We expect investors to focus on updates on

Allakos

’

ALLK

progress of its lead pipeline candidate, lirentelimab (AK002), when it reports fourth-quarter 2021 results.

The company’s earnings missed expectations in each of the trailing four quarters, with the average negative surprise being 9.8%. In the last reported quarter, Allakos delivered a negative earnings surprise of 3.6%.

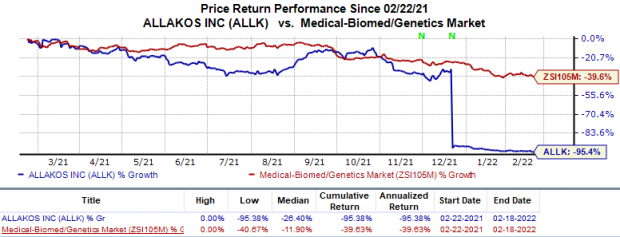

In the trailing 12 months, shares of Allakos have plunged 95.4% compared with the

industry

’s 39.6% decline.

Image Source: Zacks Investment Research

Let’s see how things have shaped up for the quarter to be reported.

Factors to Consider

Allakos currently does not have any approved product in its portfolio. As a result, the company is yet to generate revenues from product sales.

ALLK’s lead pipeline candidate lirentelimab is an investigational monoclonal antibody that targets diseases driven by mast cells and eosinophils. We note that the candidate is primarily being evaluated for eosinophilic gastrointestinal diseases (EGID).

In December 2021, Allakos announced top-line data from two separate studies — a phase III ENIGMA 2 study evaluating lirentelimab in patients with eosinophilic gastritis and/or eosinophilic duodenitis and another phase II/III KRYPTOS study evaluating the candidate in patients with eosinophilic esophagitis. Although both ENIGMA 2 and KRYPTOS studies achieved their histologic co-primary endpoints, neither of them achieved statistical significance in their symptomatic co-primary endpoints.

This was a major setback for the company as the lead indication for the drug is EGID indications. We note that other than lirentelimab, Allakos lacks pipeline candidates in clinical development. ALLK is currently analyzing data from the ENIGMA 2 and KRYPTOS studies to determine the next steps for the candidate in EGID indications.

Nonetheless, Allakos announced the expansion of the clinical development of lirentelimab in non-EGID indications last November. The expansion was based on the clinical activity demonstrated by the candidate in other indications.

ALLK has already initiated a phase II study evaluating the antibody in adult patients having moderate-to-severe atopic dermatitis. In mid-2022, the company plans to initiate a phase II/III study evaluating lirentelimab in chronic spontaneous urticaria. A phase II study evaluating the candidate in asthma is also being planned to begin in fourth-quarter 2022. Apart from these indications, ALLK is also planning to evaluate lirentelimab in additional indications in the next year.

Earnings Whispers

Our proven model does not conclusively predict an earnings beat for Allakos this time around. The combination of a positive

Earnings ESP

and a Zacks Rank #1 (Strong Buy), 2 (Buy) or 3 (Hold) increases the odds of an earnings beat. Unfortunately, that is not the case here as you will see below. You can uncover the best stocks to buy or sell before they’re reported with our

Earnings ESP Filter

.

Earnings ESP:

The company has an Earnings ESP of -28.87% as the Most Accurate Estimate of a loss of $1.73 per share is wider than the Zacks Consensus Estimate of a loss of $1.34.

Zacks Rank:

Allakos currently carries a Zacks Rank #3. You can

see the complete list of today’s Zacks #1 Rank stocks here

.

Stocks to Consider

Here are a few stocks you may want to consider as our model shows that these have the right combination of elements to beat on earnings this reporting cycle.

Epizyme

EPZM

has an Earnings ESP of +6.17% as the Most Accurate Estimate of a loss of 38 cents per share is narrower than the Zacks Consensus Estimate of a loss of 41 cents. Epizymecurrently holds a Zacks Rank #3 at present.

Epizyme’s loss per share estimates for 2022 have narrowed from $1.74 to $1.65 in the past 30 days. Epizyme missed earnings estimates in each of the last four quarters, delivering a negative surprise of 20.2%, on average.

Evelo Biosciences

EVLO

has an Earnings ESP of +12.79% as the Most Accurate Estimate of a loss of 50 cents per share is narrower than the Zacks Consensus Estimate of a loss of 57 cents. Evelo Biosciencescurrently carries a Zacks Rank #3 at present.

Evelo Biosciences’ loss per share estimates for 2022 have narrowed from $2.19 to $2.12 in the past 30 days. Evelo Biosciences missed earnings estimates in each of the last four quarters, delivering a negative surprise of 13.2%, on average.

Moderna

MRNA

has an Earnings ESP of +1.90% as the Most Accurate Estimate of $10.02 per share is higher than the Zacks Consensus Estimate of $9.83. Moderna currently has a Zacks Rank #3 at present.

In the past 30 days, earnings per share estimates of Moderna for 2022 have increased from $25.98 to $26.98 in the past 30 days. In fact, Moderna topped earnings estimates in two of the last four quarters and missed the mark on the other two occasions, delivering a negative surprise of 35.8%, on average.

Stay on top of upcoming earnings announcements with the

Zacks Earnings Calendar

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report