Quite a few regular pipeline and regulatory updates have grabbed focus in the biotech sector this week. Mergers are back in focus in the sector. Importantly, updates on COVID-19 vaccines and treatments continue to be in the spotlight amid the rapidly spreading Omicron variant.

Recap of the Week’s Most Important Stories

:

BioDelivery Gains on Buyout Deal

: Shares of

BioDelivery

BDSI

surged

after it announced a merger agreement with

Collegium Pharmaceutical, Inc

.

COLL

whereby the latter will purchase all outstanding shares of BDSI for $5.60 per share in an all-cash transaction. The transaction represents a 54% premium to BDSI stock’s closing price of $3.64 on Feb 11, 2022, and a 65% premium to the 30 trading days volume-weighted average price of $3.40. The transaction is expected to close late in the ongoing quarter.

BioDelivery has a portfolio of pain and neurology products. The acquisition will diversify and boost Collegium’s revenues by adding Belbuca as a second and highly complementary growth driver to its vastly differentiated pain portfolio. It will also add a revenue stream from Symproic and a product launch opportunity with Elyxyb. Collegium expects the acquisition to be immediately and highly accretive driven by identified annual synergies of at least $75 million.

BioDelivery Sciences currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Data on Gilead’s Veklury

:

Gilead Sciences, Inc

.

GILD

recently released encouraging data demonstrating the in vitro activity of antiviral treatment for COVID-19, Veklury (remdesivir), against 10 SARS-CoV-2 variants, including the highly contagious Omicron. The study analyzed in vitro antiviral activity by two methods to understand the susceptibility of 10 major SARS-CoV-2 variants to Veklury. Results showed similar activity of Veklury against the variants, and an early ancestral A lineage isolate detected in Seattle, WA (WA1 strain). Gilead stated that Veklury retained antiviral activity against Omicron, Delta and other emergent SARS-CoV-2 variants in multiple in vitro studies.

Veklury directly inhibits viral replication inside host cells by targeting the SARS-CoV-2 RNA-dependent RNA polymerase. Veklury was approved by the FDA on Oct 22, 2020, for adults and pediatric patients 12 years of age and older and weighing at least 40 kg for the treatment of COVID-19 requiring hospitalization. The latest data also suggest that remdesivir will retain antiviral activity against a new version of Omicron (BA.2 subvariant) because the viral RNA polymerase that remdesivir targets does not contain any additional unique mutations.

Seagen Down on Weak Outlook

:

Seagen

SGEN

shares

plunged

after the company reported fourth-quarter results. The company reported a loss of 95 cents per share, wider than the Zacks Consensus Estimate of a loss of 79 cents. Total revenues in the quarter were $430 million, declining 28.5% year over year but beating the Zacks Consensus Estimate of $403 million. Net product revenues in the fourth quarter were $369.2 million, up 26% year over year, driven by the strong uptake of Seagen’s marketed cancer drugs, Tukysa and Padcev.

However, Seagen guided 2022 revenues in the range of $1.48-$1.54 billion, much below the expectation of $2.17 billion. The sales outlook falling substantially short of expectations might have hurt investors’ sentiments.

ImmunoGen Teams With Lilly

: Shares of

ImmunoGen

IMGN

gained after it announced a global, multi-year definitive licensing agreement with pharma giant Eli Lilly and Company. Per the deal, ImmunoGen grants Lilly exclusive rights to research, develop and commercialize antibody-drug conjugates combining targets selected by Lilly with ImmunoGen’s novel camptothecin platform.

Per the terms, Lilly will pay ImmunoGen an upfront payment of $13 million, which reflects initial targets selected by Lilly. Thereafter, ImmunoGen will be eligible to receive an additional $32.5 million in exercise fees if Lilly selects a pre-specified number of additional targets. ImmunoGen is eligible to receive up to $1.7 billion in potential target program exercise fees and milestone payments based on the achievement of pre-specified development, regulatory and commercial milestones. ImmunoGen is also eligible for tiered royalties as a percentage of worldwide commercial sales by Lilly. Lilly is responsible for all costs associated with research and development.

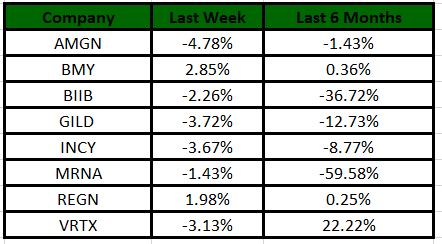

Performance

The Nasdaq Biotechnology Index has lost 0.18% in the past five trading sessions. Among the biotech giants, Bristol Myers has gained 2.85% during the period. Over the past six months, shares of Vertex have soared 22.22%. (See the last biotech stock roundup here:

Biotech Stock Roundup: BMY, AMGN, REGN, BIIB’s Q4 Earnings & More

)

Image Source: Zacks Investment Research

What’s Next in Biotech?

Stay tuned for more pipeline and regulatory updates, along with earnings updates.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report