Surmodics, Inc.

SRDX

recently announced the successful first clinical usage of its Sublime Radial Access .018 RX PTA (percutaneous transluminal angioplasty) Dilatation Catheter. The catheter, which received the FDA’s 510(k) clearance in June 2021, is the latest addition to the company’s Sublime radial access platform and joins the Sublime radial access guide sheath and the Sublime Radial Access .014 RX PTA Dilatation Catheter.

For investors’ note, the Sublime Radial Access .018 RX PTA Dilatation Catheter is indicated for the PTA dilation of peripheral vasculature stenosis in various arteries and the treatment of obstructive lesions of native or synthetic arteriovenous dialysis fistulae. However, the device is contraindicated (suggesting or indicating that it should not be used) in the treatment of coronary arteries and the neurovasculature.

With the latest successful first patient usage, Surmodics is anticipated to solidify its foothold in the global Medical Devices business.

Significance of the Successful Usage

The latest addition to Surmodics’ Sublime radial access platform enables above- or below-the-knee access via a transradial approach by providing the longest working length (220 cm) currently available in the market. The Sublime Radial Access .018 RX PTA Dilatation Catheter has been designed to deliver enhanced pushability, trackability and crossability on an RX platform.

Per an expert associated with the procedures, the Sublime Radial Access .018 RX PTA Dilatation Catheter is expected to aid in performing more complex interventions which were earlier not possible. This is likely to enhance the suite of the current devices available for the minimal arterial access lower extremity intervention procedures.

Per management, due to the lack of reliable tools limiting the ability to standardize on a radial first approach, the expansion of the company’s portfolio of radial access devices is likely to allow more physicians to adopt a radial-first strategy.

Also, the catheter is anticipated to expand Surmodics’ market opportunity by increasing the size offering to treat larger vessels and offering the shaft length required for the treatment of more distal lesions through a radial approach.

Industry Prospects

Per a report by Grand View Research

, the global PTA balloon catheter market size was valued at $2.4 billion in 2018, and is expected to register a CAGR of 10.1% between 2019 and 2026. Factors like the growing prevalence of cardiovascular disorders and peripheral artery disease, a rising elderly population and the increasing minimally-invasive surgeries are likely to drive the market.

Given the market potential, the successful first patient usage of the Sublime Radial Access .018 RX PTA Dilatation Catheter is expected to significantly boost Surmodics’ global business.

Notable Developments

Of late, Surmodics has witnessed a few notable developments across its business.

In August, the company reported the third-quarter fiscal 2021 results, where it announced the completion of the premarket approval submission for SurVeil drug-coated balloon and the receipt of the FDA 510(k) clearance on the expanded indication for the Pounce Thrombectomy System for use in vessels as small as 3.5 mm.

Surmodics, in July, announced the successful first patient use of Pounce Thrombectomy System, where 30 cm of subacute thrombus was removed and blood flow successfully restored.

The same month, the company acquired the privately-held Vetex Medical Limited and expanded its thrombectomy portfolio with a second FDA 510(k)-cleared device, the ReVene Thrombectomy Catheter.

Price Performance

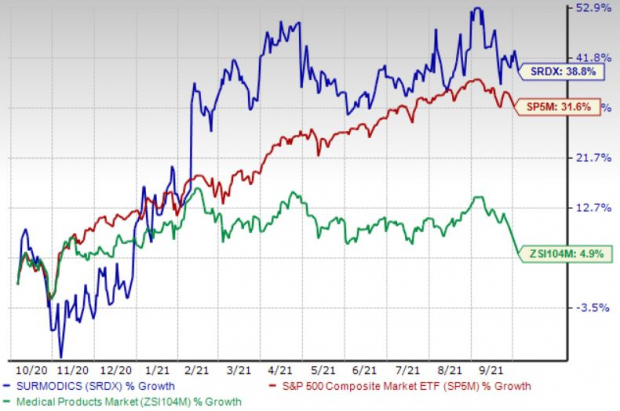

Shares of the company have gained 38.8% in the past year compared with the

industry

’s 4.9% growth and the S&P 500’s 31.5% rise.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Currently, Surmodics carries a Zacks Rank #3 (Hold).

Some better-ranked stocks from the broader medical space are

DexCom, Inc.

DXCM

,

Omnicell, Inc.

OMCL

and

West Pharmaceutical Services, Inc.

WST

.

DexCom’s long-term earnings growth rate is estimated at 15.3%. The company presently carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Omnicell’s long-term earnings growth rate is estimated at 16%. It currently holds a Zacks Rank #2.

West Pharmaceutical’s long-term earnings growth rate is estimated at 27.3%. It currently carries a Zacks Rank #2.

Zacks’ Top Picks to Cash in on Artificial Intelligence

In 2021, this world-changing technology is projected to generate $327.5 billion in revenue. Now Shark Tank star and billionaire investor Mark Cuban says AI will create “the world’s first trillionaires.” Zacks’ urgent special report reveals 3 AI picks investors need to know about today.

See 3 Artificial Intelligence Stocks With Extreme Upside Potential>>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report