Emergent BioSolutions Inc.

EBS

announced the initiation of dosing in its phase I study, which is evaluating its pipeline candidate, stabilized isoamyl nitrite (“SIAN”), for treating known or suspected acute cyanide poisoning. The study will evaluate the safety, tolerability, pharmacokinetics, and pharmacodynamics of single-use intranasal spray of SIAN.

Emergent is developing SIAN under an existing contract with the Biomedical Advanced Research and Development Authority (“BARDA”) and in collaboration with the Southwest Research Institute. The phase I study is funded by the BARDA. The SIAN is being developed for intended use by first responders and medical personnel following a cyanide incident.

Emergent already has a few vaccines targeting priority public health threats identified by the U.S. government. The company delivers these vaccines to the federal government for the strategic national stockpile. The successful development of SIAN will boost Emergent’s medical countermeasures portfolio of drugs. The BARDA funding also implies that the successful development of SIAN can also lead to purchase contracts from the U.S. government.

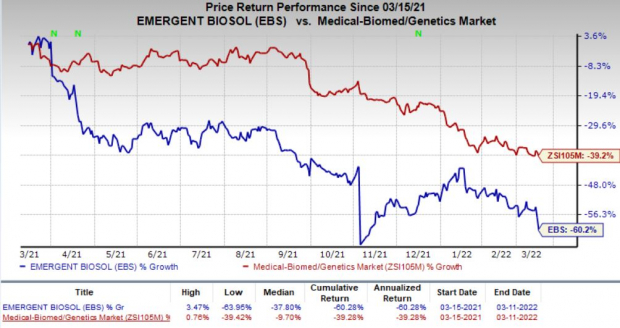

Shares of Emergent have plunged 60.2% in the past year compared with the

industry

’s decline of 39.2%.

Image Source: Zacks Investment Research

Emergent’s medical countermeasures portfolio includes its anthrax vaccines — BioThrax and AV7909 — and smallpox vaccine — ACAM2000. These products added more than $465 million to the company’s top line in 2021. The company expects these products to generate revenues in the range of $470-$510 million in 2022.

Emergent is also one of the leading contract manufacturers based in the United States. It has signed multiple agreements with several pharma/biotech companies including

J&J

JNJ

to provide development and manufacturing services for their COVID-19 vaccines. Some of its deals are also backed by the BARDA.

We note that Emergent had received a setback last year when there was a manufacturing mishap at its Bayview facility where COVID-19 vaccine ingredients of J&J and

AstraZeneca

AZN

reportedly got mixed and led to several faulty batches of J&J’s vaccine. Emergent lost its contract for AstraZeneca’s vaccine following the mishap. The production of J&J’s vaccine at the Bayview facility was also temporarily halted but it was allowed to start the service by the FDA in July 2021. The loss of AstraZeneca’s contract and temporary halt for J&J’s vaccine hurt the company’s contract development and manufacturing (“CDMO”) services revenues in 2021. The company also lowered its guidance for CDMO revenues in 2022 by $100 million on its fourth-quarter earnings call between $330 million and $380 million.

Zacks Rank & Stock to Consider

Emergent currently has a Zacks Rank #5 (Strong Sell).

Vertex Pharmaceuticals Incorporated

VRTX

is a better-ranked company from the biotech sector, carrying a Zacks Rank #2 (Buy). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex’s earnings estimates have moved north from $13.39 to $14.52 for 2022 and from $14.10 to $15.31 for 2023 over the past 60 days. VRTX has gained 7.7% in the past year.

Vertex delivered an earnings surprise of 10.01%, on average, in the last four quarters.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report