Nokia Corporation

NOK

recently inked a deal with KDDI Corporation for an undisclosed amount to support the Japan-based carrier’s transition to a fully-automated 5G core architecture. The deal will likely enhance network scale to enable subscribers to experience lower latency, increased bandwidth and higher capacity. The contract also reinforces the 25-year business relationship between the two firms.

Per the transaction, Nokia will offer 5G core standalone solutions for near-zero automation capabilities along with related software support and integration. In addition, the company will provide 5G monetization and data management software solutions to unlock future revenue-generating opportunities. These include cloud-native converged charging – used to consolidate all service charges into a single customer invoice, policy controller that acts as guardrails for greater security, and mediation that converts call data to pre-defined layouts for a specific billing system.

These state-of-the-art solutions are expected to improve KDDI’s flexibility to better respond to the evolving market demands and reduce costs by streamlining operations. In addition, they are likely to support its business model for B2B2X services by enabling services-based integrations with new 5G network functions. The B2B2X business model enables a carrier to deliver services to any number of end users by integrating telecom and IT services capabilities with applications used by various enterprises. Nokia will also offer KDDI its Digital Operations software, Cloud Operations Manager, NetAct network management system and Archive Cloud solutions to automate the backup and storage of network data across multi-vendor and multi-technology environments.

The commercial availability of Nokia’s Standalone 5G network has enabled it to take the next big step in the evolution of the 5G ecosystem to make it more pervasive across the globe. 5G networks were until now deployed primarily in Non-Standalone mode, whereby 5G network availability was dependent on the underlying LTE network for signaling support. The Standalone 5G network eliminates this 4G dependency by enabling carriers to augment their network capabilities with a simpler architecture. Moreover, it improves network speed and simplifies mobility management with seamless access to wide 5G bands for a better user experience.

The company is driving the transition of global enterprises into smart virtual networks by creating a single network for all services, converging mobile and fixed broadband, IP routing and optical networks with the software and services to manage them. Leveraging state-of-the-art technology, Nokia is transforming the way people and things communicate and connect. These include seamless transition to 5G technology, ultra broadband access, IP and Software Defined Networking, cloud applications and Internet of Things.

The company facilitates its customers to move away from an economy-of-scale network operating model to demand-driven operations by offering easy programmability and flexible automation to support dynamic operations, reduce complexity and improve efficiency. Nokia remains focused on building a robust, scalable software business and expanding it to structurally attractive enterprise adjacencies. It has inked more than 204 commercial 5G contracts across the globe. The company’s end-to-end portfolio includes products and services for every part of a network, which are helping operators to enable key 5G capabilities, such as network slicing, distributed cloud and industrial IoT. Accelerated strategy execution, sharpened customer focus and reduced long-term costs are expected to position the company as a global leader in the delivery of end-to-end 5G solutions.

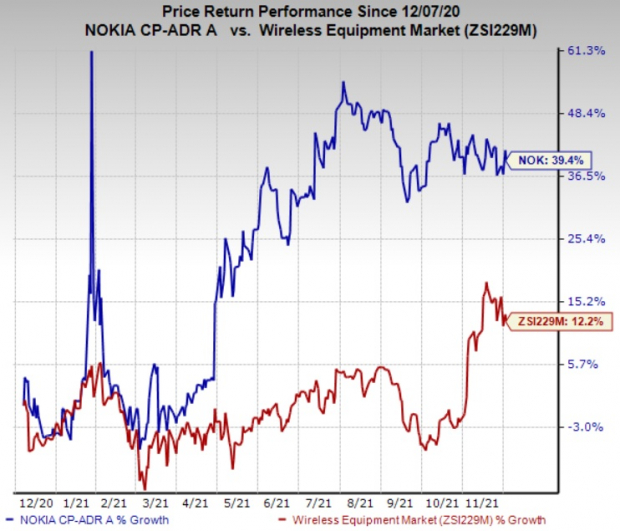

The stock has gained 39.4% in the past year compared with the

industry

’s rally of 12.2%. We remain impressed with the inherent growth potential of this Zacks Rank #3 (Hold) stock.

Image Source: Zacks Investment Research

A better-ranked stock in the industry is

Clearfield, Inc.

CLFD

, sporting a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Clearfield delivered an earnings surprise of 50.8%, on average, in the trailing four quarters. Earnings estimates for the current year for the stock have moved up 68.2% since January 2021. Over the past year, Clearfield has gained a solid 145.6%.

Qualcomm Incorporated

QCOM

, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. It has a long-term earnings growth expectation of 15.3% and delivered an earnings surprise of 11.2%, on average, in the trailing four quarters.

Earnings estimates for the current year for the stock have moved up 35.4% over the past year. Qualcomm is likely to benefit in the long run from solid 5G traction and a surge in demand for essential products that are the building blocks for digital transformation in the cloud economy.

Sierra Wireless, Inc.

SWIR

carries a Zacks Rank #2. It has a long-term earnings growth expectation of 12.5% and delivered an earnings surprise of 34.2%, on average, in the trailing four quarters.

Over the past year, Sierra Wireless has gained 4.3%. The company continues to launch innovative products for business-critical operations that require high security and optimum 5G performance.

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report