Avanos Medical, Inc.

AVNS

recently introduced its PainBlock Pro data collection and patient engagement app that enables healthcare providers to track patients’ recovery in real time for up to 10 days after surgery. The app/text message-based platform is easy to use and helps in tracking patient progress by collecting patient reported outcomes (PROs) through quick daily surveys, pre and post surgery, via the completion of the pain management therapy.

The launch of this app is another addition to Avanos Medical’s robust product portfolio, which is a significant contributor to the company’s top line.

Benefits of the New Technology

Per management, gathering real-time patient feedback forms a crucial step in getting patients back to the important things. The app helps healthcare providers to communicate with their patients with user-friendly technology, which gives key insight into the recovery process.

Image Source: Zacks Investment Research

Data collected from the aforementioned surveys can allow providers to develop customized pain management plans on the basis of critical factors that include patients’ level of pain, opioid consumption and overall satisfaction.

Market Prospects

Per

a report by Grand View Research

, the global patient engagement solutions market was worth $15.1 billion in 2020 and is projected to witness a CAGR of 21.4% from 2021 to 2028. Growing utilization of electronic health records for patient-centric care and the adoption of mobile health devices are the primary factors driving this market’s growth. Hence, this launch is well-timed for Avanos Medical.

Recent Development

Per the third-quarter 2021 earnings call, Avanos Medical continues to improve its product offerings entering the fourth quarter of the year to boost the efficacy and ease of use for its care partners.

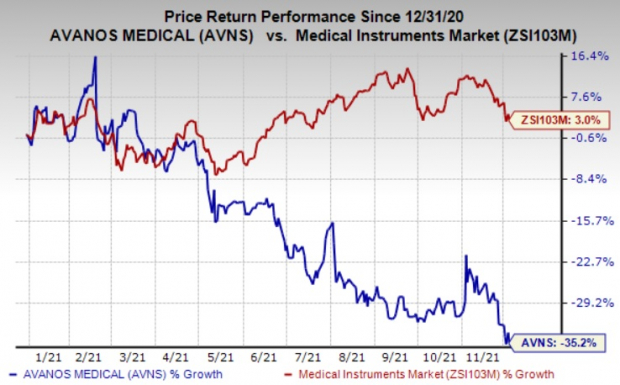

Price Performance

Shares of this Zacks Rank #3 (Hold) company have lost 35.2% on a year-to-date basis against the

industry

’s growth of 3%.

Stocks to Consider

Some better-ranked stocks in the broader medical space include

Thermo Fisher Scientific Inc.

TMO

,

McKesson Corporation

MCK

and

Cerner Corporation

CERN

.

Thermo Fisher surpassed earnings estimates in each of the trailing four quarters, the average surprise being 9.02%. The company currently carries a Zacks Rank of 2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Thermo Fisher’s long-term earnings growth rate is estimated at 14%. The company’s earnings yield of 3.7% compares favorably with the industry’s (3.6%).

McKesson beat earnings estimates in each of the trailing four quarters, the average surprise being 19.9%. The company currently carries a Zacks Rank #2.

McKesson’s long-term earnings growth rate is estimated at 8.9%. The company’s earnings yield of 9.9% compares favorably with the industry’s 3.2%.

Cerner surpassed earnings estimates in each of the trailing four quarters, the average surprise being 3.2%. The company currently carries a Zacks Rank of 2.

Cerner’s long-term earnings growth rate is estimated at 13.3%. The company’s earnings yield of 4.6% compares favorably with the industry’s (5.4%).

Investor Alert: Legal Marijuana Looking for big gains?

Now is the time to get in on a young industry primed to skyrocket from $13.5 billion in 2021 to an expected $70.6 billion by 2028.

After a clean sweep of 6 election referendums in 5 states, pot is now legal in 36 states plus D.C. Federal legalization is expected soon and that could kick start an even greater bonanza for investors. Zacks Investment Research has recently closed pot stocks that have shot up as high as +147.0%.

You’re invited to immediately check out Zacks’

Marijuana Moneymakers: An Investor’s Guide

. It features a timely Watch List of pot stocks and ETFs with exceptional growth potential.

Today, Download Marijuana Moneymakers FREE >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report