We expect investors to focus on the sales performance of

Organogenesis

Holdings

’

ORGO

two segments — Advanced Wound Care, and Surgical & Sports Medicine — when it reports third-quarter 2021 results on Nov 9, after market close.

The company’s earnings surprise history is pretty impressive. It surpassed expectations in each of the trailing four quarters, with the average being 196.4%. In the last reported quarter, Repligen delivered an earnings surprise of 114.3%.

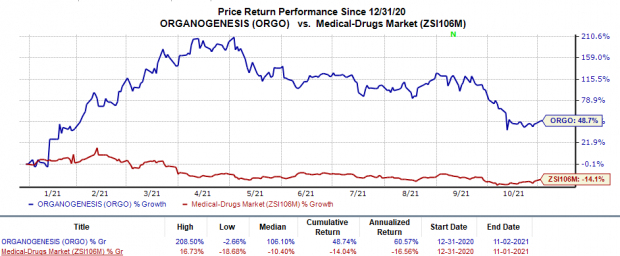

Shares of the company have surged 48.7% so far this year against the

industry

’s 14% decline.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for the quarter to be reported.

Factors to Consider

Organogenesis earns revenues from the sale of several products, which can be categorized into Advanced Wound Care (AWC), and Surgical & Sports Medicine (SSM). The AWC segment focuses on the treatment of chronic and acute wounds across various treatment settings while the SSM segment concentrates on products that support the healing of musculoskeletal injuries, including degenerative conditions such as osteoarthritis and tendonitis.

In the last reported quarter, total revenues were significantly up year over year driven by strong demand across both the segments, especially the AWC product business that registered growth of 87% year over year. We anticipate this trend to have continued in the third quarter.

The sales performance of the two business segments has most likely improved both sequentially and year over year in third-quarter 2021.

Organogenesis also categorizes total product revenues into two groups — PuraPly product revenues and non-PuraPly product revenues. In the last reported quarter, the company reported that the non-PuraPly product sales were significantly up year over year. The same trend is most likely to have continued in the third quarter.

The SSM segment reported favorable growth during second-quarter 2021 despite two of its products — ReNu (for knee osteoarthritis) and NuCel (for bony fusion in the lumbar spine) — coming off the market after May 31, 2021, following an FDA guidance that required these products to obtain a biologics license application (BLA) approval for commercialization. Earlier, these products were allowed to be commercially distributed without prior FDA approval.

While the company is conducting clinical studies on ReNu to support the potential approval for a BLA for the treatment of knee osteoarthritis, it has decided to discontinue the clinical development of NuCel. The company is currently enrolling patients in a phase III study evaluating the safety and efficacy of ReNu in patients with knee osteoarthritis.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Organogenesis this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

Organogenesis’ Earnings ESP is 0.00% as both the Most Accurate Estimate and the Zacks Consensus Estimate are pegged at 6 cents per share.

Zacks Rank:

Organogenesiscurrently carries a Zacks Rank #3.

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle:

Cytokinetics

CYTK

currently has an Earnings ESP of +2.82% and a Zacks Rank #2. The company is scheduled to report quarterly earnings on Nov 3. You can

see the complete list of today’s Zacks #1 Rank stocks here

.

FibroGen

FGEN

has an Earnings ESP of +108.22% and a Zacks Rank #3 at present. The company is scheduled to report quarterly earnings on Nov 9.

Regeneron

REGN

has an Earnings ESP of +8.78% and a Zacks Rank #1, presently. The company is scheduled to report quarterly earnings on Nov 4.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report