Commercial Metals Company

CMC

is scheduled to report third-quarter fiscal 2021 (ended as of May 31, 2021) results on Jun 17, before the opening bell.

Which Way are the Estimates Headed?

The Zacks Consensus Estimate for fiscal third-quarter revenues is pinned at $1,677 million, suggesting growth of 25% from the prior-year period. The Zacks Consensus Estimate for earnings per share is pegged at 77 cents for the quarter, indicating a year-over-year increase of 30.5%.

Q2 Performance

In the last reported quarter, the company’s top- and bottom-line figures increased year on year. While the bottom line beat the consensus mark, the top line figure missed the same. The company has a trailing four quarters average earnings surprise of 38.08%.

Key Factors

Commercial Metals is likely to have benefited from solid construction and infrastructure activity during the fiscal third quarter. The North America segment might have benefited from increased spending on the residential and construction sector, continued recovery in the manufacturing sector and strong highway infrastructure activities, fueling robust demand for rebar and long product steel.

The finished steel volumes for North America and Europe operations are expected to have witnessed strong seasonal trends in the fiscal third quarter due to the commencement of the spring and summer construction seasons. Surging demand for merchant and wire rod products in the Central European markets, and recovery in the industrial end markets in the region are likely to have supported the Europe segment during the fiscal third quarter.

Moreover, Commercial Metals’ margin is anticipated to have benefited from its focus on network optimization as well as price rise across the company’s mill products in response to the rapidly-rising scrap costs.

What Our Model Indicates?

Our proven model doesn’t conclusively predict an earnings beat for Commercial Metals this season. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat.

You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

The Earnings ESP for Commercial Metals is 0.00%.

Zacks Rank:

Commercial Metals currently carries a Zacks Rank of 2.

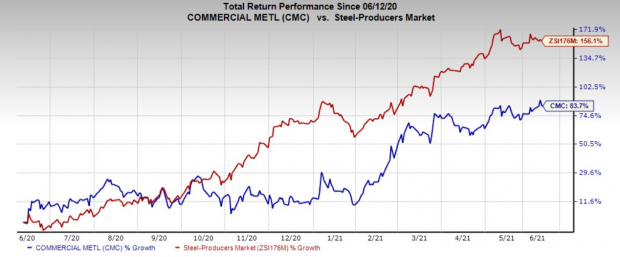

Price Performance

Commercial Metals’ shares have appreciated 83.7% in the past year compared with the

industry

’s rally of 156.1%.

Image Source: Zacks Investment Research

Stocks Worth a Look

Here are some stocks worth considering as these have the right combination of elements to post an earnings beat this quarter.

Winnebago Industries, Inc.

WGO

has an Earnings ESP of +16.57% and holds a Zacks Rank of 2, at present. You can see

the complete list of today’s Zacks #1 Rank stocks here.

Micron Technology, Inc.

MU

has an Earnings ESP of +6.83% and currently carries a Zacks Rank of 2.

Costco Wholesale Corporation

COST

has an Earnings ESP of +1.08% and carries a Zacks Rank #3, currently.

+1,500% Growth: One of 2021’s Most Exciting Investment Opportunities

In addition to the stocks you read about above, would you like to see Zacks’ top picks to capitalize on the Internet of Things (IoT)? It is one of the fastest-growing technologies in history, with an estimated 77 billion devices to be connected by 2025. That works out to 127 new devices per second.

Zacks has released a special report to help you capitalize on the Internet of Things’s exponential growth. It reveals 4 under-the-radar stocks that could be some of the most profitable holdings in your portfolio in 2021 and beyond.

Click here to download this report FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report