Wall Street is reeling under extreme volatility since the beginning of 2022. Investors are highly concerned about soaring inflation. Moreover, the uncertainty regarding the pace and magnitude of an interest rate hike by the Fed to contain inflation has injected severe fluctuations in day-to-day trading since mid-January.

The technology stocks are the major casualties of market participants’ anticipation of the beginning of a higher interest regime in 2022. Consequently, the tech-heavy Nasdaq Composite Index has suffered a bloody blow so far this year.

However, we have identified five stocks listed in Nasdaq Composite with a favorable Zacks Rank that have strong potential for the rest of this year. These are

Apple Inc.

AAPL

,

Tesla Inc.

TSLA

,

Advanced Micro Devices Inc.

AMD

,

Texas Instruments Inc

.

TXN

and

ON Semiconductor Corp.

ON

.

Fed to Take Tough Monetary Stance

On Jan 26, after the conclusion of the first Fed FOMC meeting of this year, Fed Chairman Jerome Powell indicated that the first rate hike in three years could be implemented as early as March. The central bank’s quantitative easing program will also end in March. In a separate press statement, the FOMC had also indicated that the Fed is thinking of shrinking its $9 trillion balance sheet later this year.

Meanwhile, the consumer price index for January rose 7.5% year over year, triggering a large section of economists and financial researchers to predict a 50 basis point hike in the benchmark lending rate in March instead of the market’s expectation of a 25 basis-point hike.

Some investment bankers have also said that the central bank may raise interest rate seven times this year with a magnitude of 25 basis points each time. Consequently, the yield on the benchmark 10-Year U.S. Treasury Note climbed more than 2% last week. The yield was 1.5% at the beginning of 2022.

Nasdaq Composite Tumbles

Higher market risk-free returns mean a higher discount rate for future cash flows from stock investing. This will affect growth-oriented stocks — especially technology stocks — as these generally provide higher returns over the long term. Moreover, these companies depend on easy access to cheap credit to expand their businesses.

As a result, the tech-laden Nasdaq Composite has plummeted 9.6% year to date. The other two major stock indexes, namely, the S&P 500 and the Dow slid 6.2% and 3.7% year to date. Notably, the Nasdaq Composite rallied 43.6% and 21.4% in the pandemic-ridden 2020 and 2021, respectively.

Our Top Picks

At this juncture, we have narrowed our search to five Nasdaq Composite listed U.S. corporate behemoths that have a robust business model, globally acclaimed brand name and solid financial condition to sustain amid a higher interest rate regime. Each of our picks sports a Zacks Rank #1 (Strong Buy). You can see

the complete list of today’s Zacks #1 Rank stocks here

.

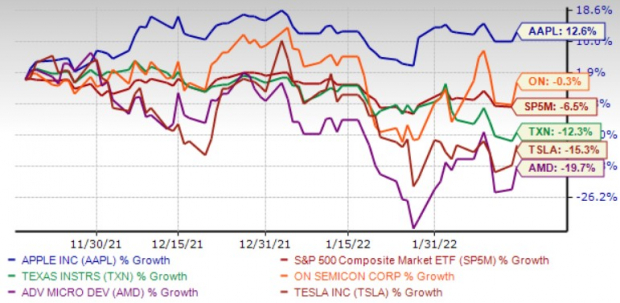

The chart below shows the price performance of our five picks in the past three months.

Image Source: Zacks Investment Research

Apple

is benefiting from continued momentum in Services, the robust performance of iPhone, iPad, Mac, Wearables and an expanding App Store ecosystem. Although Apple’s business primarily runs around its flagship iPhone, the Services portfolio has emerged as the company’s new cash cow. AAPL currently has more than 745 million paid subscribers across its Services portfolio.

Apple is encouraging developers to use artificial intelligence and machine learning in their apps. The company’s Core ML 2 API helps developers recognize faces or animals in photos, and parse the meaning of the text. AAPL’s focus on autonomous vehicles and augmented reality/virtual reality technologies presents growth opportunities for the long haul.

Apple has an expected earnings growth rate of 9.6% for the current year (ending September 2022). The Zacks Consensus Estimate for the current year has improved 5.7% over the past 30 days.

Tesla

has acquired a substantial market share within the electric car segment. Increasing Model 3 delivery, which forms a significant chunk of TSLA’s overall deliveries, is aiding its top line. Along with Model 3, Model Y is contributing to its revenues.

In addition to increasing automotive revenues, Tesla’s energy generation and storage revenues should boost its earnings prospects. TSLA said that its overall deliveries increased 20% in the third quarter from its previous record in the second quarter, marking the sixth consecutive quarter-on-quarter gain.

Tesla has an expected earnings growth rate of 37.6% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 11.7% over the past 30 days.

Advanced Micro Devices

is riding on robust performance from the Computing and Graphics, and Enterprise Embedded and Semi-Custom segments. AMD is benefiting from the strong sales of its Ryzen and EPYC server processors, owing to the increasing proliferation of AI and Machine Learning in industries like cloud, gaming and supercomputing.

The growing clout of 7-nanometer products in the data center vertical, driven by work-from-home and online learning trends, is a key catalyst of Advanced Micro Devices. AMD has raised its 2021 guidance for revenues on the back of strong growth across all businesses.

Advanced Micro Devices has an expected earnings growth rate of 43.4% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 20.8% over the past 30 days.

Texas Instruments

is benefiting from growth in the personal electronics market owing to the coronavirus-led work-from-home trend. Additionally, solid momentum across the Analog segment owing to robust signal chain and power product lines, is benefiting the top line of TXN.

The continued rebound in the automotive market is a tailwind for Texas Instruments. Solid growth in the industrial market is another positive for TXN. Strategic investments in new growth avenues and competitive advantages should also reap results in the long term. TXN’s portfolio of long-lived products and efficient manufacturing strategies are the other catalysts.

Texas Instruments has an expected earnings growth rate of 10.1% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 10.6% over the past 30 days.

ON Semiconductor

has benefited from an increase in supply, and favorable mix and pricing across all end-markets served. ON’s record third-quarter results were mainly driven by a strong demand environment, particularly for power and sensing products in automotive and industrial end markets. ON Semiconductor continues to gain traction among electric vehicle manufacturers for both silicon carbide and insulated-gate bipolar transistor-based products.

ON Semiconductor has an expected earnings growth rate of 41% for the current year. The Zacks Consensus Estimate for current-year earnings has improved 7.2% over the past 7 days.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report