Pfizer Inc.

PFE

announced topline data from the phase III ELEVATE UC 12 study, which evaluated its immuno-inflammatory pipeline candidate etrasimod for moderately-to-severely active ulcerative colitis (UC).

The ELEVATE UC 12 study evaluated etrasimod versus placebo over a 12-week treatment period in 354 UC patients who already received at least one conventional, biologic or JAK therapy. It achieved both primary and key secondary endpoints with statistically significant improvements. Participants administered with etrasimod achieved the primary endpoint of clinical remission with statistical significance over placebo.

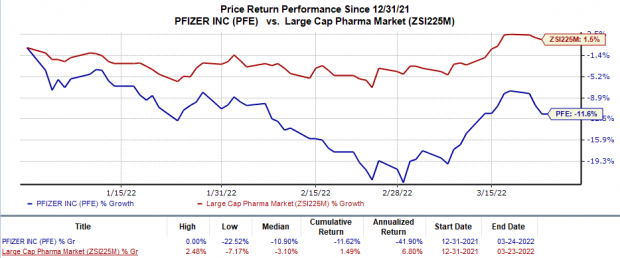

Shares of Pfizer have declined 11.6% this year so far against the

industry

’s 1.5% rise.

Image Source: Zacks Investment Research

Pfizer is also evaluating the candidate in another phase III ELEVATE UC 52 study in UC patients for a 52-week treatment period. Results from the same study are awaited by the end of first-quarter 2022. PFE plans to use data from both the ELEVATE UC 12 and ELEVATE UC 52 studies to seek regulatory approvals for etrasimod to address UC indication.

Apart from UC, etrasimod is being studied across multiple gastroenterology and dermatology indications, including atopic dermatitis (AD), eosinophilic esophagitis, Crohn’s disease (CD) and alopecia areata.

We remind investors that etrasimod was added to Pfizer’s pipeline

following its acquisition

of Arena Pharmaceuticals in an all-cash transaction for a total equity value of approximately $6.7 billion. The transaction closed earlier this month.

Other than etrasimod, the acquisition added two mid-stage candidates, namely APD418 and temanogrel to Pfizer’s pipeline, which are being developed as treatments for cardiovascular disorders.

The targeted UC market is highly competitive with many companies like

AbbVie

ABBV

and

Johnson & Johnson

JNJ

marketing their own drugs, which utilize different mechanisms of action to treat the indication.

Earlier this month, AbbVie received an approval for label expansion from the FDA for its JAK inhibitor drug Rinvoq to address UC indication. ABBV’s Rinvoq is already approved for three indications in the United States, such as AD, active psoriatic arthritis and rheumatoid arthritis. In the full year 2021, AbbVie generated $1.6 billion from Rinvoq product sales.

J&J markets its blockbuster drug Stelara, a human IL-12 and IL-23 antagonist, approved by the FDA for treating moderate-to-severely active UC. The drug is also approved for CD indication. Evidently, Stelara is also JNJ’s largest product, accounting for 9.7% of its total 2021 revenues. For the full year, J&J recorded revenues worth $9.1 billion from Stelara sales.

Zacks Rank & Stock to Consider

Pfizer currently carries a Zacks Rank #3 (Hold). A better-ranked stock in the overall healthcare sector is

Vertex Pharmaceuticals

VRTX

, carrying a Zacks Rank #2 (Buy) at present. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

Vertex Pharmaceuticals’ earnings per share estimates for 2022 have increased from $14.33 to $14.52 in the past 30 days. Shares of VRTX have risen 13% year to date.

Earnings of Vertex Pharmaceuticals beat estimates in each of the last four quarters, the average being 10%.

Just Released: Zacks Top 10 Stocks for 2022

In addition to the investment ideas discussed above, would you like to know about our 10 top buy-and-hold tickers for the entirety of 2022?

Last year’s 2021

Zacks Top 10 Stocks

portfolio returned gains as high as +147.7%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys

Access Zacks Top 10 Stocks for 2022 today >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report