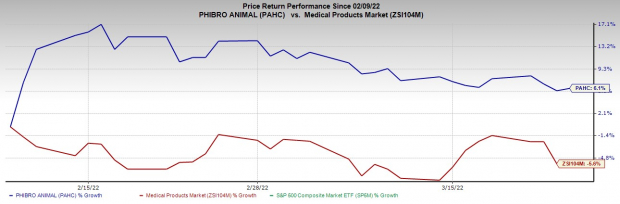

Shares of

Phibro Animal Health Corporation

PAHC

have rallied 6.1% against the

industry

‘s 5.6% decline since its second-quarter fiscal 2022 earnings released on Feb 9.

The global diversified animal health and mineral nutrition company has a market capitalization of $801.97 million. Its earnings for second-quarter fiscal 2022 surpassed the Zacks Consensus Estimate by 12.1%.

The Zacks Rank #2 (Buy) company has a favorable

VGM Score

of A. VGM Score helps identify stocks with the most attractive value, best growth and the most promising momentum.

The rally was largely driven by the ongoing strength in Phibro’s vaccine business. The company’s strong global presence raises optimism. A stable solvency position continues to favor the stock.

Image Source: Zacks Investment Research

Let’s take a quick look at the important catalysts to understand this positive trend.

Key Growth Drivers

Potential in Emerging Markets:

Phibro has existing operations, and established sales, marketing and distribution network in more than 75 countries. In the fiscal second quarter, the robust performance in the company’s Animal Health segment was primarily driven by increased sales of medicated feed additives and others in North America and South America. Meanwhile, the company’s vaccine sales growth was led by higher domestic and international volumes.

The company has continued to invest in Far East Asia, wherein huge growth is expected for the poultry and dairy industries. Currently, the company is expanding its dairy business in the markets of Australia, Brazil and Mexico.

Prospering Vaccine Business:

Phibro registered a 19.7% improvement in vaccine net sales in the fiscal second quarter. The company’s vaccine business is witnessing higher domestic volumes, as well as increased demand in the Asia Pacific region.

The company’s notable buyouts, including KoVax’s assets and MJ Biologic’s swine vaccines in the United States, are likely to fuel growth in the booming business. Its new vaccine facility in Sligo, Ireland, will strengthen vaccine production.

Stable Solvency Position:

Phibro exited the fiscal second quarter with cash and short-term investments in hand of $95 million. Meanwhile, the total debt was $400 million, much higher than the short-term cash level. However, if we go by the company’s near-term payable debt level of $13 million, it is pretty low compared with the cash in hand. This is good news in terms of the company’s solvency position, particularly during the year of the pandemic when it is majorly facing manufacturing and supply halt globally.

Favorable Growth Parameters

For 2022, Phibro has an expected earnings growth rate of 8.27% compared with the industry’s projected 12.5% rise. Meanwhile, revenues are expected to grow 9.64% on a year-over-year basis compared with the industry’s estimated 12.92% increase.

Phibro has a current cash flow growth rate of 7.95% compared with the industry’s growth rate of 13.41%. The stock’s return on equity (ROE) stands at an impressive 22.44% versus the industry’s (10.85%).

Phibro raised its

dividend

once in the past five years, with its payout growing 5.1%. PAHC’s payout ratio is currently at 38% of earnings.

Other Key Picks

A few other top-ranked stocks in the broader medical space are

Henry Schein, Inc.

HSIC

,

McKesson Corporation

MCK

and

IDEXX Laboratories, Inc.

IDXX

.

Henry Schein has an estimated long-term growth rate of 11.8%. HSIC’s earnings surpassed estimates in the trailing four quarters, the average surprise being 25.5%. It currently has a Zacks Rank #2. You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Henry Schein has outperformed the industry over the past year. HSIC has gained 29.3% compared with the industry’s 7.1% rise over the past year.

McKesson has a long-term earnings growth rate of 11.8%. MCK’s earnings surpassed estimates in the trailing four quarters, delivering a surprise of 20.6%, on average. It presently carries a Zacks Rank #2.

McKesson has outperformed the industry over the past year. MCK has gained 56.6% in the said period compared with 7.1% growth of the industry.

IDEXX has a long-term earnings growth rate of 13%. The company’s earnings surpassed estimates in the trailing four quarters, delivering an average surprise of 18.6%. IDXX currently has a Zacks Rank #2.

IDEXX has outperformed its industry in the past year. IDXX has gained 12.6% against the industry’s 2.6% decline in the same period.

Just Released: Zacks’ 7 Best Stocks for Today

Experts extracted 7 stocks from the list of 220 Zacks Rank #1 Strong Buys that has beaten the market more than 2X over with a stunning average gain of +25.4% per year.

These 7 were selected because of their superior potential for immediate breakout.

See these time-sensitive tickers now >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report