 compared to some of its near-century old peers, the $11 billion gold company is no stranger to the scene. Operating in Brazil, Ghana, Mauritania, Russia and the United States, Kinross is slowly expanding its global footprint, and its moves are paying off.

In just the past five years, Kinross has earned investors with a strong stomach over 400% in returns. And just since January, the company’s share price soared by 85%. – which is impressive by any and all metrics.

And Kinross is showing no signs of slowing. With a healthy balance sheet, favorable earnings reports, and governments, banks, and retail investors piling into safe haven assets, it’s likely to continue climbing. Even Warren Buffett, the Oracle of Omaha, has joined the gold rush, taking a $563 million stake in Barrick – a move which could be a sign of things to come. If gold continues its dramatic rise, who knows where gold companies like Kinross could end up by the end of the year.

Newmont (NYSE:NEM, TSX:NGT)

Newmont is the biggest gold mining company on the planet, but that doesn’t mean that it doesn’t still have the potential to earn investors healthy returns. Founded in 1916, and based in Greenwood Village, Colorado, Newmont is a veteran miner with one of the top executive teams in the business, and its operations span 11 countries, including gold mines in Nevada, Colorado, Ontario, Quebec, Mexico, the Dominican Republic, Australia, Ghana, Argentina, Peru, and Suriname.

Last year, Newmont acquired Goldcorp – a move that seemed somewhat controversial for shareholders at the time. But its $10 billion acquisition has paid off in a big way as gold prices soared to record highs as investors, spurred by the COVID pandemic and weakening U.S. dollar, piled into safe haven assets. Since the acquisition, gold prices have soared from $1282 to $2006 per ounce, fueling a 90% rally in the company’s share price.

Kirkland Lake Gold (NYSE:KL; TSX:KL)

Kirkland Lake is another one of world’s most exciting gold miners – and it also happens to be based in Canada. Though not quite as massive as Barrick or Newmont, Kirkland is no stranger to striking headline grabbing deals in the industry. In fact, just recently, Kirkland and Newmont signed a $75 million exploration deal that could wind up being a game-changer for the industry.

According to a joint press release on August 18th, “Newmont has acquired an option from Kirkland on the mining and mineral rights subject to a royalty payable by Newmont to Royal Gold, Inc. (the Holt Royalty) in exchange for a $75 million payment to Kirkland Lake Gold. Newmont can exercise the Option only in the event Kirkland intends to restart operations at the Holt Mine and process material subject to the Holt Royalty”

This alliance will provide Kirkland with cash flow to evaluate new alternatives for the future of the mining complex, dive deeper into its existing properties, and weigh other opportunities where the two gold companies may be able to find common ground in the future.

By. Kim Drew

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements

This news release contains forward-looking information which is subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ from those projected in the forward-looking statements. Forward looking statements in this release include that prices for gold will retain value in future as currently expected; that Starr Peak can fulfill all its obligations to acquire its Quebec property, including receiving stock exchange approval; that Starr Peak’s Quebec property can achieve drilling and mining success for gold; that historical geological information and estimations will prove to be accurate; that high-grade targets exist; and that Starr Peak will be able to carry out its business plans, including timing for drilling. These forward-looking statements are subject to a variety of risks and uncertainties and other factors that could cause actual events or results to differ materially from those projected in the forward-looking information. Risks that could change or prevent these statements from coming to fruition include that the Company may not get TSXV approval; it may not be able to finance its intended drilling program; Starr Peak may not raise sufficient funds to carry out its plans; geological interpretations and technological results based on current data that may change with more detailed information or testing; and despite promise, there may be no commercially viable minerals on Starr Peak’s property. The forward-looking information contained herein is given as of the date hereof and the Company assumes no responsibility to update or revise such information to reflect new events or circumstances, except as required by law.

DISCLAIMERS

This communication is for entertainment purposes only. Never invest purely based on our communication. We have not been compensated by Starr Peak but may in the future be compensated to conduct investor awareness advertising and marketing for TSXV:STE. The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company’s stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The writer of this article is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

RISK OF INVESTING. Investing is inherently risky. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.