Enphase Energy, Inc.

ENPH

revealed that Enphase Energy Systems, powered by its IQ 7+ and IQ 7A Microinverters, are being widely used in Oklahoma.This highlights Enphase’s expanding footprint in the U.S. solar market. Last month, ENPH announced that the company witnessed the increased adoption of the Enphase Energy System, powered by IQ Microinverters and IQ Batteries, in Wisconsin.

Factors Boosting Enphase’s Growth in Oklahoma

The increased adoption of the Enphase Energy System in Oklahoma is buoyed by extreme weather conditions, which impact the functionality of the grid. In such a scenario, battery storage not only extends the availability of electricity throughout the day but also reduces dependence on the grid.

Moreover, the region boasts a solid growth trend in residential battery capacity. Hence, it is imperative to mention that Oklahoma is likely to witness a surge of nearly six folds in battery storage deployments by 2026, per the report from the Energy Storage Association and Wood Mackenzie. The intriguing growth trend provides a platform for ENPH to further expand with its product offerings in the region and capitalize on the growth trend.

Enphase’s Pathway to Growth

Enphase Energy boasts a solid position in the solar market. The company enjoys strong demand for its products in the domestic and international solar markets. Moreover, the company strives to boost its pathway to growth through its continuous efforts to bring in technologically advanced and innovative products to the market.

In the fourth quarter, Enphase Energy introduced its IQ8 family of microinverters to residential installers in North America and expects to introduce the same internationally in the second half of 2022. This, in turn, is likely to further enhance its domestic and international revenue generation prospects.

Additionally, ENPH makes strategic acquisitions to expand in the solar market like the latest acquisition of SolarLeadFactory LLC, through which the company aims to build its installers base. The growth in installers will further augment the deployment of Enphase Energy’s products.

Also, in January 2022, Enphase Energy inked a partnership agreement with Semper Solaris, through which it intends to boost the deployment of the Enphase Energy System in California. Such growth strategies are likely to provide sustainable growth to the company and increase demand for its products going forward.

U.S Battery Storage Market Boom & Peer Moves

The increased penetration of the solar energy market is instrumental to the battery storage market’s growth as solar energy fails to provide electricity 24×7. Moreover, the decreasing prices for battery technology and an extension of the solar investment tax credit are some of the catalysts that are further propelling demand for the battery storage system. In 2021, the United States recorded a solid 200% increase in battery storage capacity, highlighting the increased adoption of storage solution technology.

Per the latest report from the U.S. Energy Information Administration, the United States is likely to witness a capacity addition of 10 gigawatts in battery storage in the next two years.

Considering the expanding market size of the battery storage market, there are sizeable opportunities for ENPH and solar players in the industry to capitalize on growth trends. In this context, solar majors who have already carved out a position in the U.S. battery storage market are

SunPower

SPWR

,

SunRun

RUN

and

SolarEdge Technologies

SEDG

.

In March 2022, SunPower announced that its residential battery storage system, SunVault Storage, with 26-kilowatt hour (kWh) and 52 kWh configurations, is now capable of providing whole-home backup services to customers without sacrificing essentials or comfort during an outage. The installation of the new Sunvault will begin in June 2022.

The Zacks Consensus Estimate for SunPower’s 2022 earnings has been revised upward by 10.9% in the past 60 days. Shares of SPWR have rallied 31.2% in the past month.

SunRun’s Bright box provides uninterrupted backup power for the entire home. It also excels in providing electricity during peak demand times, thus buffering customers from high rates.

The Zacks Consensus Estimate for SunRun’s 2022 earnings indicates a growth rate of 8.3% from the prior-year reported figure. RUN shares have rallied 14% in the past month.

SolarEdge launched its residential battery, the SolarEdge energy bank in 2021. This is a 10-kilowatt single-phase battery that integrates with its SolarEdge energy hub family of inverters. Some of the existing SolarEdge systems can be upgraded with a storage solution for backup or on-grid maximum self-consumption use.

SolarEdge boasts a long-term (three to five years) earnings growth rate of 23%. The Zacks Consensus Estimate for 2022 earnings indicates a 44% improvement over the prior-year quarter’s reported figure. SEDG shares have appreciated 13.8% in the past year.

Price Movement

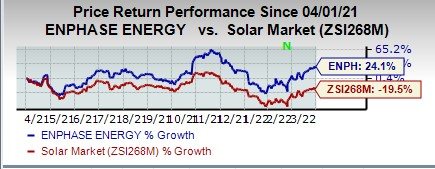

In the past year, shares of Enphase Energy have rallied 24.1% against the

industry

’s decline of 19.5%.

Image Source: Zacks Investment Research

Zacks Rank

Enphase Energy currently carries a Zacks Rank #3 (Hold). You can see

the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here

.

5 Stocks Set to Double

Each was handpicked by a Zacks expert as the #1 favorite stock to gain +100% or more in 2021. Previous recommendations have soared +143.0%, +175.9%, +498.3% and +673.0%.

Most of the stocks in this report are flying under Wall Street radar, which provides a great opportunity to get in on the ground floor.

Today, See These 5 Potential Home Runs >>

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days.

Click to get this free report