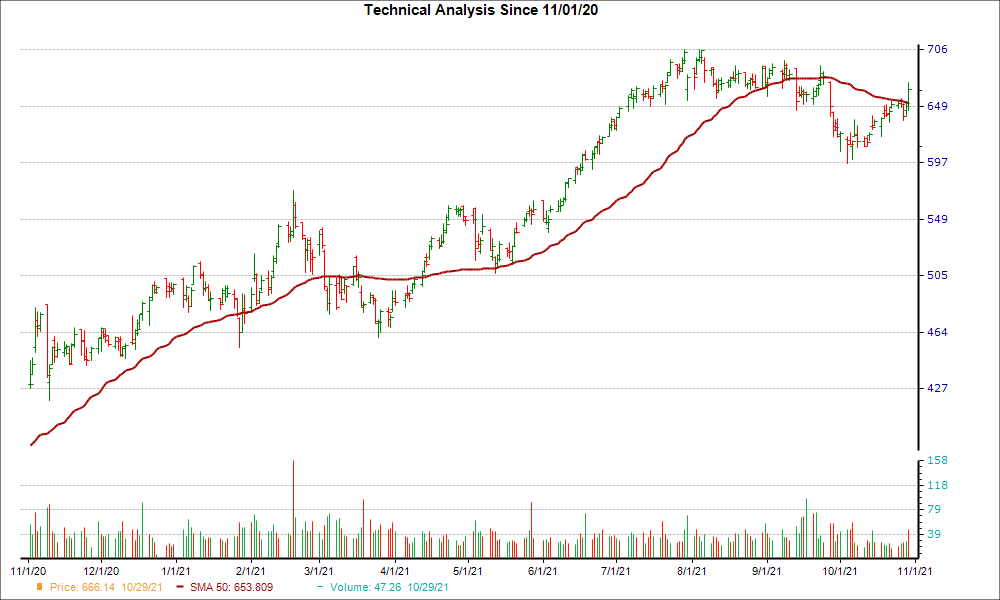

Idexx Laboratories (IDXX) is looking like an interesting pick from a technical perspective, as the company reached a key level of support. Recently, IDXX broke out above the 50-day moving average, suggesting a short-term bullish trend.

One of the three major moving averages, the 50-day simple moving average is commonly used by traders and analysts to determine support or resistance levels for different types of securities. However, the 50-day is considered to be more important since it’s the first marker of an up or down trend.

IDXX could be on the verge of another rally after moving 6.8% higher over the last four weeks. Plus, the company is currently a Zacks Rank #3 (Hold) stock.

Looking at IDXX’s earnings estimate revisions, investors will be even more convinced of the bullish uptrend. There have been 1 higher compared to none lower for the current fiscal year, and the consensus estimate has moved up as well.

With a winning combination of earnings estimate revisions and hitting a key technical level, investors should keep their eye on IDXX for more gains in the near future.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report