Johnson & Johnson

’s

JNJ

pharmaceutical company, Janssen announced that it has submitted a supplemental biologics license application (sBLA) for inflammatory drug, Stelara, to the FDA. The sBLA is seeking the label expansion of the drug as a potential treatment of juvenile psoriatic arthritis (jPsA) in pediatric patients aged 5 years and older. The company anticipates the FDA to provide its decision in late 2022, following a potential acceptance.

The sBLA has been filed based on extrapolated data from nine clinical studies that evaluated Stelara in adults with active PsA, and in adult and pediatric patients with moderate-to-severe plaque psoriasis. The extrapolated data includes an estimated response, trends or effects of a drug or candidate based on historical observations from patients with closely related conditions. This type is used when there is limited availability of pediatric patients.

Stelara is currently approved as a treatment of several inflammatory disorders namely plaque psoriasis, active PsA, active Crohn’s disease, and active ulcerative colitis in adults. The drug is also approved for treating plaque psoriasis in pediatric patients aged six months or older.

The juvenile PsA is a disorder characterized by joint inflammation and psoriatic skin lesions similar to PsA in adults and is a challenging disease to treat. Per the company release, jPsA occurs in a small patient population, affecting only 5% of juvenile arthritis patients. This condition occurs in an estimated 20 to 45 children for every 100,000 children in the United States.

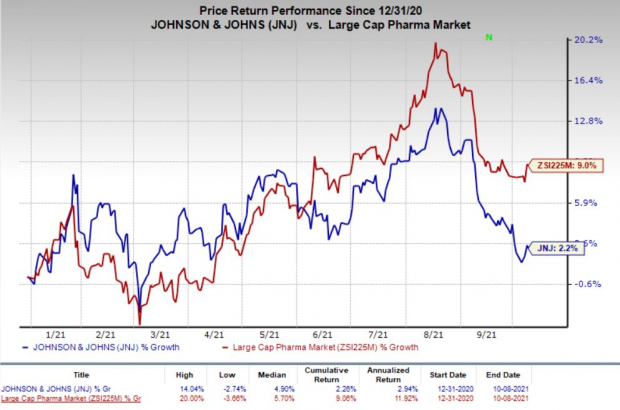

This year so far, J&J’s shares have risen 2.2% compared with an increase of 9% for the

industry

.

Image Source: Zacks Investment Research

We note that Stelara is the largest drug of J&J’s immunology franchise that generated sales of $4.4 billion in the first half of 2021, registering growth of 25.8% year over year. The drug is one of the key products that helped J&J to deliver above-market growth for the pharmaceutical business in 2021. The strong performance of the drug will receive a boost following a potential approval to treat the challenging jPsA.

Meanwhile, J&J is evaluating Stelara as a potential treatment for axial spondylitis in phase III studies.

Zacks Rank & Stocks to Consider

J&J currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks in the pharma/biotech sector include

Vertex Pharmaceuticals

VRTX

,

Regeneron Pharmaceuticals

REGN

and

Horizon Therapeutics

HZNP

, all sporting a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Vertex’s earnings per share estimates have moved north from $12.28 to $12.37 for 2021 and from $13.02 to $13.13 for 2022 over the past 60 days.

Regeneron’s earnings estimates have been revised upward from $53.22 to $61.41 for 2021 and from $44.11 to $46.73 for 2022 over the past 60 days. The stock has increased 13.9% year to date.

Horizon’s earnings per share estimates have increased from $4.46 to $4.67 for 2021 and from $5.84 to $6.23 for 2022 over the past 60 days. The stock has rallied 55.6% year to date.

Tech IPOs With Massive Profit Potential

In the past few years, many popular platforms and like Uber and Airbnb finally made their way to the public markets. But the biggest paydays came from lesser-known names.

For example, electric carmaker X Peng shot up +299.4% in just 2 months. Think of it this way…

If you had put $5,000 into XPEV at its IPO in September 2020, you could have cashed out with $19,970 in November.

With record amounts of cash flooding into IPOs and a record-setting stock market, this year’s lineup could be even more lucrative.

See Zacks Hottest Tech IPOs Now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report