Shares of popular COVID-19 vaccine maker,

Moderna, Inc.

MRNA

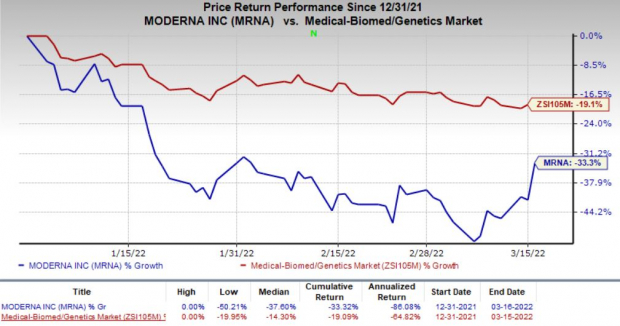

have gained 33.9% in the past 10 days, following a decline of nearly 70% since September 2021. In fact, Moderna’s shares have declined 33.3% so far this year compared with the

industry

’s decrease of 19.1%.

Image Source: Zacks Investment Research

The company’s total sales of $18.5 billion in 2021 were majorly driven by the supply of its mRNA-based COVID-19 vaccine, Spikevax, and its booster doses in several countries across the globe. However, waning COVID-19 infection cases across the globe during the past six months may have heightened uncertainty among investors about its COVID-19 vaccine and booster doses. Investors might have also been concerned about the company’s prospects amid rising competition.

The recent recovery in share price has likely been driven by an anticipated rise in demand for its COVID-19 vaccine amid authorizations for younger population in different countries as well as the increasing risk of a new wave.

Risk of New Wave

Speculations of a new COVID wave are rife following a surge in infection cases in many countries. There have been recent reports of lockdowns in China following reportedly the largest surge of Covid-19 infections by the Omicron variant since the coronavirus first emerged in 2020. There has also been a rise in COVID-19 infection cases in Western Europe, following which some experts and health authorities have warned about another wave of the pandemic in the United States.

A rise in COVID-19 cases is likely to drive demand for vaccines and booster doses. Another wave of COVID-19 infection cases across the globe may lead to increase in COVID-19 vaccination programs in different countries.

Amid the hope of rising demand for Moderna’s Spikevax and booster doses, investors are also cheering the company’s initiatives to sign more advance purchase agreements. Earlier this week, Moderna signed an agreement with Japan’s government for the supply of additional 70 million doses of booster doses in 2022 on top of the existing agreement for 93 million doses of its vaccine. The company also expanded its agreement with Colombia for an additional 10.8 million doses last month.

Expanding Target Population

Moderna’s COVID-19 vaccine and booster doses are getting approved for use in children below 12 years in many countries. The expanded patient population for the vaccine is likely to boost its demand further amid a potential new wave of infections. Moreover, Spikevax is yet to gain authorization for use in adolescents in the United States. A potential approval amid the surging infection cases will be beneficial for Moderna.

Moreover, the company’s Omicron-specific booster dose is currently in a pivotal clinical study evaluating it in adults. An effective Omicron-specific booster has the potential to drive revenues higher for the company in 2022.

Estimates for Moderna’s earnings per share for 2022 have also improved 2.6% in the past 90 days, implying strong fundamentals.

Another COVID-19 vaccine-maker,

BioNTech

’s

BNTX

shares have also increased for the majority of the past two weeks, presumably in anticipation of rising demand for its vaccine. BioNTech has developed Comirnaty in collaboration with

Pfizer

PFE

. BioNTech and Pfizer’s vaccine has already received authorization for use in children aged five to eleven years of age in the United States. A regulatory application seeking authorization to use the second booster dose of Comirnaty in older adults was submitted by Pfizer and BioNTech earlier this week.

Competition

Although the COVID-19 pandemic is priming for yet another wave of infections, we note that the competition scenario can be different for vaccines compared to last year with the availability of effective COVID-19 drugs, especially from Pfizer and

Merck

MRK

. Pfizer and Merck have developed oral COVID-19 drugs — Paxlovid and molnupiravir —, which have already gained emergency use authorization in the United States. Earlier this month, the world Health Organization (“WHO”) recommended the use of molnupiravir for non-severe COVID-19 patients with the highest risk of hospitalization.

Conclusion

Moderna’s shares have started a recovery since Mar 7, which is likely to continue going forward on the back of an anticipated rise in demand for Spikevax and boosters due to rising infections cases. The company is gaining regulatory authorization for use in the younger population as well as in new countries, which are likely to aid its top line going forward. Its focus on signing purchase agreements bodes well. However, competition from other COVID-19 vaccines and therapeutics may hurt demand. Moreover, the demand for vaccines will be hurt if COVID-19 infections are effectively restricted by different countries.

Zacks Rank

Moderna currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

7 Best Stocks for the Next 30 Days

Just released: Experts distill 7 elite stocks from the current list of 220 Zacks Rank #1 Strong Buys. They deem these tickers “Most Likely for Early Price Pops.”

Since 1988, the full list has beaten the market more than 2X over with an average gain of +25.4% per year. So be sure to give these hand-picked 7 your immediate attention.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report