Copper prices surged around 25% this year. The recovery in industrial demand worldwide, optimism regarding economic growth, demand in top consumer China, disruptions in top producers Chile and Peru, and Biden’s infrastructure plan all worked in favor of the metal. So far this year, copper ranged from a low of $3.5035 per pound in February to an all-time high of $4.8840 per pound in May. It is currently at around $4.42 per pound, with the yearly average at around $4.24 per pound.

Supply constraints, low stockpiles and a solid long-term demand outlook supported by the ongoing green energy revolution are likely to keep copper prices elevated. We suggest keeping an eye on stocks like

BHP Group

BHP

,

Freeport-McMoRan Inc.

FCX

,

Southern Copper Corporation

SCCO

and

Teck Resources Limited

TECK

that are well-poised to capitalize on this growth trend.

Copper “Charging Ahead”

Copper is a metal essential to the global economy and will play a crucial role in the achievement of the global clean energy transition. Copper is the third most consumed industrial metal in the world, according to the U.S. Geological Survey. Given its widespread use, copper has long been considered as a bellwether for the global economy. The International Monetary Fund’s (“IMF”) forecast anticipates the world economy to expand by 4.9% in 2022. Beyond 2022, global growth is projected to moderate to about 3.3% over the medium term. Sustained growth in copper demand is anticipated to continue as the metal is essential to economic activity. Infrastructure development in major countries such as China and India will particularly support demand.

The increasing global awareness regarding cleaner energy and electric cars will be a key catalyst for copper demand in the long term. The red metal is an essential component in EVs and is utilized in electric motors, batteries, inverters and wiring. According to the International Copper Association (“ICA”), while conventional cars contain 18 to 49 pounds of copper, plug-in hybrid electric vehicles (PHEV) use 132 pounds and battery electric vehicles (BEV) contain 183 pounds. The EV charging infrastructure is largely based on copper-based technologies. Per the International Energy Agency, clean energy technologies will account for around 45% of copper demand in 2040, higher than 24% in 2020. Per Statista, global copper demand for charging infrastructure is expected to reach some 115,000 metric tons by 2025.

Chile and Peru together account for close to 40% of the world’s copper production. Supply from these countries had been under pressure due to the impact of the coronavirus pandemic. The emergence of new strains might lead to operations being disrupted again and thus impact copper supply. Also, a new taxes and royalties bill in Chile, which has already approved by the Senate could, if unaltered, may put around 25% of the copper output from the country at risk. Under the proposed change, the royalty rate would be based on output rather than profits and could rise to 75% when copper prices exceed $4 per pound. This might lead to several companies ceasing operations in the country, as they are already running at high costs. In Peru, the second-largest producer, community protests against mining projects is becoming an increasing threat. These developments might put the copper output in jeopardy.

Also, grade decline, rising input costs, water constraints and scarcity of high-quality future development opportunities continue to constrain the metal’s supply. This demand-supply imbalance will probably push copper prices north, which bodes well for miners. Miners are now committed to cost-reduction strategies and digital innovation to drive operating efficiencies, which will also drive margins in the long haul.

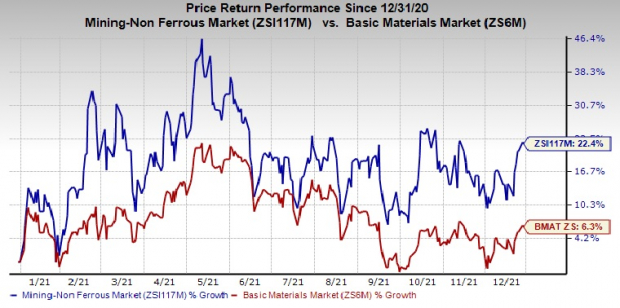

Copper miners fall under the Zacks

Mining – Non-Ferrous

industry, which has gained 22.4% year-to-date compared with the broader

Basic Materials

sector’s growth of 6.3%.

