Theravance Biopharma, Inc.

TBPH

incurred a loss of 43 cents per share in the fourth quarter of 2021, wider than the Zacks Consensus Estimate of a loss of 30 cents but narrower than the year-ago loss of 92 cents.

Total revenues of $14.9 million missed the Zacks Consensus Estimate of $15.59 million. Revenues were down 20.2% year over year.

The top line comprised collaboration revenues worth $2.8 million from Janssen, a wholly-owned subsidiary of

Johnson & Johnson

JNJ

, and $12.1 million from the collaboration agreement with

Viatris

VTRS

in relation to Yupelri (revefenacin).

Theravance and Viatris are jointly developing and commercializing Yupelri, a long-acting muscarinic antagonist, as a once-daily nebulized treatment of chronic obstructive pulmonary disease (COPD). Viatris and Theravance are sharing U.S. profits and losses related to the commercialization of Yupelri. While Viatris gets 65% of the profits, Theravance gets 35%.

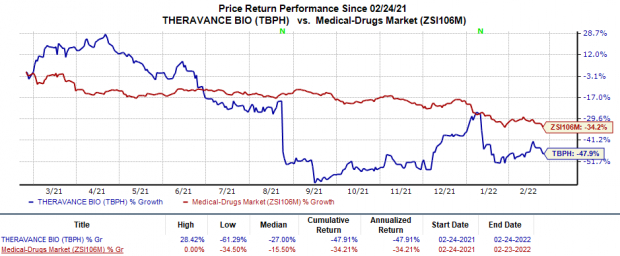

Shares of Theravance have declined 47.9% so far this year compared with the

industry

’s decrease of 34.2%.

Image Source: Zacks Investment Research

Quarter in Detail

Research & development expenses were $31.2 million, down 52.1% from the year-ago quarter’s figure.

Selling, general & administrative expenses were down 28.4% year over year to $21.5 million.

As of Dec 31, 2021, Theravance had cash, cash equivalents and marketable securities worth $173.5 million compared with $216.2 million as of Sep 30, 2021.

Full-Year Results

For 2021, Theravance generated revenues worth $55.3 million, reflecting a decrease of 23% year over year.

For the same period, TBPH reported a loss of $2.87 per share compared with the year-ago loss of $4.46.

2022 Guidance

For 2021, Theravance expects adjusted research & development expenses (excluding one-time figures and share-based compensation) in the range of $45-$55 million, while adjusted selling, general and administrative expenses are projected between $35 million and $45 million.

TBPH expects to achieve sustainability in cash flow and become cash flow positive in the second half of 2022.

Other Updates

Following the failure of the its two non-respiratory disease-related programs, namely izencitinib and ampreloxetine in a phase II and phase III study, respectively, Theravance

announced

that it will prioritize respiratory therapeutics to maximize its shareholder value in the long run.The restructuring will involve reduction of workforce by 75%, which is expected to be completed by February-end.

Theravance decided to complete the ongoing studies on ampreloxetine and izencitinib for symptomatic neurogenic orthostatic hypotension and Crohn’s disease (CD), respectively and then discontinue further developmental activity on these candidates. Top-line data from both studies is expected in the first quarter of 2022.

We note that J&J’s Janssen Biotech entered into a collaboration agreement with Theravance in 2018 for izencitinib to treat inflammatory intestinal diseases, including ulcerative colitis (UC) and CD. However, after the failure in the UC study and TBPH’s decision to close the clinical studies on CD, J&J’s subsidiary sent a notice in December 2021 to TBPH, terminating their collaboration.

Last month, Theravance announced that it enrolled the first patient in the phase IV study to evaluate Yupelri against Boehringer Ingelheim’s Spiriva HandiHaler in adults with severe to very severe COPD over a 12-week treatment period. Top-line data from the study is expected in first-quarter 2023. TBPH expects that a potential success in this study will not only help Yupelri acquire the new market share but also strengthen its competitive advantage.

Zacks Rank & Key Pick

Theravance Biopharma currently carries a Zacks Rank #2 (Buy). Another top-ranked stock in the overall healthcare sector is

Vertex Pharmaceuticals

VRTX

, sporting a Zacks Rank of 2 at present.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $13.35 to $14.33 in the past 30 days. The same for 2023 has risen from $14.12 to $15.31 in the past 30 days. The stock has risen 6.3% in the past year. Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report