Biohaven Pharmaceutical

BHVN

incurred a loss of $3.01 per share in fourth-quarter 2021, wider than the Zacks Consensus Estimate of a loss of $2.07 but narrower than the year-ago loss of $3.62.

Adjusted loss, which excludes non-cash stock-based compensation and a few other non-cash expenses, for the fourth quarter was $2.32 per share compared with $2.69 in the year-ago period.

Total revenues, solely from Nurtec ODT, were $190 million in the fourth quarter, in line with the Zacks Consensus Estimate. Sales were up 40% sequentially and 441% year over year on the back of strong demand and higher net price realization. Please note that the company had launched Nurtec ODT in March 2020.

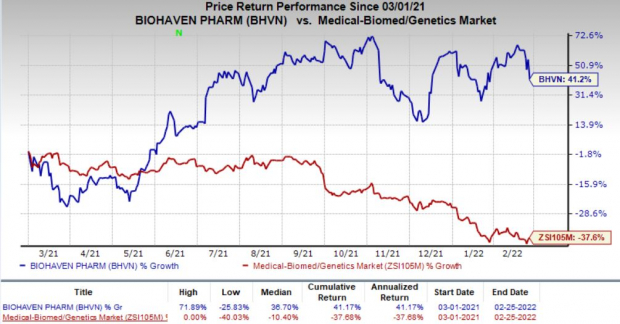

Shares of Biohaven declined 8.9% on Feb 25, following the wider-than-expected loss in the fourth quarter. However, the company’s shares have gained 41.2% in the past year against the

industry

’s decrease of 37.6%.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development (R&D) expenses, including stock-based compensation, were $91.1 million in the quarter, up 23.9% year over year, driven by higher pre-clinical and late-stage clinical activities.

Selling, general and administrative (SG&A) expenses were $219.5 million in the quarter, up 79.3% from the year-ago period. The significant increase in SG&A expense was driven by higher costs to support the commercialization of Nurtec.

As of Dec 31, 2021, Biohaven had cash and restricted cash worth $367 million compared with $523.9 million as of Sep 30, 2021.

Full-Year Results

Biohaven reported revenues of $462.5 million for 2021, compared with $63.6 million in revenues in 2020. In 2021, the company incurred a loss of $13.09 per share, widening from $13.06 per share from the year-ago period. Adjuted loss in 2021 was $9.86 per share, narrowing 4.4% year over year.

Nurtec Update

In a separate press release, Biohaven stated that its oral anti-CGRP drug, Nurtec ODT, was recommended by the Committee for Medicinal Products for Human Use for approval in Europe as an acute and preventive treatment for migraine. The company expects approval from the European Commission in the first half of 2022. During the fourth quarter, the drug received approval in Israel as acute and preventive treatment and in Kuwait as an acute treatment for migraine.

In November 2021, Biohaven inked a strategic agreement with

Pfizer

PFE

for the commercialization of Nurtec ODT in ex-U.S. markets. The deal with Pfizer was completed last month. Biohaven recorded an upfront payment of $500 million upon completion which included $150 million in cash and the rest in equity investment. Biohaven is eligible to receive up to $740.0 million in future milestones from Pfizer along with royalties on net sales of Nurtec ODT outside the United States. Per the same deal, Pfizer also gained rights to another candidate in Biohaven’s pipeline, zavegepant, which is also being developed as a migraine treatment.

Earlier this month, Biohaven announced top-line data from a phase III study evaluating Nurtec ODT in migraine patients in China and South Korea. Data from the study was consistent with previous studies, which supported the drug’s approval in the United States. Data from this study will support the regulatory application, expected to be filed in the second half of 2022, for the potential approval of the drug in China and South Korea.

In February, Biohaven initiated a phase II/III study to evaluate Nurtec ODT as a potential treatment for chronic rhinosinusitis. The company is planning a clinical study in the first quarter of 2022 to evaluate Nurtec ODT as a potential treatment for temporomandibular disorder.

License Agreements

Earlier this month, Biohaven expanded its pipeline through two new agreements with

Bristol-Myers

BMY

and privately-held Knopp Biosciences.

Biohaven signed a worldwide license agreement, with Bristol-Myers gaining development and commercialization rights to the latter’s phase III-ready pipeline candidate, taldefgrobep alfa. Biohaven is planning to start a phase III study to evaluate the candidate in patients with spinal muscular atrophy later this year. Biohaven will pay Bristol-Myers regulatory approval milestone payments and sales-based royalties related to taldefgrobep alfa development and commercialization.

Biohaven added an epilepsy candidate, BHV-7000, under its agreement with Knopp Biosciences to acquire the latter’s Kv7 channel targeting platform. The company plans to start a clinical study on the candidate later this year. Per the same agreement, Biohaven also gains rights to other pipeline candidates from Knopp Biosciences’s Kv7 channel targeting platform.

Zacks Rank

Biohaven currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

A better-ranked drugmaker is

Collegium Pharmaceutical

COLL

, sporting a Zacks Rank of 1.

Collegium’s earnings per share estimates have moved north from $3.66 to $5.43 for 2022 in the past 30 days. COLL has gained 3.6% so far this year.

Collegium delivered a negative earnings surprise of 22.76%, on average, in the last four quarters.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report