Nektar Therapeutics

NKTR

announced that the registrational phase III study — PIVOT IO-001 — evaluating a combination regimen of its lead pipeline candidate — bempegaldesleukin (bempeg) — failed to meet its primary endpoints of progression-free-survival (“PFS”) and objective response rate (“ORR”). The study was evaluating the candidate as a first-line treatment for melanoma patients.

Please note that Nektar was conducting the study in collaboration with

Bristol-Myers

BMY

.

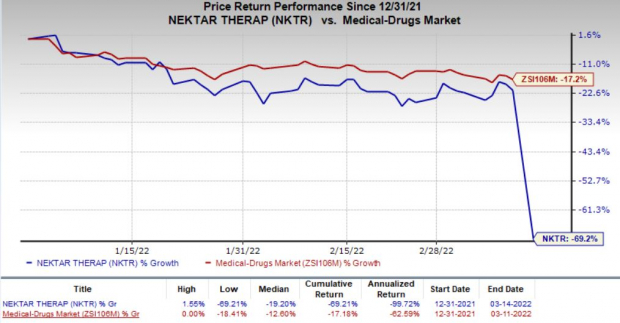

Shares of Nektar plunged 60.9% on Mar 14 following the negative study data readout. In fact, Nektar’s shares have declined 69.2% so far this year compared with the

industry

’s decrease of 17.2%.

Image Source: Zacks Investment Research

The PIVOT IO-001 study was comparing Nektar’s bempeg in combination with Bristol-Myers’ immuno-oncology drug, Opdivo, to Opdivo monotherapy in previously-untreated patients with unresectable or metastatic melanoma. An interim analysis of this late-stage study by an independent data monitoring committee demonstrated that the addition of bempeg to Opdivo for treating first-line melanoma resulted in no additional clinical benefit for PFS and ORR, compared to Opdivo monotherapy.

Following the setback, Nektar and Bristol-Myers have decided to unblind the study and not to perform additional analyses for the overall survival endpoint. The companies will now review the PIVOT IO-001 study data and plan to share the results with the scientific community later.

Based on the unfavorable outcome in PIVOT IO-001 study, Nektar and Bristol-Myers have also unblinded another late-stage study — PIVOT-12 — evaluating the bempeg plus Opdivo combo regimen as adjuvant immunotherapy after complete resection of melanoma in patients at high risk for recurrence. The companies also stopped further enrollment in the study. The PIVOT-12 is also comparing the bempeg plus Opdivo regimen to Opdivo monotherapy in the patient population.

Failure of bempeg in the melanoma study is likely to have raised skepticism about upcoming data readouts from two other registrational studies evaluating bempeg plus Opdivo as potential treatment for renal cell carcinoma and urothelial cancer. The studies are continuing unhindered and data readout is expected in the first half of 2022. Any negative update from these studies can be detrimental for Nektar as it will delay the commercialization prospect of its pipeline.

Nektar is also evaluating bempeg in combination

Merck

’s

MRK

immuno-oncology drug, Keytruda. The phase I/II study — PROPEL — is evaluating bempeg in combination with Merck’s Keytruda for treating metastatic non-small cell lung cancer. Initial data from the study presented in November last year showed that bempeg plus Merck’s Keytruda demonstrated early evidence of clinical benefit. A phase II/III study is evaluating bempeg plus Merck’s Keytruda as a first-line treatment for metastatic or unresectable recurrent squamous cell carcinoma of the head and neck in patients whose tumors express PD-L1.

Apart from bempeg, Nektar is developing NKTR-255 for treating several oncology indications and NKTR-358 targeting auto-immune indications.

Nektar’s partner,

Eli Lilly

LLY

is evaluating NKTR-358 in two mid-stage studies involving patients with lupus or ulcerative colitis. Lilly plans to initiate two more mid-stage studies to evaluate the candidate as a potential treatment for atopic dermatitis and another undisclosed auto-immune indication. Lilly initiated the atopic dermatitis study based on data from a proof-of-concept study, which demonstrated sustained disease control for at least six months following treatment with NKTR-358.

Zacks Rank

Nektar currently has a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Zacks Names “Single Best Pick to Double”

From thousands of stocks, 5 Zacks experts each have chosen their favorite to skyrocket +100% or more in months to come. From those 5, Director of Research Sheraz Mian hand-picks one to have the most explosive upside of all.

It’s a little-known chemical company that’s up 65% over last year, yet still dirt cheap. With unrelenting demand, soaring 2022 earnings estimates, and $1.5 billion for repurchasing shares, retail investors could jump in at any time.

This company could rival or surpass other recent Zacks’ Stocks Set to Double like Boston Beer Company which shot up +143.0% in little more than 9 months and NVIDIA which boomed +175.9% in one year.

Free: See Our Top Stock and 4 Runners Up >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report