Mirati Therapeutics

MRTX

reported fourth-quarter loss of $3.72 per share, which was wider than the Zacks Consensus Estimate of a loss of $3.01 as well as the year-ago loss of $2.08 per share.

Mirati reported $0.3 million as collaboration revenues for the fourth quarter compared with $1.7 million in the year-ago quarter. The Zacks Consensus Estimate was $8.0 million.

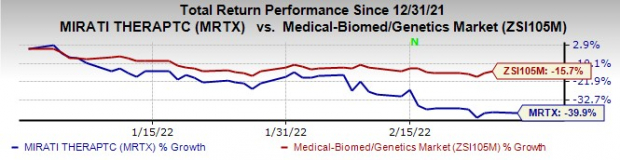

In the year so far, the stock price of Mirati has declined 39.9% compared with the

industry

’s decline of 15.7%.

Image Source: Zacks Investment Research

Quarter in Detail

Research and development expenses rose 86% from the prior-year quarter to $153.8 million due to an increase in development expenses of its lead pipeline candidates, adagrasib and sitravatinib and preclinical as well as early discovery activities and higher employee-related expenses.

General and administrative expenses rose 71.8% from the year-ago quarter to $43.5 million due to an increase in professional services expenses and higher employee-related costs in the quarter.

Cash, cash equivalents and short-term investments as of Dec 31, 2021 were $1.5 billion compared with $1.2 billion as of Sep 30, 2021.

Full-Year 2021 Results

The company recorded total revenues of $72.1 million in 2021 compared with $13.4 million in 2020.

The net loss per share was $11.21 per share compared with a loss of $7.96 per share in 2020.

Pipeline Update

Mirati has submitted a new drug application (NDA) to the FDA for adagrasib, its KRAS inhibitor drug, seeking approval for previously-treated KRASG12C-mutated non-small cell lung cancer (NSCLC). The FDA is expected to give its decision on Dec 14, 2022. The NDA was based on phase II registration-enabling cohort of the KRYSTAL-1 study on adagrasib and was filed under the FDA’s real-time oncology review pilot program

The KRYSTAL-1 study is evaluating adagrasib in multiple cohorts in combination with other therapies. These include a combination of adagrasib with

Merck

’s

MRK

Keytruda for first-line NSCLC, a combination of adagrasib plus Boehringer Ingelheim’s Gilotrif (afatinib) for advanced NSCLC and adagrasib combined with

Bristol-Myers

’

BMY

Erbitux for second-line colorectal cancer (“CRC”).

Preliminary data from the adagrasib plus Merck’s Keytruda cohort demonstrated that the combination achieved a 100% disease control rate, with all seven patients exhibiting tumor regression ranging from 37% to 92% as of Oct 21, 2021.

Mirati Therapeutics is also pursuing a broad combination development program for adagrasib beyond the combinations with Merck’s Keytruda and Bristol-Myers’ Erbitux. These include combinations with SHP2, SOS1 or CDK 4/6 inhibitors.

In the fourth quarter, Mirati announced that it is partnering with

Verastem Oncology

VSTM

to evaluate the combination of adagrasib with Verastem’s RAF/MEK inhibitor, VS-6766, in a phase I/II study in patients with KRAS G12C mutant NSCLC.

The phase I/II study will determine the maximum tolerated dose and recommend the dose for a phase II study and also study the safety, tolerability and efficacy of the combination in patients who have progressed on a KRAS G12C inhibitor. Mirati and Verastem will jointly oversee the study.

Another pipeline candidate, sitravatinib is being evaluated in a pivotal phase III study (SAPPHIRE) in combination with Bristol-Myers’ Opdivo for second-line or third-line non-squamous NSCLC. Data from the study is expected in the second half of 2022. If the data from this study is positive, it could be the basis for regulatory submissions for sitravatinib in the United States and Europe.

Mirati currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report