Image Source: Zacks Investment Research

4 Copper Stocks to Keep an Eye On

We suggest you keep an eye on these copper-mining stocks. We have handpicked four such stocks that have a Zacks Rank #3 (Hold) and a

VGM Score

of A. Our research shows that stocks with such a combination offer the best investment opportunities.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

BHP Group

: Aided by its strong cash flow, the company has lowered its long-term debt level considerably over the past few years, which will contribute to growth. Efforts to make operations more efficient through smarter technology adoption across the entire value chain will continue to aid in reducing costs, thereby bolstering the company’s margins. BHP intends to unify its corporate structure from two-parent companies into one. This move will aid its strategy to focus on commodities (copper, nickel and potash) that will help it ride on growing global trends such as decarbonisation, electrification population growth, rising living standards in the developing countries among others. The company has completed the Spence Growth Option copper project, which is expected to average 300,000 tons per annum of production (including cathodes) over the first four years.

Headquartered in Melbourne, Australia, BHP Group engages in exploration, development, and production of oil and gas properties; and mining of copper, silver, zinc, molybdenum, uranium, gold, iron ore, and metallurgical and energy coal. BHP has a long-term estimated earnings growth rate of 4%. The Zacks Consensus Estimate for the company’s fiscal 2022 earnings suggests year-over-year growth of 3%.

Freeport-McMoRan

: The company is conducting exploration activities near existing mines with a focus on opportunities to expand reserves. Freeport-McMoRan will benefit from an ongoing large-scale concentrator expansion project at Cerro Verde that will provide incremental annual production of around 600 million pounds of copper and 15 million pounds of molybdenum. Cerro Verde’s expanded operations benefit from cost efficiencies, and large-scale and long-lived reserves. It completed the Lone Star copper leach project and is on track to produce around 200 million pounds of copper annually. The company’s effective cost management and efforts to reduce debt levels appear encouraging.

This Phoenix, AZ-based company is engaged in mineral exploration and development; mining and milling of copper, gold, molybdenum and silver; and smelting and refining of copper concentrates. The Zacks Consensus Estimate for Freeport-McMoRan’s earnings for fiscal 2022 indicates year-over-year improvement of 23.7%. The estimates have been revised upward by 14% over the past 60 days. The company has a long-term estimated earnings growth rate of 29%.

Southern Copper Corporation

: The company has the largest copper reserves in the industry and operates high-quality, world-class assets in investment grade countries, such as Mexico and Peru. Its constant focus on increasing low-cost production is commendable. The company will gain from its efforts to grow in Peru given that the country is currently the second-largest producer of copper globally and holds 13% of the world’s copper reserves. It is worth mentioning that Peru’s national output is anticipated grow to 225000 tons in 2022. Southern Copper’s total investment program in Peru runs to $7.9 billion. The company maintains its target to produce 1.9 million tons by 2028 by developing its organic growth projects.

This company based in Phoenix, AZ engages in mining, exploring, smelting, and refining copper and other minerals. The Zacks Consensus Estimate for Southern Copper’s earnings for 2022 has moved north by 5% in 60 days’ time. SCCO has a long-term estimated earnings growth rate of 16.1%.

Teck Resources

: The company has a portfolio of world-class assets in stable jurisdictions and a solid pipeline of projects. The progression of the flagship QB2 copper growth project crossed the two-third mark in the third quarter of 2021 despite the COVID-19 impact in Chile. The first production is expected in the second half of 2022. Once completed, QB2 will transform the company’s copper business, making it a major global copper producer. It has several other copper growth projects in the pipeline to help meet future global copper demand. The company continues to implement its innovation-driven efficiency program, RACE21, which is expected to improve productivity across the business and drive annualized EBITDA growth.

Vancouver, Canada-based Teck Resources is a diversified resource company committed to mining and mineral development with business units focused on steelmaking coal, copper, zinc and energy. The Zacks Consensus Estimate for the company’s earnings for 2022 has moved up 21% over the past 60 days. TECK has a long-term estimated earnings growth rate of 37.8%.

Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through November, the

Zacks Top 10 Stocks

gained an impressive +962.5% versus the S&P 500’s +329.4%. Now our Director of Research is combing through 4,000 companies covered by the Zacks Rank to handpick the best 10 tickers to buy and hold. Don’t miss your chance to get in on these stocks when they’re released on January 3.

Be First to New Top 10 Stocks >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report