Juniper Networks, Inc.

JNPR

has announced that QTnet, a telecommunication service provider in Japan, has selected its wired, wireless and security solutions to boost the latter’s eSport Challenger’s Park.

QTnet has built a stadium where everyone can experience amazing performance powered by Juniper’s AI-driven network. eSports is one of the fastest-growing industries in the world.

QTnet entered the eSports space by acquiring Sengoku Co., Ltd. in 2020, which operates one of Japan’s professional eSports teams. In August 2021, QTnet opened one of western Japan’s largest eSports facilities.

QTnet realized the need to build a network for professional players while considering the connectivity needs of visitors. To that end, QTnet partnered with Juniper to build an AI-driven network that would enable high-performance end-user experiences.

QTnet deployed Juniper Wireless Access Points across the complex to create a wireless environment that provides fast and reliable connectivity.

Juniper’s EX Series Switches and SRX Series Services Gateways enabled QTnet to meet the network requirements for eSports activities. The company is well-positioned to support customers in this space in delivering superior gaming and viewing experiences.

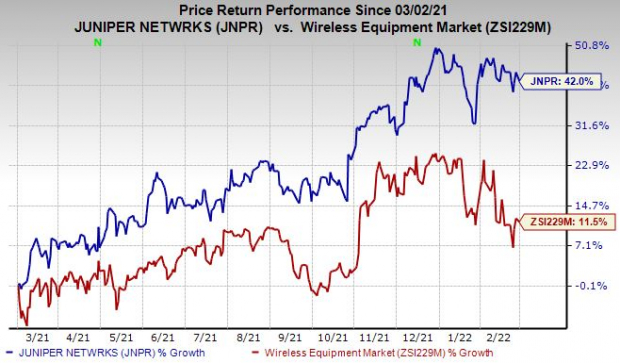

JNPR is benefiting from solid order momentum was across verticals, customer solutions and regions. The stock has gained 42% in the past year compared with the

industry

’s growth of 11.5%.

Image Source: Zacks Investment Research

Investments in customer solutions and sales organizations have enabled Juniper to capitalize on the increasing demand across end markets.

The company is experiencing supply-chain headwinds related to rising component costs and shortages, as well as elevated freight costs, which are expected to persist, at least through the first half of 2022.

JNPR currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Clearfield, Inc.

CLFD

is a better-ranked stock in the industry, sporting a Zacks Rank #1. The Zacks Consensus Estimate for its current-year earnings has been revised 20.5% upward over the past 60 days.

Clearfield delivered a trailing four-quarter earnings surprise of 50.7%, on average. It has gained 87.6% in the past year.

Qualcomm, Inc.

QCOM

, carrying a Zacks Rank #2 (Buy), is another solid pick for investors. The consensus estimate for current-year earnings has been revised upward by 12.2% over the past 60 days.

Qualcomm delivered a trailing four-quarter earnings surprise of 12.2%, on average. It has appreciated 25.5% in the past year.

Sierra Wireless, Inc.

SWIR

also carries a Zacks Rank #2. The consensus mark for current-year earnings has been revised upward by 237.5% over the past 60 days.

Sierra Wireless pulled off a trailing four-quarter earnings surprise of 58%, on average. The stock has returned 11.9% in the past year.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report