Biogen

BIIB

announced an agreement with its South Korean partner, Samsung Biologics to sell its equity stake in their joint venture, Samsung Bioepis for a payment of up to $2.3 billion. With the acquisition of Biogen’s 49.9% stake in Samsung Bioepis, Samsung Biologics will have full ownership of the joint venture.

Samsung Bioepis, the joint venture between the two companies, markets three anti-TNF biosimilars in Europe – Flixabi (a biosimilar referencing Remicade), Benepali (a biosimilar referencing Enbrel) and Imraldi (a biosimilar referencing Humira).

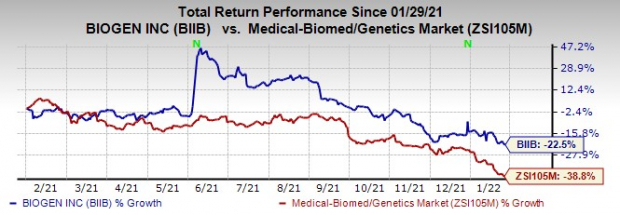

Biogen’s shares were up in after-hours trading on Thursday, in response to the news. In the past year, Biogen’s shares have declined 22.5% compared with the

industry

’s decrease of 38.8% in the same time frame.

Image Source: Zacks Investment Research

In November 2019, Biogen secured exclusive rights to commercialize two new ophthalmology biosimilars from Samsung Bioepis across major markets worldwide, including the United States, Canada, Europe, Japan and Australia.

These biosimilars were SB11, a biosimilar of

Roche

’s

RHHBY

eye drug, Lucentis and SB15, a proposed biosimilar of

Regeneron

’s

REGN

eye drug Eylea.

SB11 was approved in the United States and Europe in 2021 in the name of Byooviz. The biosimilar drug received approval for three approved indications of Roche’s Lucentis — neovascular (wet) age-related macular degeneration (AMD), macular edema following retinal vein occlusion (RVO), and myopic choroidal neovascularization (mCNV). Samsung Bioepis and Biogen have an agreement with Roche that will allow them to start the commercialization of Byooviz in the United States from June 2022.

SB15 is in late-stage development. Eylea is Regeneron’s key top-line growth driver. Eylea, approved for several eye diseases, continues to generate revenues for the company on consistent label expansions. Regeneron is working on expanding the drug’s label into additional indications, which will further boost sales.

Despite Samsung Biologics acquiring Biogen’s stake in Samsung Bioepis, the companies will continue with their exclusive agreements for the commercialization of Flixabi, Benepali and Imraldi. Biogen will also keep commercial rights for Byooviz and SB15.

Out of the purchase consideration, Biogen will receive $1 billion in cash at closing of the transaction and two payments of $812.5 million and $437.5 million due at the first and second anniversary, respectively, of the closing of the transaction. Biogen is also eligible for $50 million of potential commercial milestone payments.

Biogen’s biosimilars revenues have declined in the past couple of quarters due to pricing pressure and the impact of COVID-19. The sale of its stake in the biosimilars JV will strengthen Biogen cash position. The upfront cash can be used for acquiring another pipeline candidate, which fits well with Biogen’s portfolio.

Zacks Rank & Stock to Consider

Biogen currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the biotech sector is

Alkermes

ALKS

which carries a Zacks Rank #1 (Strong Buy) at present. You can see

the complete list of today’s Zacks #1 Rank stocks here

.

Alkermes’ earnings per share estimates for 2022 have increased from 70 cents to 71 cents in the past 60 days. Shares of Alkermes have risen 17% in the past year.

Earnings of Alkermes beat estimates in all the last four quarters, delivering a surprise of 147%, on average.

Infrastructure Stock Boom to Sweep America

A massive push to rebuild the crumbling U.S. infrastructure will soon be underway. It’s bipartisan, urgent, and inevitable. Trillions will be spent. Fortunes will be made.

The only question is “Will you get into the right stocks early when their growth potential is greatest?”

Zacks has released a Special Report to help you do just that, and today it’s free. Discover 7 special companies that look to gain the most from construction and repair to roads, bridges, and buildings, plus cargo hauling and energy transformation on an almost unimaginable scale.

Download FREE: How to Profit from Trillions on Spending for Infrastructure >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report