Stocks ripped off a solid stretch over the last week that helped many investors breathe a sigh of relief amid the triple threat of higher interest rates, rising energy prices, and geopolitical chaos. The Nasdaq is up about 10% from its March 14 lows, even with Wednesday’s 1.3% drop.

Wall Street appeared to cheer the fact that the first rate hike came in at 25 basis points and not 50 bps. Perhaps most importantly, investors are pleased that Powell and the Fed provided a roadmap for the remainder of 2022 as the U.S. ends its easy-money policies and attempts to clamp down on 40-year high inflation.

The current outlook for interest rate hikes could easily change if inflation doesn’t start to slowly come down. Plus, higher rates are historically bad for stocks. The continued Russian attacks in Ukraine only amplify the nerves and uncertainty. The fighting and sanctions have also sent global energy and oil prices, which were already surging well before the invasion, even higher.

The backdrop may continue to keep many investors on the sidelines, especially after the tumultuous start to 2022. But hoarding cash amid 7%+ inflation is also somewhat risky. Even though the 10-year U.S. Treasury is near three-year highs that only puts them at 2.3%.

Therefore, we could see many on Wall Street continue chasing returns in stocks for the foreseeable future, even if the big tech trade of the last decade goes a bit dormant for the time being as investors look to energy and other recently booming areas.

Here are a couple strong, dividend-paying stocks to consider buying amid the current economic uncertainty and market volatility.

Public Storage

PSA

Public Storage is a REIT that primarily acquires, develops, owns and operates self-storage facilities. PSA’s portfolio included nearly 2,800 self-storage facilities in roughly 40 states at the end of 2021. Public Storage has been gaining momentum for years as Americans continue to buy more things, from furniture to clothing, electronics, and beyond.

Tons of this stuff is poised to end up in Public Storage units and other self-storage facilities that are full of what function like giant walk-in lockers or garages. People all over the country from all walks of life pay to rent units, often on a monthly or yearly basis. No matter whether you live in a big city to a rural area, it shouldn’t be too hard to spot a self-storage facility.

Public Storage and other players have benefited from the covid economy and the housing boom. Businesses use these facilities as well, and some people even use them to store cars and other large items. Public Storage is also focused on bolstering its digital offerings where people can currently sign up, manage their accounts, and open gates and doors all from PSA’s mobile app.

Image Source: Zacks Investment Research

Public Storage had grown its revenue a steady clip for the past decade before it posted blowout FY21 results in late February that saw it top our Q4 FFO estimates and issue upbeat guidance. PSA’s revenue climbed 17% to help lift its FFO (which are essentially earnings for REITs) by 22%.

Zacks estimates call for Public Storage’s revenue to climb 15% in 2022 to reach $3.9 billion and lift its adjusted FFO by 17%. The company’s improved bottom-line outlook for FY22 and FY23 helps it land a Zacks Rank #2 (Buy) right now. The post-fourth quarter release revisions are part of a much longer trend of strong upward FFO revisions over the last several years.

PSA shares have surged 50% in the past year to blow away the S&P 500’s 15% and its industry’s 7%. The stock has also managed to move roughly sideways in 2022, even as the market drops. This is part of a 170% climb over the last 10 years that’s helped Public Storage crush its industry and the broader Zacks Financial sector that it’s a part of.

Public Storage stock trades a few percentage points below the records it hit earlier this month. Despite its run and current levels, PSA trades at a 16% discount to its year-long highs at 23.7X forward 12-month earnings and slightly below its median. The stock is also trading just above its 10-year median despite its 170% climb.

Wall Street is also rather high on PSA, with eight of the 13 brokerage recommendations Zacks has at strong buys. And its 2.17% dividend yield is not too far below the 10-year U.S. Treasury and blows away the S&P 500’s average. It is also worth stressing just how much

stuff

the average person or family has and how unlikely many are to ever get rid of it.

AbbVie

ABBV

AbbVie and its stock price are thriving even as patent protections run out for one of the world’s best-selling drugs, Humira. Biosimilars are currently available outside of the U.S. Thankfully, AbbVie prepared to move forward, in part, through its $63 billion Allergan acquisition that it completed in 2020.

AbbVie’s deal brought Botox and other popular drugs into a diversified portfolio that features immunology, oncology, neuroscience, a strong R&D pipeline, and beyond. ABBV’s FY20 revenue surged 38%, fueled by its Allergan deal. Most recently, the pharmaceutical giant topped our Q4 estimates in early February and its fiscal 2021 revenue surged another 23%, even though international Humira revenue dropped nearly 10%.

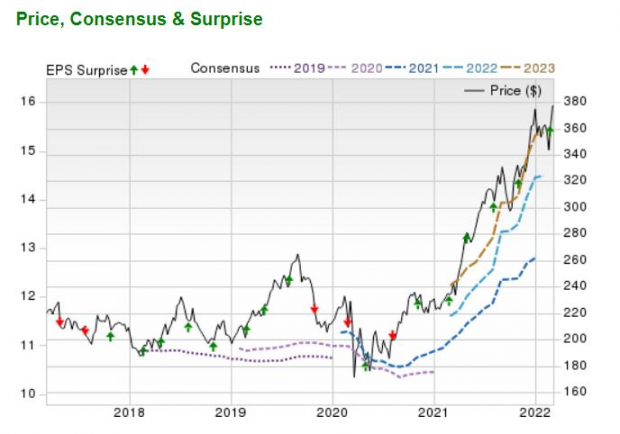

The strong top-line growth helped ABBV’s adjusted earnings climb 20%. Zacks estimates call for its FY22 EPS to jump another 11% on 7% higher sales that would see it pull in just over $60 billion. AbbVie, which lands a Zacks Rank #3 (Hold) at the moment, has seen its FY22 and FY23 consensus earnings estimates pop since its release.

Image Source: Zacks Investment Research

AbbVie has consistently topped our quarterly EPS estimates and it lands “B” grades across the board for Value, Growth, and Momentum in our Style Scores system. Plus, Wall Street is high on the stock, with nine of the 13 brokerage recommendations Zacks has at “Strong Buys,” with nothing below a “Hold.”

AbbVie also offers investors a solid dividend payment that it’s continually raised, with the payout up 250% since the inception in 2013. ABBV’s current 3.5% yield crushes its industry’s 2.5% average and the 30-year U.S. Treasury’s 2.60%.

AbbVie’s yield isn’t boosted by a falling stock price. The stock has surged 141% in the last five years to blow away the Large-Cap Pharma’s 65% and the S&P 500’s 100%. This includes a stellar 54% run in the past 12 months and a 17% climb in 2022, as investors rotate out of technology into more stable, dividend-paying names. In fact, ABBV touched new records Wednesday of over $161 per share.

Despite the run, AbbVie trades at 11.7X forward 12-month earnings at the moment. This marks a nearly 20% discount vs. the Large Cap Pharma’s 14.2X and 40% compared to the benchmark. Plus, AbbVie trades 35% beneath its own highs over this stretch and not too far above its median.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report