Republic Services, Inc.

RSG

reported impressive fourth-quarter 2021 results, with earnings and revenues surpassing the Zacks Consensus Estimate.

Adjusted earnings (excluding 4 cents from non-recurring items) per share of $1.02 outpaced the consensus mark by 1% and rallied 2% year over year.

The company’s average recycled-commodity price per ton sold in the fourth quarter was $218, up $12 per ton on a sequential basis and $108 year over year.

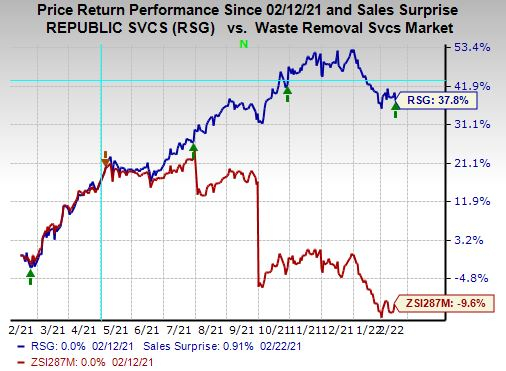

So far this year, shares of Republic Services have gained 37.8% against a 9.6% loss of the

industry

it belongs to.

Image Source: Zacks Investment Research

Revenues

Quarterly revenues of $2.95 billion surpassed the consensus estimate by 2.7% and increased 15% year over year. The company’s top line includes a favorable impact of 9.9% from internal growth and 4.9% from acquisitions.

Revenues in the Collection segment totaled $2.15 billion, up 11.3% year over year. Revenues in the Transfer segment amounted to $171 million, rising 9.8% year over year. Revenues in the Landfill segment totaled $635.1 million, increasing 9.8% year over year. Environmental solutions segment revenues of $91.7 million surged more than 100% year over year. Other segment revenues of $184.1 million increased 30.9% year over year.

Operating Results

Adjusted EBITDA margin of 28.1% declined 180 basis points (bps) from the prior-year quarter’s levels.

Operating income was $501.6 million, up 16% from the year-ago quarter’s levels. The operating margin rose to 17% from 16.8% in the year-ago quarter.

Total selling, general and administrative expenses were $315.5 million, up 22.4% from the year-ago quarter’s figures.

Balance Sheet and Cash Flow

Republic Services exited fourth-quarter 2021 with cash and cash equivalents of $29 million compared with $40.1 million at the end of the prior quarter.

Long-term debt (net of current maturities) was $9.55 billion compared with $9.26 billion at the end of the prior quarter.

The company generated $648.9 million of cash from operating activities in the reported quarter. The Adjusted free cash flow was $158.9 million.

In the December-end quarter of 2021, the company paid out $146.1 million of cash dividends to shareholders. RSG announced had declared a quarterly cash dividend of 46 cents per share. The dividend will be paid on Apr 14 to shareholders on record as of Apr 1.

During the reported quarter, the company repurchased 0.3 million shares for $36.7 million. As of Dec 31, 2021, the company had $1.7 billion available under its October 2020 repurchase program.

2022 Guidance

Adjusted earnings per share (EPS) are projected between $4.58 and $4.65. The midpoint of the guidance ($4.615) is higher than the Zacks Consensus Estimate of $4.59.

Republic Services expects an increase in the average yield of approximately 3.4% and volume growth in the range of 1.5-2%.

The adjusted EBITDA margin is anticipated to expand approximately 30-40 basis points.

RSG expects to generate $1.625-$1.675 billion of adjusted free cash flow.

RSG expects to invest at least $500 million in acquisitions and $175 million in solar energy investments.

Currently, Republic Services carries a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Sectorial Snapshot

Robert Half International

RHI

reported impressive fourth-quarter 2021 results, with earnings and revenues beating the Zacks Consensus Estimate. Quarterly earnings of $1.53 per share beat the consensus mark by 9.3% and soared 100% year over year.

Revenues of $1.71 billion surpassed the consensus mark by 4% and increased 44% year over year on a reported basis and 43% on an as-adjusted basis. RHI currently sports a Zacks Rank #1.

Automatic Data Processing

ADP

recently reported better-than-expected second-quarter fiscal 2022 results. Adjusted EPS of $1.65 beat the Zacks Consensus Estimate by 1.2% and rose 9% year over year.

Total revenues of $4.03 billion beat the consensus mark by 1.1% and increased 9% year over year. ADP currently carries a Zacks Rank #2 (Buy).

Rollins

ROL

reported mixed fourth-quarter 2021 results, with earnings meeting the Zacks Consensus Estimate and revenues beating the same. Adjusted earnings of 14 cents per share met the Zacks Consensus Estimate and increased 7.7% year over year.

Revenues of $600.3 million beat the consensus mark by 3.3% and rose 11.9% year over year. ROL currently carries a Zacks Rank #2.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top picks for the entirety of 2022?

From inception in 2012 through 2021, the

Zacks Top 10 Stocks

portfolios gained an impressive +1,001.2% versus the S&P 500’s +348.7%. Now our Director of Research has combed through 4,000 companies covered by the Zacks Rank and has handpicked the best 10 tickers to buy and hold. Don’t miss your chance to get in…because the sooner you do, the more upside you stand to grab.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report